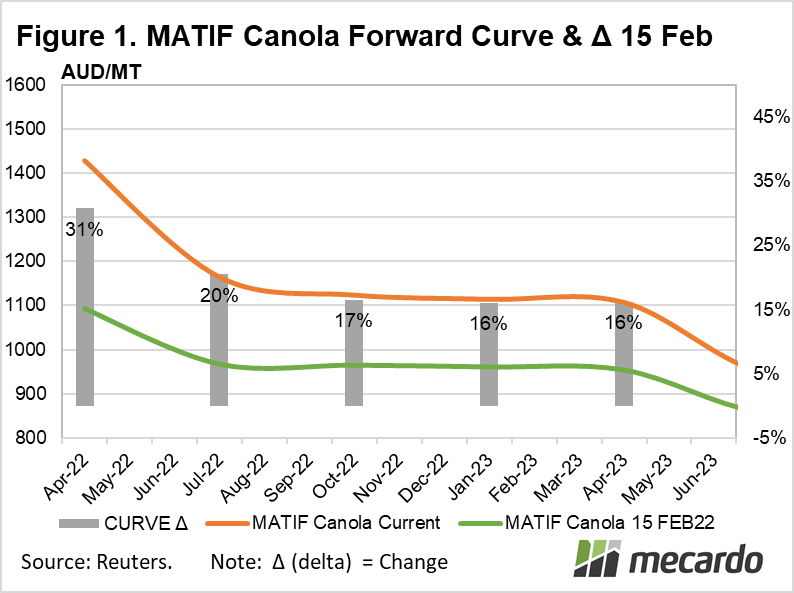

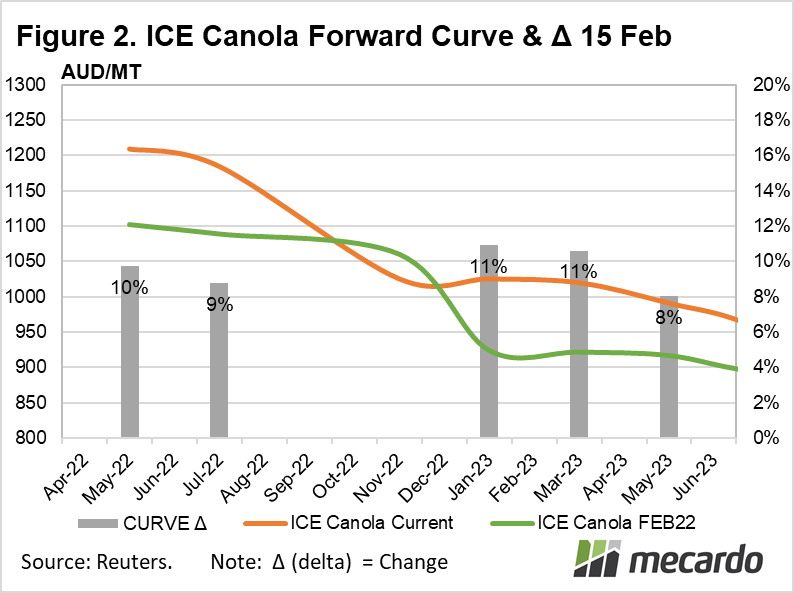

Canola prices for 2022-23 have risen 16% in the EU futures markets since Russia’s war on Ukraine began, however, the issue for Australian growers is how to take advantage of the international price lift.

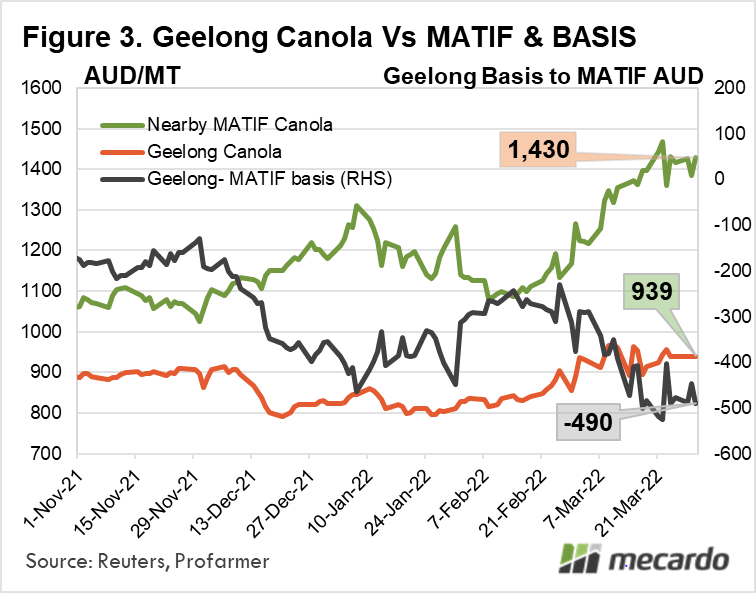

With Jan-23 Paris MATIF Canola prices currently at $1,100, (figure 1) and ICE prices at $1,025 (figure 2) – the tricky question is not just whether this is a price worth locking in, but also how tocapitalise on it in practice, given that the basis discount applicable to Aussie spot product is sitting at $500 odd dollars currently. (figure 3)

For 2021/22 some growers were caught out by their hedging strategy of selling Paris MATIF Canola futures contracts at what appeared to be lucrative prices at the time, and of course, they were. However, when MATIF prices rose substantially, local Australian prices did not shift in tandem, and the Australian Canola’s basis discount blew out to deep discounts. As a result, losses were incurred on the international futures short positions which were sold, which were not counterbalanced by similar sized price gains on the physical production positions held within Australia.

How did this happen? The problem with Canola price risk management for Australian producers is that there is no liquid local market for Australian canola futures, so the next best option is to use international futures markets. Unfortunately, while the positive correlation between Australian and European Canola prices is significant, it is far from perfect, and last year, the relationship broke down. When hedging production utilising imperfectly matched underlying assets, the risk that emerges is called cross hedging risk, or basis risk.

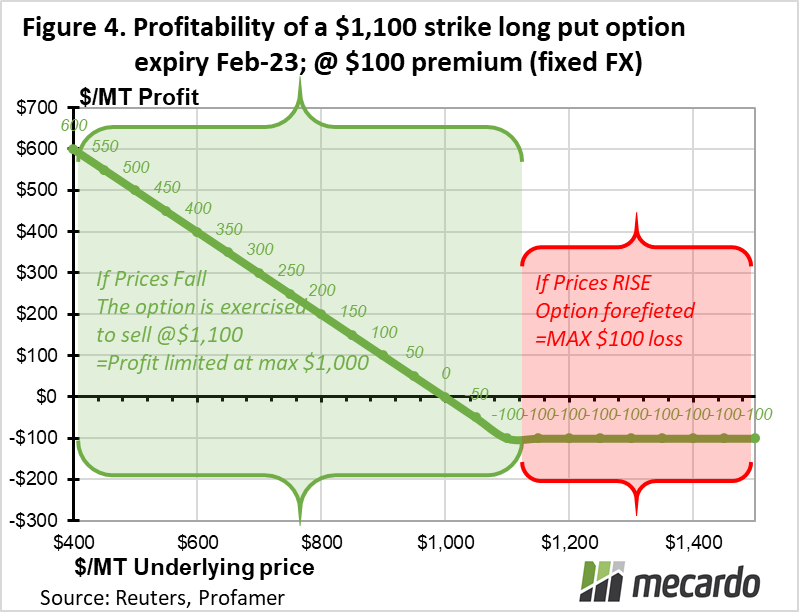

So what alternatives are there other than utilising MATIF and ICE futures contracts to manage canola price risk? Two key products to consider are futures options, and physical forwards.

The purchase of Canola put option contracts will provide the right, but not a firm obligation, to sell canola futures at a particular price (the strike price) at, or before a certain date. With such an instrument, if the market has gone in the wrong direction (in this case risen, not fallen), you have the ability to do nothing, and effectively walk away. There is no such thing as a free lunch though, and similar to an insurance policy, a non-refundable fee, or premium is payable to secure the future right to sell at a particular price. At the moment, due to the extreme volatility in grain markets, premiums are substantial, with €750 ($1,100) strike Feb-23 expiry puts settling at an implied price of 65€($AU 96). The profitability profile of the position, assuming a fixed FX rate is depicted on (figure 4)

Physical forward contracts in comparison are more straightforward products, offered by various grain brokers and traders, where a future price is guaranteed for an agreed fixed quantity, at a particular delivery date. Risk is still inherent in such arrangements though, as you must deliver the entire volume of grain as agreed. This is where production risk becomes a factor – if the crop fails to produce as expected, you’ll have to shell out cash to make up the shortfall. Invariably, if things go awry, you won’t be the only one suffering a bad crop, and prices are likely to have surged, adding insult to injury. As a result, only forward selling a sensible proportion of your expected harvest is a prudent practice.

When figuring out what proportion of your harvest could safely be committed to forward selling take into account planned planting acreage, current moisture profiles, the necessary additional rainfall during the season to generate an average yield, and the possibility of rare “black swan” events relevant to your property like floods, fires, and extreme weather that could spell disaster. Some producers sell forward just enough volume such that their expected gross revenue will cover input costs for the season, leaving the remaining volume exposed to market prices at harvest as the cream on top. Obtaining trusted agronomic advice, and buying quality seed with traits best suited to your conditions is one way of reducing production risks.

What does it mean?

The current market offers solid canola pricing for next season in 2022/23. However, risks abound in both inaction, and in entering into price risk management, to varying extents.

Selecting a portfolio of inputs and seed with traits expertly tailored to the upcoming season and your property’s conditions, will help manage production risk exposure. Consider optimizing for average expected crop performance under a wide range of scenarios as opposed to maximizing potential yield under a narrow set of necessary conditions to increase the proportion of production that could be sold forward.

Have any questions or comments?

Key Points

- Canola prices are high in international markets currently

- Swaps, forwards and options are available risk management tools.

- Production risk must be considered: Quality advice and seed are critical.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Refinitiv, Profarmer, Mecardo