Both Local and international futures markets are available for producers to lock in a price for a portion of their wheat crop expected to be harvested in the 2022/23 season. While locking in a price reduces downside risk, it also limits upside risk, today, we look at some options.

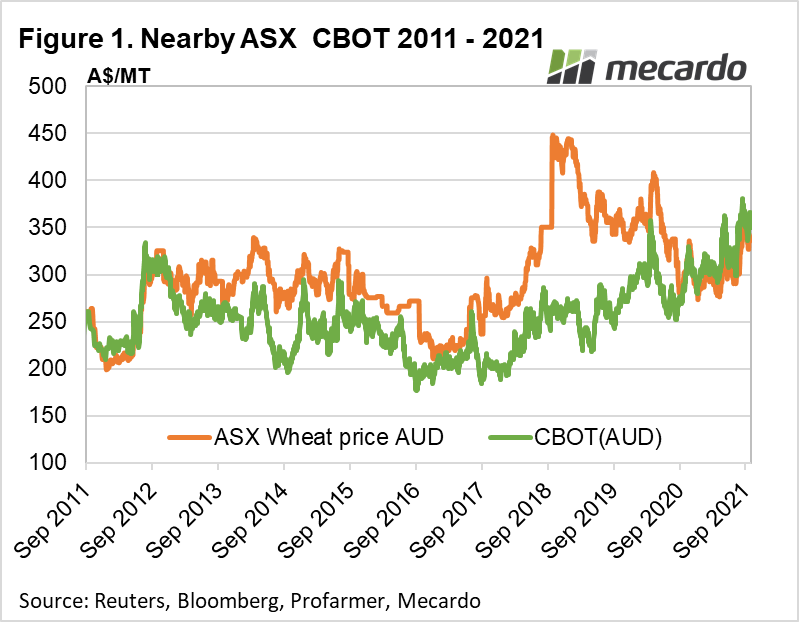

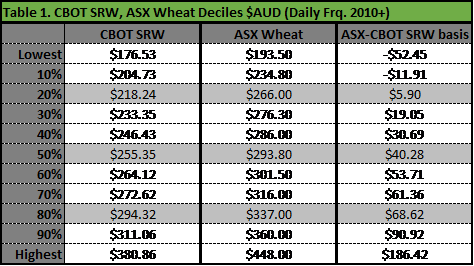

Historically speaking, Australian ASX wheat prices trade at a premium to that of US CBOT SRW prices. This is especially true in periods of poor harvests or droughts, with the 2018/19 period a good example. (figure 1)

Australian wheat prices don’t exactly follow international trends, but they mostly do move in the same general direction. The gap between the two prices is referred to as basis.

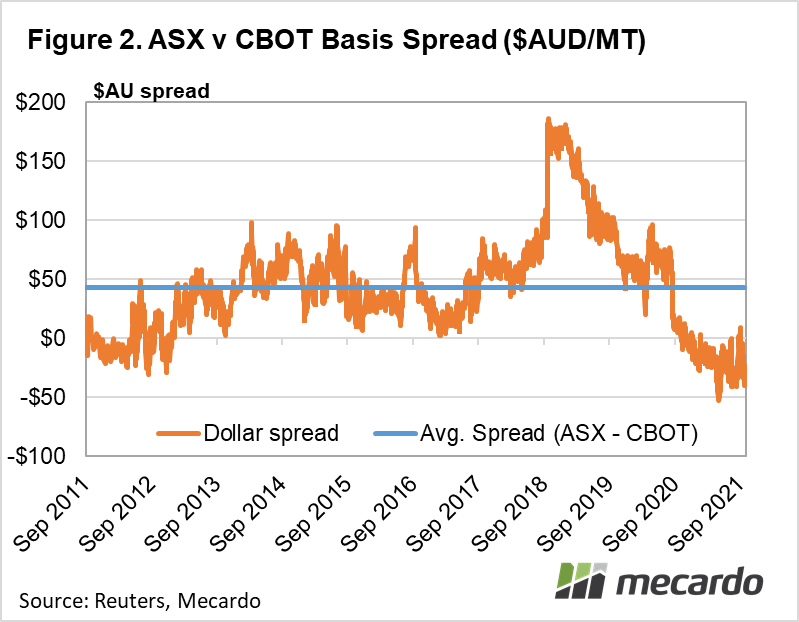

Over the last decade or so, the nearby ASX wheat price basis on nearby contracts has averaged at around a $40 premium to the US CBOT price. However, at present, that basis premium has flipped around to a -$20 discount because of the good season we are enjoying at present, in stark contrast to the poor harvest just completed in North & South America. (figure 2)

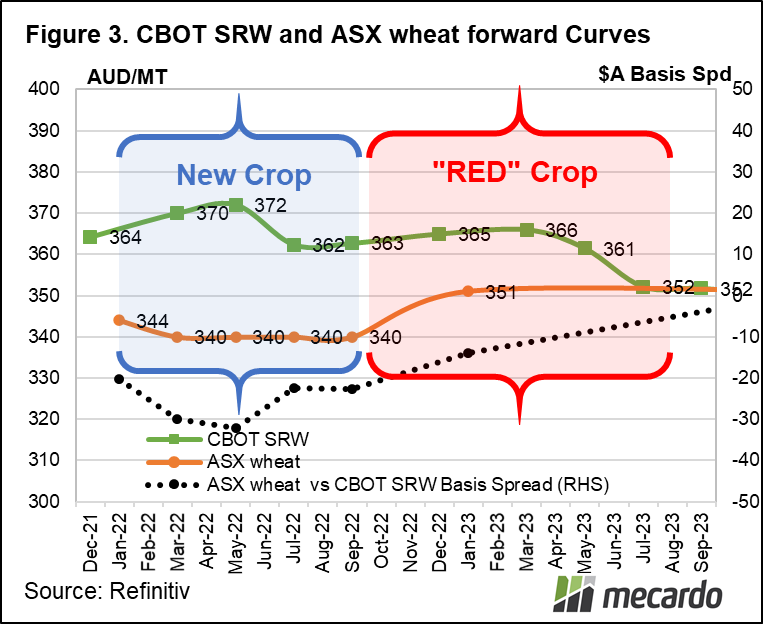

New crop JAN-22 delivered ASX wheat futures are currently sitting at $343, which, historically speaking, is an elevated, decile-8 price. If we move our focus to the 2022/23 “red” crop, the ASX JAN-23 contract provides the opportunity to lock in a similar, attractive decile 8 price in advance, at $~350

On the futures markets, there are a number of choices- we will look at two key ones in this example- ASX wheat futures, the movements of which are naturally more strongly aligned with our domestically attainable physical port prices, or international Chicago traded, CBOT SRW wheat.

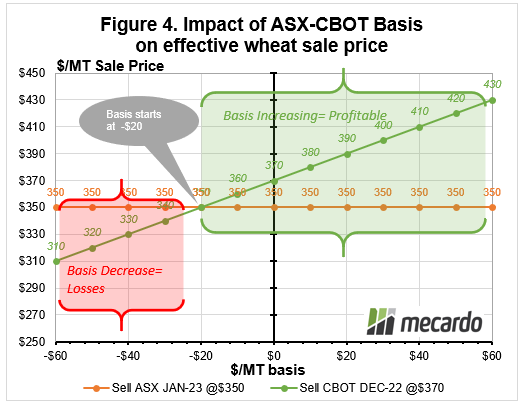

Growers selecting to hedge “red” crop using JAN-23 Wheat futures on the ASX at $350 is a simple strategy which provides a fixed price. However, locking in a forward price for DEC-22 on CBOT at $370 will leave scope for additional profit if Australia has a more challenging cropping year, and the current basis of -$20 turns around to a more “normal” premium over CBOT. As the premium of the ASX price over CBOT, (the Basis) increases, the effective sale price for the hedged wheat increases. (figure 4). The risk with this strategy however, is that another good cropping year may cause the basis to become more negative, resulting in a lower effective sale price.

Consideration needs to be given to the risk of “overhedging” production, remembering that the hedge is for future production that will not be harvested until December 2023.

A remedy to prevent an overhedging scenario is to not sell forward more wheat than would reasonably be expected to be produced in a poor year. Where this volume sits is an important consideration for each farm business.

What does it mean?

Producers have the opportunity to lock in a wheat price of $350 for the wheat crop of 2022 using ASX wheat futures contracts.

If you have the view that local basis will increase to a premium again by 2023, then using CBOT futures will protect against any global fall in prices but leave the grower exposed to higher potential basis and therefore a higher final price. Historically speaking, prices are currently at decile 8 for Australian wheat, and therefore well above average, hedging is well worth considering if increasing certainty about your future wheat revenues fits within your objectives and risk profile.

Have any questions or comments?

Key Points

- Futures markets offer opportunity to lock in prices

- Futures markets indicate wheat prices available at decile 8 prices for “red” crop

- Options to hedge price risk include local ASX contracts, and US CBOT contracts.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Refinitiv, CME, ASX