The US farm bureau federation conducts a regular survey on the cost of food in America, which has highlighted the rapid increase in retail food costs that US consumers have faced over the last 12 months. Mecardo also conducted a survey of a similar 4th of July basket of goods in Australia for relative comparison.

Strong demand for beef from the US, and elevated 90CL prices over the pandemic period have helped support the extreme cattle prices that have emerged in Australia in response to positive climatic conditions generating a herd rebuild.

Just like Australians, Americans love celebrating summer public holidays with a traditional BBQ.

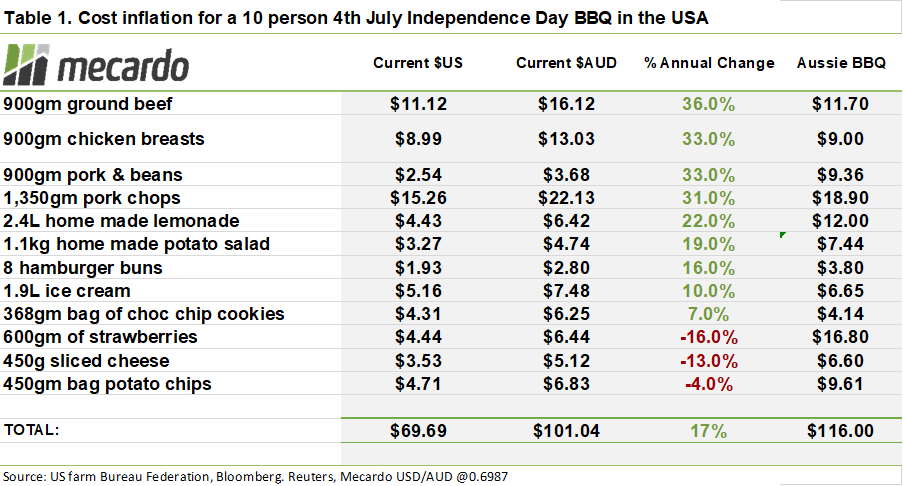

US farm bureau federation’s annual market basket survey for 2022 revealed that the cost of holding an all-american Independence Day BBQ with all the standard trimmings for ten people has risen 17% to $70 USD ($101 AUD) compared to 2021. (Table 1) In contrast, food inflation for this particular basket was stagnant in 2021, with prices actually falling marginally.

The largest price rises in the BBQ cookout basket came from the meat components. US retail beef prices captured in the survey were up 36% from the prior year, with chicken and pork up 33% also.

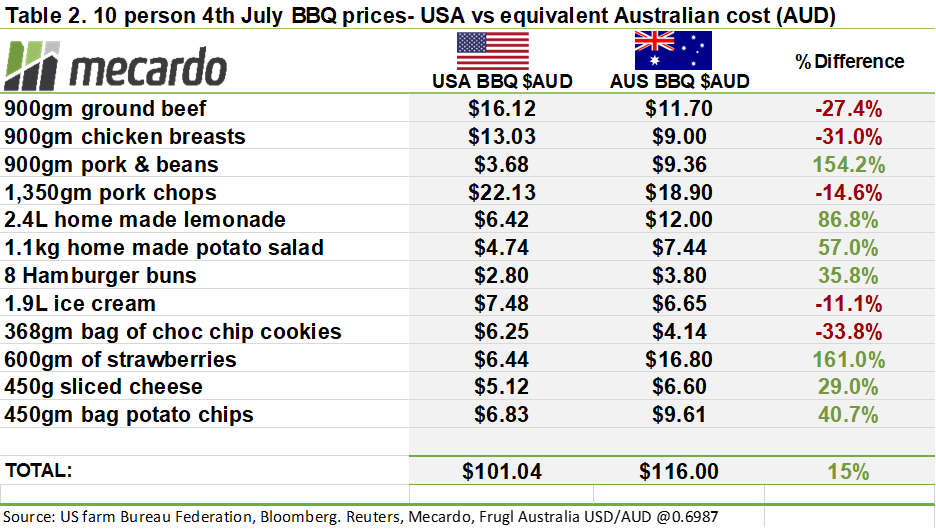

For comparison to the American situation, Mecardo undertook a 4th July BBQ basket snapshot survey in Ballarat, VIC for a roughly equivalent range of BBQ goods, selecting normal, non-special sale feature related shelf pricing, utilizing data from the Frugl mobile app.

Equivalent goods selected included standard Aussie favourites like Bulla ice cream, Coles ultimate choc chip cookies, Cheer sliced cheese, Stagg canned pork & beans, Queensland strawberries, and of course, 100% Australian fresh pork, chicken and beef.

As of July 4th, 2022, the cost of hosting a 10 person American style BBQ in Australia, came out to be $116 or 15% more than our US counterparts.

Retail Aussie beef, chicken and pork was between 15% and 30% cheaper than what Americans are paying in store. However, other items like cheese, potato chips, and fresh fruit and veg like strawberries and lemons for the lemonade came out considerably more expensive compared to purchasing roughly equivalent goods in the US.

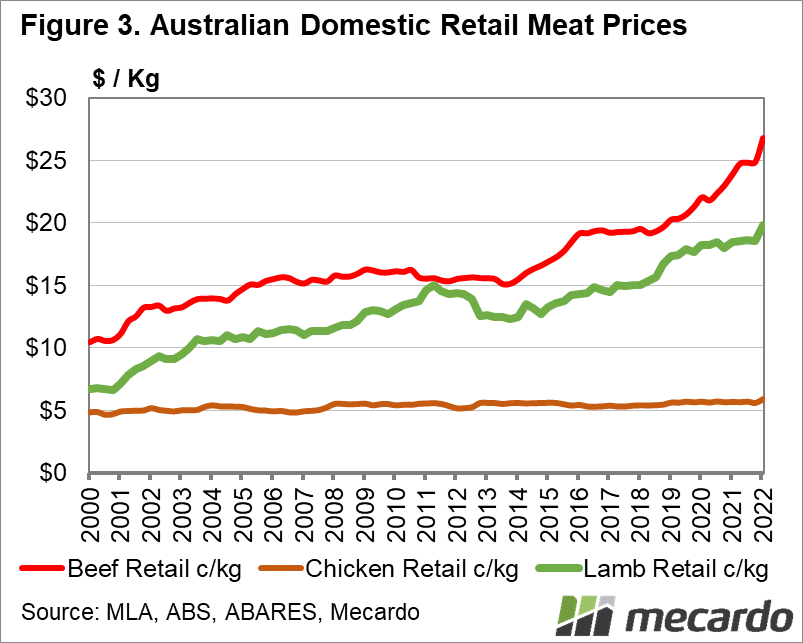

While from the rudimentary snapshot survey we have taken today, Australian meat looks cheap compared to the US, Aussies have by no means missed out on meat price hikes. According to ABS surveys, Aussie average domestic retail beef prices have risen 22% since March 2020, while lamb prices have surged 10%, and chicken 3.5%. (figure 3). Bear in mind though, when looking at this chart that the ABS data represents a basket of cuts, both premium, and budget, so the stated prices won’t line up with the mince or chicken breast prices in table 2.

What does it mean?

Sharply higher food prices for Americans, particularly in the meat category have the potential to cause the volume of beef consumed in the US to fall, putting pressure on US red meat demand now and into the future. This could translate into lower export prices for Australian beef.

That said, despite high food inflation, Americans still appear to enjoy lower food prices for a lot of food items compared to Australians apart from meat, particularly in relation to fresh produce.

Have any questions or comments?

Key Points

- US BBQ costs have increased 17% since 2021

- US meat costs have jumped 33% since 2021

- Aussies would still pay 15% more than Americans for the same BBQ.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: ABS, MLA, US Farm Bureau Federation, Bloomberg, Reuters, Mecardo.