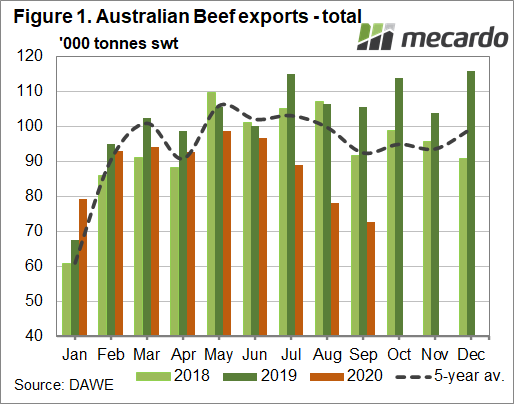

Beef exports continued heading south for the month of September, in line with production, and it is likely to keep tracking lower for the rest of the year. September saw Australia send just 72,619 tonnes of beef overseas, the lowest monthly volume since January 2019. This was also just one tonne more than the closest September low, recorded in 2007. And while some export markets have decreased more than others, Australian beef goes to plenty of different countries, therefore spreading the risk posed by a global economic turndown, as long as there is enough Aussie product to go around.

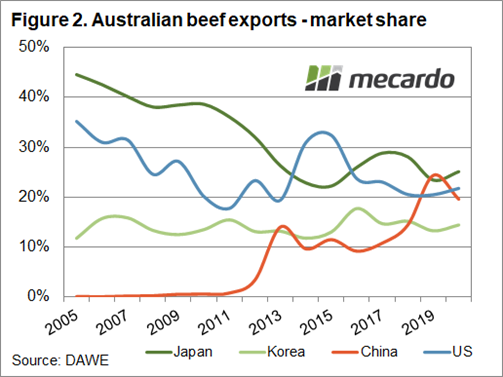

Japan has taken more than a quarter of all Australian beef exports this year, and while their September volume was about 3,000 tonnes less than the long-term average, it was up on the previous month, by 4 per cent. They’ve purchased 9% less beef from Australia for the year to date compared to 2019, with some of this put down to a lack of grain fed product being available. Despite close to record high grain fed cattle prices, the cost of feeders to place on feed will likely put a halt to any significant growth in grain fed production.

Beef exports to the US are down just 8% for the January to September period, but September itself saw a bigger drop of 13% on the previous month. It’s not unusual for this market to take less of our hamburger beef at this time of year, as they move into cooler weather and pack the BBQ’s away, with domestic grinding beef prices in the US also dropping. But the US imports as a whole are one to watch. Despite the drop in Aussie beef product received, Steiner Consulting reports that the US imported 25% more beef in general for the four weeks to September 26, with New Zealand imports up a whopping 138% for that period year-on-year.

Meat and Livestock Australia also made an interesting observation in their latest global meat market wrap, pointing out that for 2019-20 financial year, global meat exports reached a record 33 million tonnes shipped weight, an increase of 5.3% year-on-year. The economic impact of Covid-19 had yet to play much of a role in export figures in this time period (although supply and logistic constraints would have), so it perhaps isn’t a good reflection of things to come in the short term – but rather what could have been.

What does it mean?

If demand does continue on with this relative strength, Australia’s ability to fill it – at the right price – will be challenged. But on a positive note, the drop in exports this year has been fairly evenly spread across the range of destinations; and this diversity lowers Australia’s risk if they begin to lose considerable market share in any one country.

Have any questions or comments?

Key Points

- Beef export volumes continued to drop in September, and are now tracking 11% lower for the year-to-date.

- Australia recorded the lowest September beef export volume since 2007.

- Diverse beef export markets helping slow further price falls as production also trends lower.

Click on graph to expand

Click on graph to expand

Data sources: MLA, Steiner Consulting, Mecardo