Statistics Canada has released its latest canola production forecasts yesterday and they are even more pessimistic than previous forecasts. Canola production estimates were slashed 2.1mmt to 12.8mmt from the August prediction (figure 1). This caused an immediate bullish reaction on the international futures markets.

This season on the prairies was considered exceptional, and not in a positive way. The models indicated that plants reached peak health over four weeks ahead of normal, before their condition deteriorated rapidly, with the data indicating that this drought could be considered more widespread and serious than has been seen since NDVI records began in 1987.

This is the smallest crop seen since 2008/09 season.

The market reaction to the news of a 15% smaller crop in Canada was immediate in futures markets.

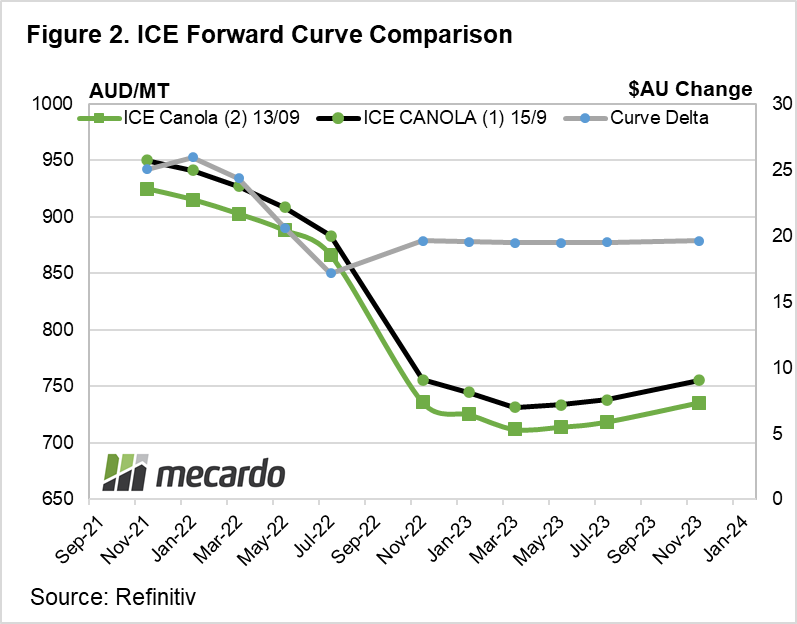

Nearby NOV-21 Canadian ICE futures contract prices rose by around $25AUD (3%), to $A950. The price uplift also flowed through to contracts settling after the harvest of the next crop in August 2022, with contracts settling in NOV-22 and later up ticking $20AUD to $A750. (figure 2)

Similarly, in European markets, the nearby OCT-21 MATIF contract rose $28AUD, to $A950 easing back to a $25 increment in APR-22. For new crop in 2022/23, the uplift was more subdued, with JUL-22 to APR-23 prices inflating by $19-$13 to $A790 (figure 3)

However, in contrast to the traders on ICE, MATIF traders were more bullish in their outlook for “red” crop beyond JUL-2023, pushing prices $31 higher in the back end from JUL-23 to Jan-24.

Prices have recently been higher in AUD terms, at over A$1,000 back in mid AUG-21 when nearby ICE futures were trading at over C$918, before drifting back to the C$850 (A$914) mark a fortnight ago. However, for prices to rise back over that record point again this season would probably take yet another substantial downgrade in the Canadian harvest outlook for this year. The market reaction to final production estimates due on Dec 3, 2021 should be closely monitored.

Meanwhile, in Australia, Indicative Geelong port prices have reacted positively to the news, lifting $25, to $875.

What does it mean?

This latest release of sophisticated forecasting on the Canadian canola crop has pointed firmly towards an even more dire harvest than first thought, meaning global canola supply this year will be substantially tighter, supporting higher prices. However, the futures market angling downward over time suggests that the outlook for Canola prices next year is lower at $A750-$790, in line with the expectation of an influx of supply from a more normal global crop next year.

Have any questions or comments?

Key Points

- Statistics Canada’s latest Canola Crop estimate down 2.1mmt to 12.8mmt

- Lowest Canadian Canola crop in 13 years

- Nearby ICE canola up $25, MATIF $28

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Statistics Canada, Refinitiv