Last week Mecardo looked at global oilseed markets and the rapid rise being seen in spot markets both internationally and locally. Those still holding old season Canola would be few and far between, it is new crop and further out where the interest in hedging lies.

Many local growers are hesitant to hedge canola prices, with the crop being a little more fickle than cereals, and having some wider swings in price. However, harvest prices above $700/t will have no doubt piqued the interest of even the most ardent ‘sell it once it’s in the bin’ devotee.

There is no guarantee canola prices will remain at the heady highs we see today. We are currently in the middle of the oilseed hedging window, when uncertainty surrounding the development of northern hemisphere crops sees a risk premium in the market.

This year the risk premium has been ably assisted by tight old crop supplies, strong demand, and issues harvesting the crop which would normally be providing soybeans out of South America now.

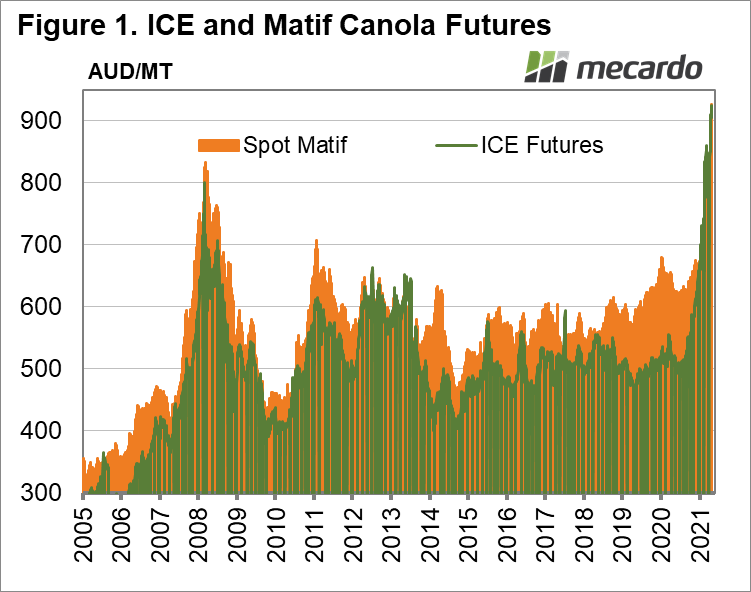

Figure 1 shows both ICE and Matif Futures have breached the $900/t mark in our terms thanks to the issues shown above. Unfortunately for local growers still holding canola, spot prices here are based on new crop northern hemisphere values.

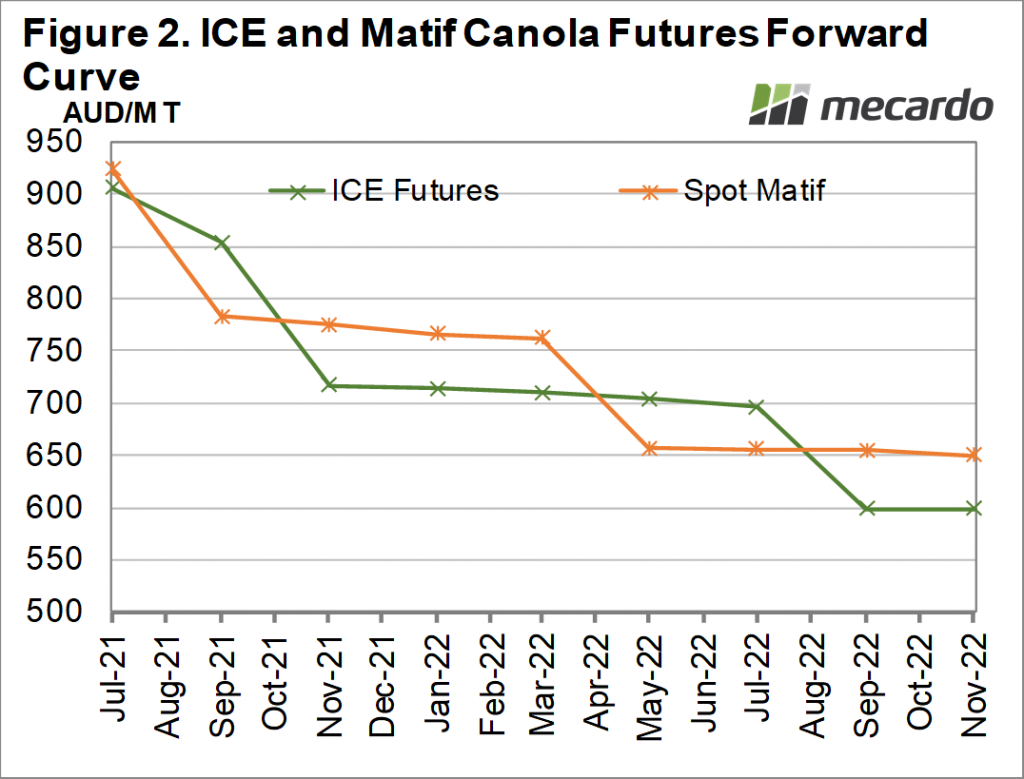

When prices rally like they have on short term supply issues, futures markets tend to be highly discount to the spot prices. Crushers obviously don’t want to pay current prices for canola delivered in four or five months’ time.

Figure 2 shows just how severe the short-term supply deficit is. ICE Canola futures for September are 6% below spot, and November are 28% behind. The European crop will come in a little earlier and have a heavy 18% discount to November.

For the 2021-22 Australian harvest, figure 2 shows ICE and Matif between $700 and $750/t, and the 22-23 harvest at $600-650/t. Compared to the $900+ spot market forward prices they look cheap, but we can see in figure 1 that futures have only spent one harvest above $700, and five of the last 15 harvests above $600.

What does it mean?

Most growers would take canola prices above $600/t every year, but few will be forward selling in the current market. Concerns around production often deter forward selling, but it is worth taking a close look at the moment, for at least 10% of expected production. High prices will no doubt encourage production in overseas markets, and prices will correct, the question is when.

Have any questions or comments?

Key Points

- Canola and Rapeseed markets have hit extreme highs in spot markets, but are discounted forward.

- For the two coming harvests futures are still very strong compared to historical values.

- Selling swaps would lock in very good canola prices for the next two harvests.

Click to expand

Click to expand

Data sources: ICE, Matif, Mecardo