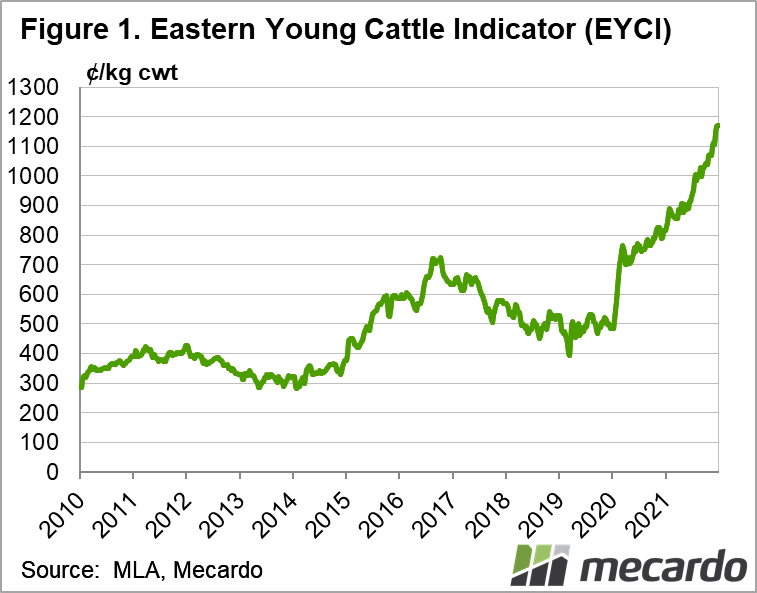

Tomorrow will bring the opening Eastern Young Cattle Indicator (EYCI) for the year, and if weaner sales so far in 2022 are anything to go by, another record could well be on the cards. Looking back at the major movements for the cattle market over the past 12 months, this time last year we were expecting something had to give, with Australian beef prices already expensive on a global market. And while that sentiment still stands, the purple patch certainly rode out 2021 - and doesn’t look like it’s going anywhere fast, especially as rain continues to fall in the east.

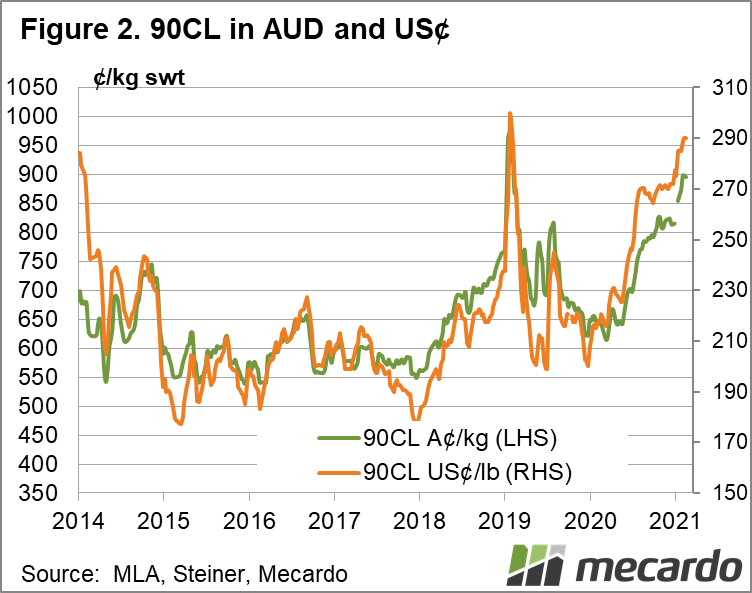

To review, at the close of 2021 reporting, the EYCI was 44% higher year-on-year at 1169¢/kg, while the National Cow price had climbed to 696¢/kg – a 45% increase on the same time in 2020. The 90CL US export price was also well up, rising 40% year-on-year to finish 2021 at 898¢/kg. Every single national cattle saleyard indicator averaged a record price for the calendar year, with medium cows making 633¢/kg for the year (up 15%), heavy steers 749¢/kg (up 16%) and trade steers 905¢/kg (up 22%).

We are only a few sales into the annual weaner sales this year, with plenty more calves to go under the hammer across Victoria this week. In January last year, we quoted weaner prices for 300kg calves at averaging 530¢/kg, up 33% from the previous high of 400¢/kg in 2017.

On the first day of sales at the Northern Victoria Livestock Exchange, Angus steers topped at $1980 (weighing 460kg), and overall averaged $1666. Cut to 12 months later, and according to Beef Central, Angus steer weaners topped at $2880 and averaged $2460, with heifers at $2085, on the equivalent sale day. Steers in the 280-360kg weight bracket averaged 716¢/kg, and heifers the same weight 643¢/kg, averaging out at about 680¢/kg. In other words, the price increase has been roughly $800, or 150¢/kg – up 33%.

What does it mean?

As expected, the cattle

market has kicked off the year with more record-breaking prices, with summer

rainfall bolstering restockers, the lotfeeding sector still hungry for cattle,

and finished prices finishing last year with enough confidence to encourage

traders. As pricing and slaughter reports start back up, we will get a better

insight into how Covid-19 impacted processing sectors, freight, and economies,

both domestically and globally, will impact market confidence in the coming

months.

Have any questions or comments?

Key Points

- Cattle market yet to falter as purple patch holds on for 2021.

- Average prices across the board reached new highs, with national trade steers at 905¢/kg for the year.

- Early weaner sales are up an estimated $800, or 150¢/kg, on last year’s results.

Click on figure to expand

Click on figure to expand

Data sources: MLA, Steiner, Mecardo