As we progress toward November, cattle supply continues to show evidence of rapid expansion in line with historical trends. Rising prices in tandem with this, are indicative that demand is more than keeping pace, with the Eastern states Young Cattle Indicator (EYCI) continuously notching up all-time record levels. Confidence in our industry is high, and it’s becoming increasingly difficult to see a reversal of fortunes in the near future.

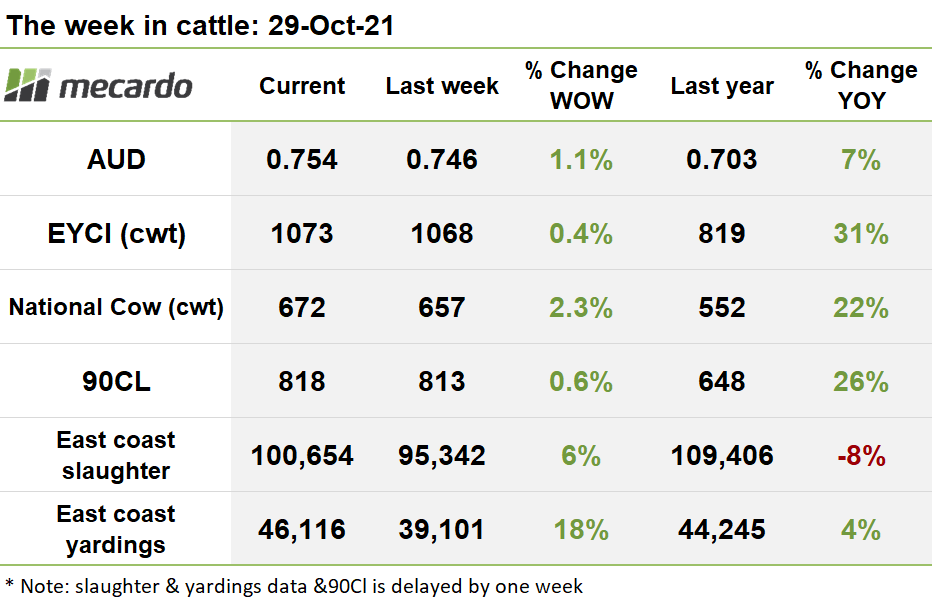

Slaughter numbers continued to move in a manner close to the past trends set in 2020, and on average over the last 5 years. Last week, the number of cattle slaughtered rose 6% week on week, to 100,654 head. This still remains 8% below 2020 levels for this time of year, and the trajectory is slowing down, but history suggests that there is scope for further lifts in the next few weeks.

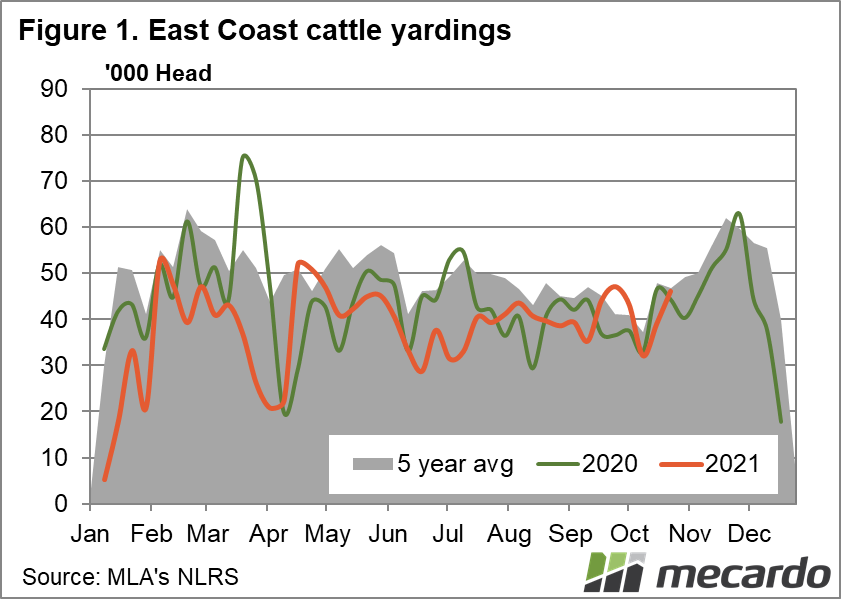

Yarding’s climbed 18% week on week last week to reach 46,116 head. We are now 4% above last year’s level for this time of year, and 2% below the 5-year average. Could they go higher? EYCI eligible cattle yardings numbers published each day give us a sneak peek in real time about the supply situation for the current week. They booked a big rise again this week, so it’s likely that when the numbers come out, they will reveal that supply was still in ascent mode this week.

The EYCI powered higher as it rose another 10¢(<1%) to climb to yet another all-time high record of 1,076¢/kg on Tuesday, before slipping back to 1,073¢/kg by the end of the week . Eligible young cattle yardings rose 25% to 16,796 head. Firm prices coupled with higher supply suggest that strong demand is still burning for cattle.

All the key markets posted mixed results this time, with average Roma prices pushing up 3.8% to 1095¢/kg, and but Wagga Wagga backtracked slightly, dipping 1% to 1,099¢/kg, on slightly higher yardings. Dubbo also reported a 3% fall to 1,048¢/kg, possibly a victim of cooling demand, as supply fell on last week.

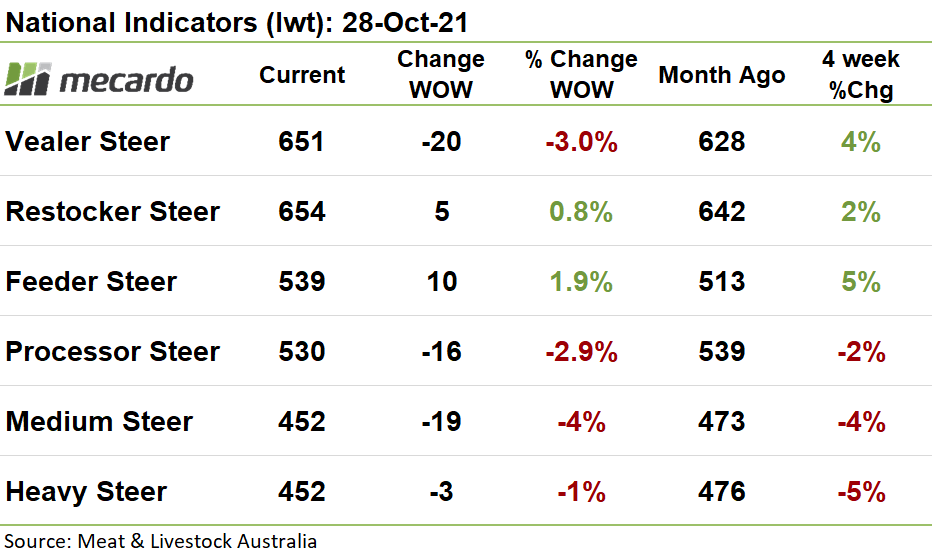

The suite of National indicator posted varying results, this week, with restockers and feeder steers gently climbing, but all other categories indicated some pushback on prices for finished cattle.

90CL frozen cow prices tracked up 5¢(<1%) last week to close at 818¢/kg swt, with the appreciation in the AUD offset by a lift in the US price of 3¢ to 276¢/lb. Steiner depicts a rosy outlook for lean beef prices in Q1-22 as imported product availability is expected to remain very tight, while the domestic US cow herd continues to shrink.

The Aussie dollar ascended further, rising 1.1% against the US greenback this week to 0.754US. The driver for the AUD’s appreciation of late has been the speculation on two expected interest rate rises from the RBA in Q4 2022. Recent commentary from the RBA on concerns about rising inflation are indicative that they may soften their official stance to keep rates low till 2024.

The week ahead….

Supply continues to rise, and yet price indicators remain firm for the moment, especially in the case of tradable cattle. This paints a picture of strong underlying demand effortlessly soaking up the additional offerings coming through, and a mountain of confidence in the industry. As we march though to summer, consolidation of the monsoon season in Northern Australia has potential to inject further steam into an already hot market.

Have any questions or comments?

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: MLA, Mecardo, BOM