Back in March we took a look at cattle slaughter rates and compared them to where industry projections were pegged. The conclusion was that forecasts were going to have to be revised, and Meat and Livestock Australia’s (MLA) April Industry Projections have done this. The intent to rebuild is pushing supplies to extreme lows.

Cattle producers have shown their hand thus far in 2021, opting to hold cattle back from slaughter and live export in favour of rebuilding the herd. This makes sense, as even with prices at record levels now, the market could sustain a 20% fall and still be profitable for cow/calf producers.

Since MLA released their initial 2021 Cattle Industry Projections in January, there have been some changes in the market. Most notably late summer rains across Queensland and NSW has bolstered restocker demand and severely impacted supply.

The changed conditions have been reflected in slaughter and therefore herd projections. Figure 1 shows that after two years of more than 6% declines in the cattle herd, a 5% bounce is expected to June 30, 2021. Growth over 5% is rare, having last occurred in 2011, and before that in 1994.

Hence MLA is expecting growth to slow in 2022 and 2023, but this year’s very strong levels have the herd 3% higher than the February projections this year, and 5% higher than previously projected for 2022 and 2023. This is nearly 1.5 million head more in 2023 than previously expected.

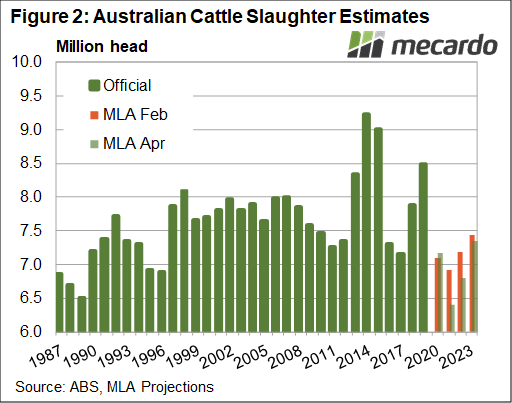

The extra cattle in the herd are coming from reduced turn off. Figure 2 shows that while the official ABS slaughter numbers for 2020 came in slightly higher than expected, MLA has stripped half a million head, or 7.4%, out of 2021 slaughter.

The year on year decline in cattle slaughter is expected to be a huge 10.8%. MLA also adjusted 2022 slaughter 5% lower, to 6.8 million head, which will make it two years in a row of slaughter under 7 million head. This hasn’t been seen since the mid-90s.

Added to the decline in slaughter is a 25.7% reduction in live export in 2021, and no recovery above 1 million head out to 2023. This obviously helps with the herd rebuild, with more females being added to the northern herd.

What does it mean?

The slaughter and price data coming through at the moment shows us we are at the extreme level of the herd rebuild at the moment. MLA’s projections aren’t suggesting huge improvements over the coming year, so prices should remain at a solid premium to world markets for another year or so, weather dependent of course.

More ‘normal’ but still very tight supplies are expected in 2023, but as long as seasons are somewhere near normal, prices aren’t headed back to the levels of 2019 before we get out to 2024 or 2025.

Have any questions or comments?

Key Points

- Extreme low cattle slaughter and live export saw MLA revise industry projections in April.

- The herd is now expected to grow more quickly, recovering to 2018 levels by 2023.

- Tight supply is still expected for the coming 18 months, which will support prices.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, ABS, Mecardo