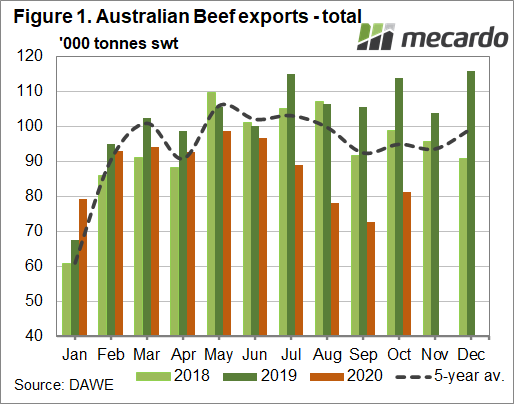

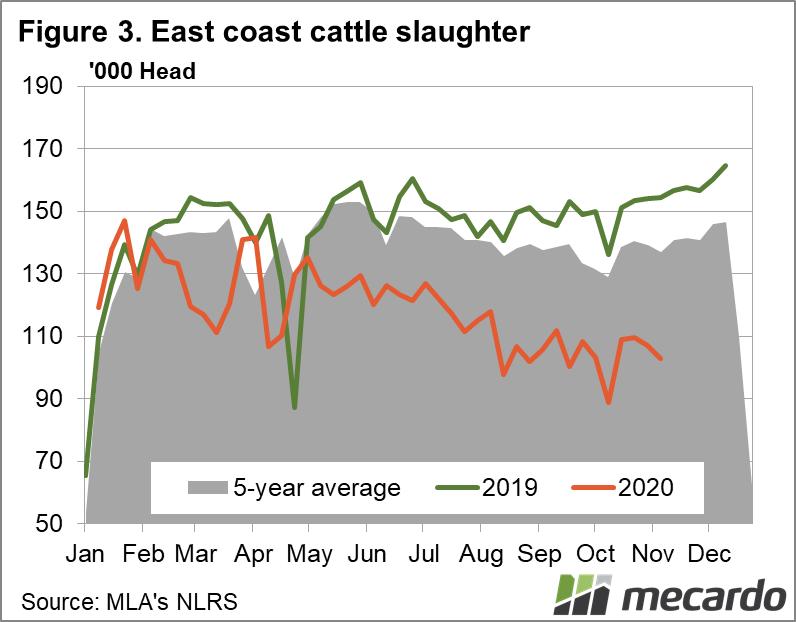

Australian beef export volumes and values continue to track lower year-on-year, and well below five-year-average levels. For the year-to-October, 874,421 tonnes shipped weight of beef have headed overseas, compared to more than 1 million tonnes for the same period last year, a drop of 13 per cent. Despite global economic challenges, however, this decline would appear to continue to be primarily supply driven, with year-to-date eastern states cattle slaughter tracking at about 14% lower for 2020, according to the National Livestock Reporting Service figures.

Japan was the largest beef export market for Australia in October (and for 2020 so far), having only taken 9 per cent less product for the year-to-date compared to 2019. Japan is also the top market for chilled beef specifically, and their continued demand in this area has led to Australia’s total chilled beef exports sitting at just 2% lower than last year. The US, China and South Korea have all imported more Australian chilled beef for the year to October than they did in 2019, while their frozen product intake has dropped. Frozen Australian beef exports overall have dipped 17% year-on-year, as China remains the biggest market for this category of Australian beef.

Chinese trade suspensions of five plants that Meat and Livestock Australia describes as “significant suppliers to the market” has contributed to Australian beef exports to the country being down 28% for the year-to-date. In October, Chinese volumes were down a whopping 59% year on year, pointing to trade issues not being the only contributor. Chilled beef exports to China have increased, as the affluent look to premium Australian product, but competition for the volume frozen market has ramped up from South America.

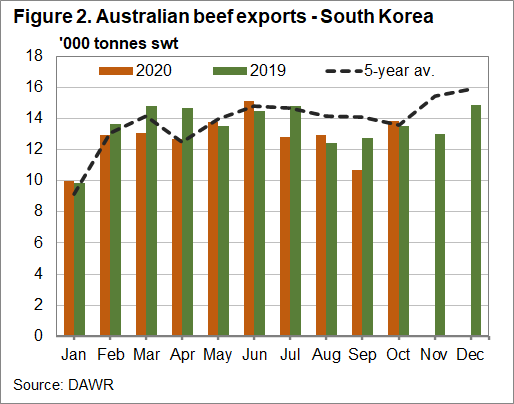

Australia’s fourth-largest beef export market, South Korea, is likely to raise the tariff on beef imports from here to 30% (up from the usual 21.3%) this month, as we supply more than the 174,087 tonnes shipped weight safeguard volume to the country. This usually means the volume of beef from Australia dips significantly for the remainder of the year. While beef exports to South Korea are down just 5% for the year-to-date, this has meant the tariff increase has been triggered a month later than last year, and may not impact the market in any significant way.

What does it mean?

Beef exports have fallen in line with the decline in slaughter this year, showing that aside from trade tussles with China, demand doesn’t seem to be waning. There also would appear to be very little push back on Australia’s sky-high prices, which is assisted by the steady chilled beef export volumes. MLA forecasts beef exports will be on the increase next year, painting more positivity for Aussie beef overseas.

Have any questions or comments?

Key Points

- Total Australian beef exports have dropped 13% for the year to October, but chilled beef is only 2% lower.

- Japan remains Australia’s biggest beef market for 2020, while exports to China were down 59% year-on-year for October.

- Korean import tariff set to kick in this month as Australian beef exports to the country click over the safeguard volume for 2020.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, DAWE, Mecardo.