Back in 2015 Mecardo looked at the difference between the 21 MPG and the Merino Cardings indicator (combing to carding basis) as a measure of price risk, with the conclusion that the narrow basis pointed to some upside for the combing indicator price. This article returns to this perspective on the greasy wool market.

Carding prices are often mentioned as a possible lead indicator of combing wool price movements. The author has yet to find a combination of price series that provide such a lead indicator in the market. Where the carding wool prices do provide some useful information for combing wool prices is in the basis or difference in price. When the gap is narrow between combing and carding wools, it is generally flagging that combing wool prices have little downside risk and potentially plenty of upside risk.

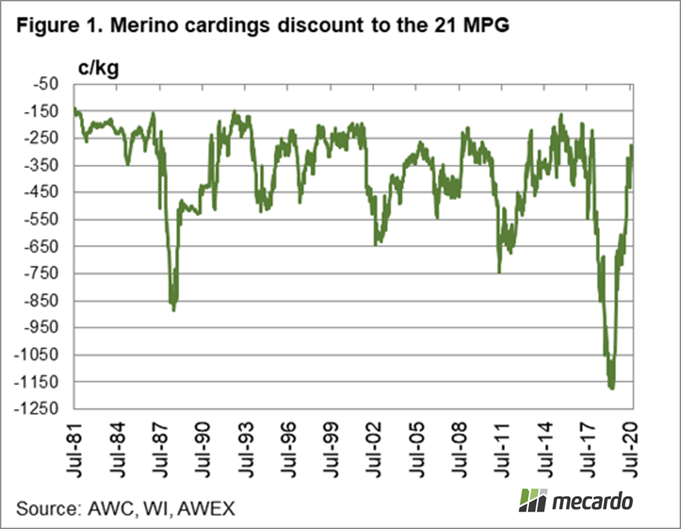

Figure 1 shows the Merino Cardings (MC) discount to the 21 MPG from the early 1980s to last week in Australian cents per kg terms. Students of the greasy wool market will recognise that the schematic in Figure 1 looks very much like an inverted 21 MPG price series. The periods of peak 21 MPG levels correspond to large differences in price between the two indicators. The minimum basis has generally been between 150 and 250 cents. The basis bounced off this minimum level quite a few times between 2013 and 2017 before widening to an unprecedented 1175 cents in 2019. Since early 2019 the basis has narrowed dramatically, down to 295 cents.

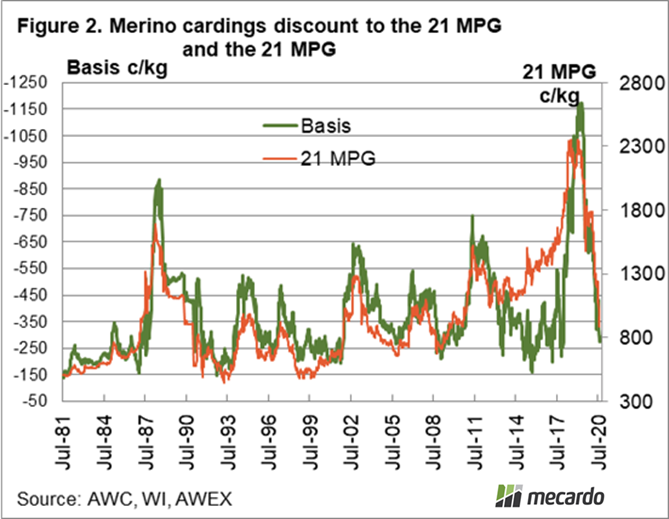

In Figure 2 the basis from Figure 1 is shown (left hand scale and inverted) along with the 21 MPG (right hand scale). The strong correlation between the 21 MPG and the difference in price between the 21 MPG and the MC means that it is the change in 21 MPG driving change in the basis. Cyclical lows in the 21 MPG at various levels, is accompanied by a small basis within the -150 to -250 cents range.

The combining to carding basis is useful as an indicator of whether the 21 MPG is at or close to a cyclical low point. In the current market the basis is 295 cents, low but still with some risk of narrowing further. The underlying assumption is that the MC will hold its value and not fall further. This assumption will be tested by the effect of COVID-19 in the coming quarters. Assuming carding prices are low enough to hold, the combing carding basis points to limited further downside (maybe 100 cents or so) risk for the 21 MPG.

What does it mean?

COVID-19 is going to provide an intriguing test to the carding combing basis effectiveness at flagging a base in cyclical prices for combing prices. The relationship has worked well for four decades but this is the first pandemic driven down cycle, so we need to be careful in extrapolating from past market patterns. Given that caveat the carding combing basis is close to a level which would indicator combing merino prices are at a cyclical low.

Have any questions or comments?

Key Points

- The combing to carding basis has narrowed from extraordinary levels in 2019 to be close to levels flagging a cyclical basis in the 21 MPG.

- The basis still has some capacity to narrow yet but it seems to be flagging that most of the fall in combing prices has been made

- This view is built on the assumption that carding prices will hold their value

Click on graph to expand

Click on graph to expand

Data sources: AWC, WI, AWEX, ICS , Mercado