The world looks closely at the market prospects for corn, as it’s the largest crop grown in the US with 96.9 million acres planted in 2020, an 8% increase on 2019, as well as a significant exported product onto the world market. The latest USDA crop progress report comes at an important time for the market, with the report noting that the corn crop is entering the yield critical stage of “silking”, and its progress has now moved ahead of the five-year average.

Silking is the stage where the corn cob begins to push out the shiny, thread-like fibres that grow as part of the ears of the corn, and is the first critical measure of possible crop yield.

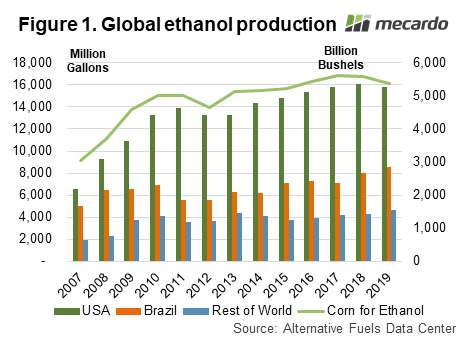

The US consumes for stock feed about a third of corn production, with just over a third usually used to produce ethanol, with the remaining third either consumed in the US or exported.

The corn crop has grown over the last 12 years on the back of increased ethanol demand, with the Energy Information Administration (EIA) estimating that in 2019 10% or 14.54 billion gallons of fuel ethanol was consumed.

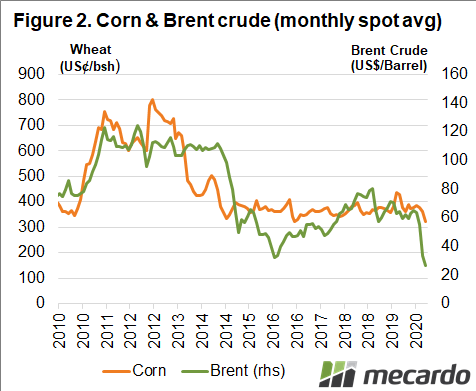

The CV-19 impact has been keenly felt by the crude oil markets, as travelling has been significantly curtailed, so fuel and oil stocks have been building. This problem is impacting directly on oil & ethanol demand & price (Figure 2).

Domestic consumption is also impacted, although predicting what happens regarding food purchases is difficult, given normal logistic capacity consumers continue to purchase.

The big driver on the positive side, for now, is exports of US grains to China. The Phase #1 deal appears to be working with China imports surging in June as the economy appears to be recovering.

The way this plays out is not only critical for grain demand and price this year, but it will also impact on future production with the latest USDA forecasting prices for 2021 to be below the cost of production. Without additional government aid, US farmers will be reviewing the crop intentions.

What does it mean?

Due to its scale and the export component of the US corn crop, the prospects of all grain prices, be they wheat, barley, soybean, maize or corn are tied to the US corn market. Prospects for the price of corn will influence the planting intentions of US farmers further impacting the stock position, and therefore prices.

While increased export sales will support corn prices, with this demand spilling over to other grains, any prolonged CV-19 impact on fuel demand is negative for ethanol, corn and therefore grain prices more generally.

The outlook for now is mixed, weak demand on the back of the CV-19 pandemic is problematical, while China purchases are a supportive prospect.

Have any questions or comments?

Key Points

- Strong Chinese demand for corn with good crop conditions.

- Ethanol & Crude Oil demand impacted due to CV-19.

- Price forecasts to dampen US farmer planting intentions.

Click on graph to expand

Click on graph to expand

Data sources: USDA, EIA, Alternative Fuels Data Center, Mecardo