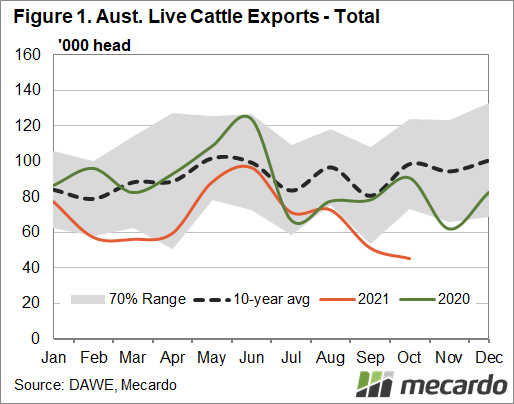

Australia’s live cattle exports have taken a tumble in the second half of the year, with two major factors we’ve been talking about all year having the biggest impact - record high domestic prices and global lockdowns because of Covid-19. In October, live cattle exports fell to just 45,106 head - the lowest October total for at least a decade, and the lowest monthly total since February 2017. For the year-to-October, live cattle exports are down a quarter compared to 2020, and they are 36% lower than for the same period in 2019 .

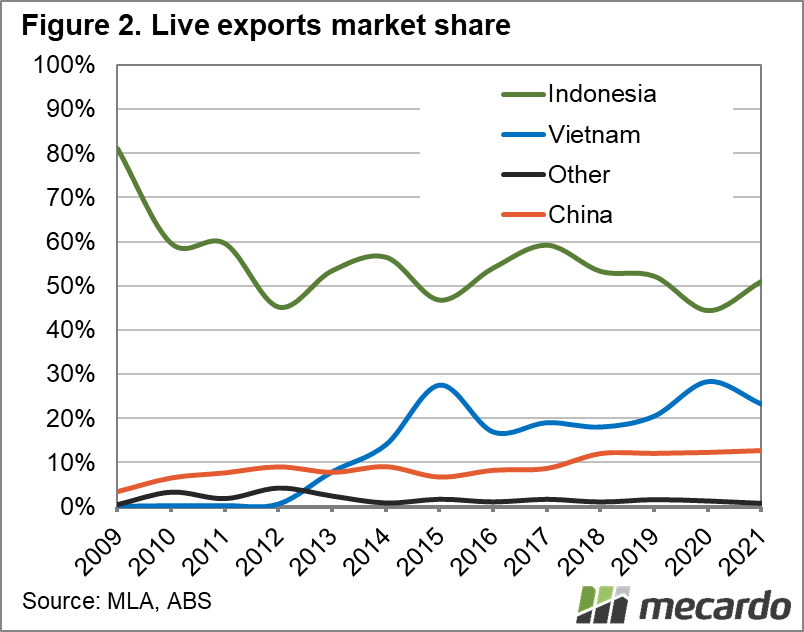

Indonesia has remained Australia’s largest live cattle market, taking more than 50% of total exports. Obviously numbers to Indonesia have fallen this year to date, but they haven’t represented all of the decline, with Australian live cattle to Indonesia down 16% for January to October (compared to total markets down 25%). However, this market has been particularly hurting since July – when Covid-19 lockdowns in reaction to the Delta strain, were first put into place. In October for instance, total live export numbers out of Australia were back 54% on the five-year-average, while those to Indonesia were back nearly 59%. If we look at the July-October period, total exports were down 23%, while the Indonesia market was down 26%.

Live cattle exports to Vietnam have also struggled in recent months, with numbers in October more than 80% below the five-year-average, with just 2,542 cattle heading that way. In comparison, more than 26,000 cattle were exported to Vietnam in October for both 2019 and 2020. For the year-to-October, Vietnam, which makes up about 23% of Australia’s live cattle export, has received 36% less cattle from our ports. Interestingly, the October South East Asia Report on Beef Central indicates competition for this market is ramping up from Brazil, which has a lower price point and is looking for new opportunities while they are still unable to send processed beef to China.

And according to Meat & Livestock Australia’s latest industry outlook released this month, there is more downside to come this year. They project that total live cattle exports will be 30% lower in 2021. This is a revision of just 1% lower than the 29% drop forecast in their July outlook. The biggest movement in the outlooks, however, came from the next two years. The July forecast had live cattle exports in 2023 up 32% on the estimated numbers for 2021. But by November’s outlook, this increase had fallen to just 18%. And when we compare the MLA’s first outlook, the expectation was that live cattle exports would only fall 9% this year, before lifting 7% by 2023. This means the forecast for 2023 in November is 20% lower than it was in February.

What does it mean?

A quick look at what current prices are available have steers out of Darwin at about 15% above year-ago levels, supported by strong domestic demand and low herd figures. If both Australian cattle numbers and our Asian importer economies experience some growth in coming months as expected, the live export market should see a recovery, but our regulatory framework and prolonged low number + high price equation has likely meant some market share has been lost to competitors for the medium to long term.

Have any questions or comments?

Key Points

- October live cattle exports dip to the lowest monthly numbers since February 2017 and more than 50% below the five-year average for the month.

- Live cattle export numbers have fallen by 25% year-on-year for the January to October period.

- Indonesia remains Australia’s largest live cattle export market with 51% of the share, and is down 16% for the year to October.

Click on figure to expand

Click on figure to expand

Data sources: Mecardo, MLA.