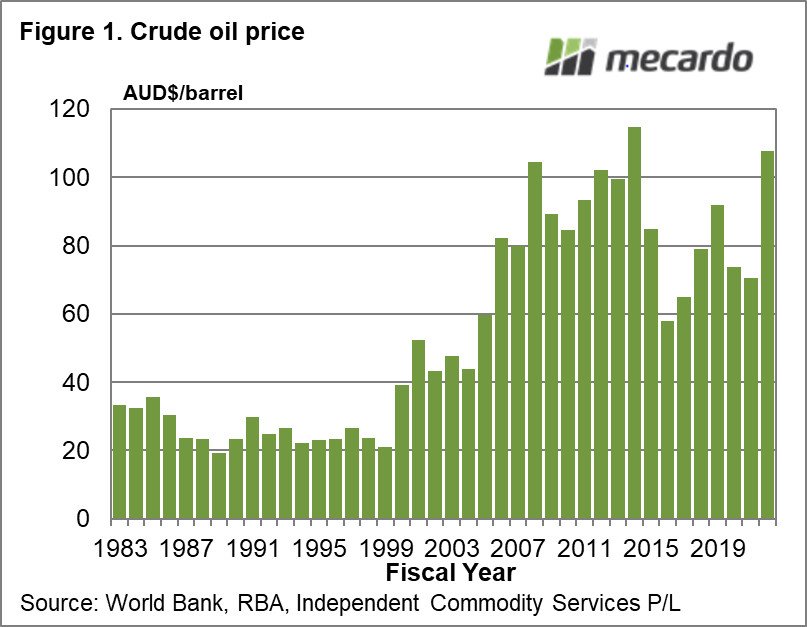

Energy prices have jumped this season with crude oil up in Australian dollar terms from $70 last season to $108 per barrel to February. Energy is a significant cost within manufacturing and provides raw material for manmade fibres, so we look at the relationship between oil, manmade fibres and the 21 MPG in this article.

PCI Fibres and Raw Materials, a fibre consultancy, were once asked about the relationship between crude oil and manmade fibre prices. They replied with this schematic (scroll down to page 7 in the link). This was their way of saying – it is a complicated system and the linkages are not straight forward.

Figure 1 shows the annual average price for a barrel of oil in Australian dollar terms from 1983 onwards, with the current financial year average to February. The price has increased 54% this season, back up close to the 2013-14 peak level. In US dollar terms it is up 47% for the season to date. Either way crude oil prices have risen substantially.

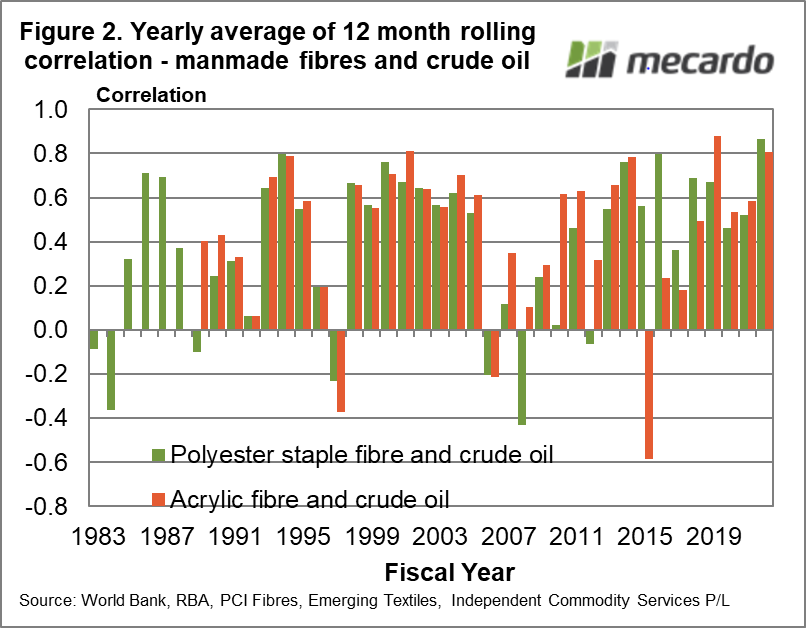

What is the relationship between manmade fibres and crude oil prices? Figure 1 shows the seasonal (financial year) average for rolling 12 month correlations between polyester staple fibre and crude oil and acrylic fibre and crude oil, from the mid-1980s onwards. The key feature of the graph is that the manmade fibre and crude oil price correlations are heavily skewed to being positive, that is the prices tend to follow the same direction. However there are periods when the correlation disappears or even goes into reverse (negative). This represents a problem for the simple assumption that higher oil prices will drive higher manmade fibre prices – it is quite likely but not a certainty.

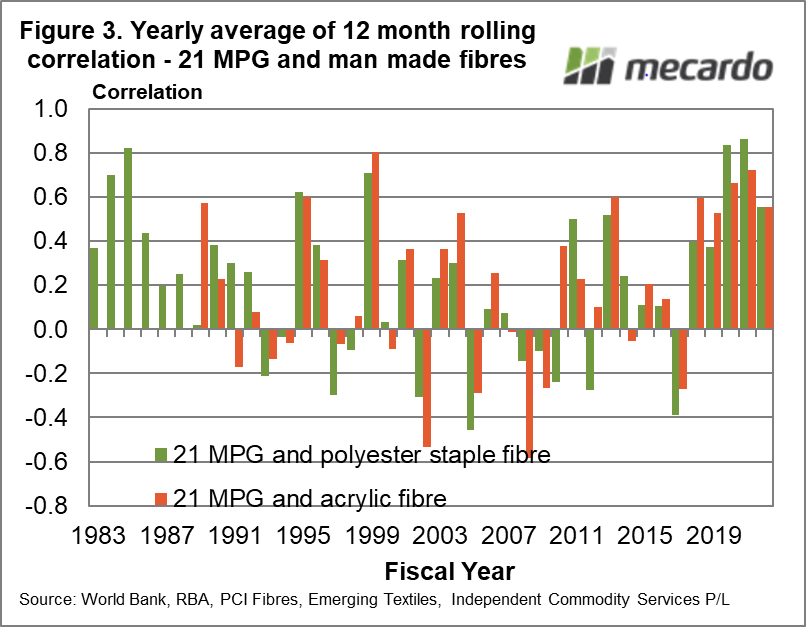

What about wool? Figure 3 looks at the correlations between the 21 MPG and both polyester staple and acrylic fibres, using a similar method to Figure 2. The correlations jump around a lot, swinging from strongly positive to strongly negative, with little correlation in some years. In recent years the correlation has skewed to be strongly positive but the pandemic effect in 2020 (and the subsequent recovery in 2021) was driving commodity prices in those years, so 2020 and 2021 probably need to be ignored. In doing so the correlation between the 21 MPG becomes even more variable, so in looking forward to later in 2022 and in 2023 take your pick, will the correlation be strongly positive or negative?

What does it mean?

As a direct influence on broad merino prices, oil has a poor record. It is too simplistic to assume broad merino prices will increase as a consequence of higher oil prices. They might, but it is simply a guess.

Have any questions or comments?

Key Points

- Oil prices are up by around 50% for this season.

- Manmade fibre prices tend to be strongly positively correlated with oil prices, but there are periods when the correlation breaks down or even reverses.

- The 21 MPG has a highly variable correlation to polyester staple and acrylic fibre prices. There is no real consistency.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: World Bank, RBA, PCI Fibres, Emerging Textiles, ICS