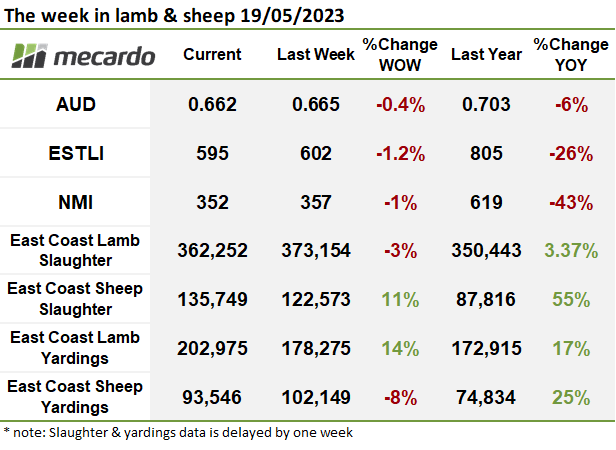

The cheaper direction settled in this week with prices for most categories of lamb and sheep pushing lower. With supply exceeding normal bounds for this point in the season and plenty of saleyard reports this week noting some regulars were MIA, the pressure on the market remained.

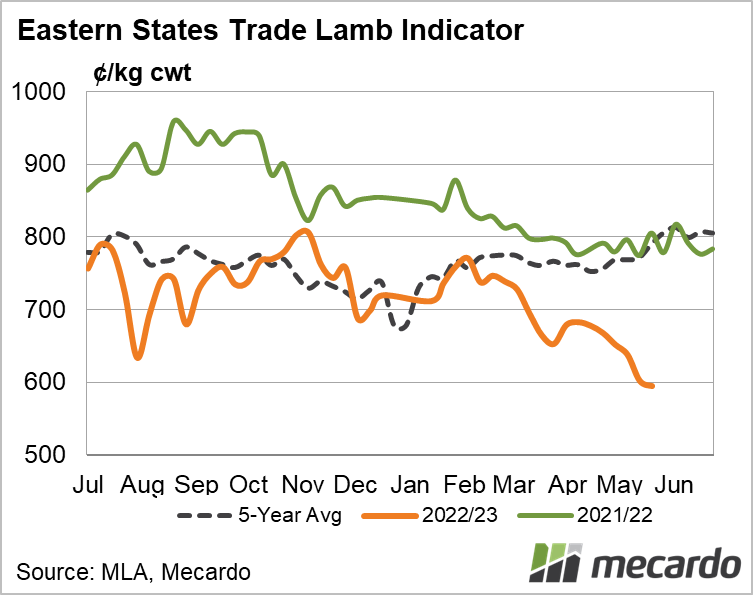

The Eastern States Trade Lamb Indicator (ESTLI) lost another 9¢ over the week tipping the ESTLI under the $6 mark at 595¢/kg cwt (-20% YOY). The last time we saw the ESTLI under $6 was back in April of 2018, right before we saw African Swine Fever outbreaks in China send demand for red meat surging. In the West, trade lambs followed the eastern market lower, dropping 52¢ on the week to 449¢/kg cwt.

The National Heavy Lamb Indicator continued to track lower, down 6¢ on the week to 661¢/kg cwt. In Victoria, heavy lamb prices did bounce towards the end of the week, but not enough to make up for the early losses.

In both Victoria and NSW, restocker lamb prices bounced 40-60¢ higher this week, after falling around 90¢ last week. In WA and SA, the market was playing catchup and restocker prices weakened week on week. This dragged the National Restocker Lamb Indicator down 6¢ overall to 472¢/kg cwt. Light lambs failed to attract more buying activity, with the National Indicator losing another 16¢ over the week to 497¢/kg cwt.

Merino lambs were the bright spot this week. The National Merino Lamb Indicator has been trading in a range from 490 to 570¢ since the start of April, and this week ended in the upper range at 544¢/kg cwt. This upward movement this week was driven by NSW and WA.

The National Mutton Indicator fell 5¢ over the week, settling at 352¢/kg cwt.

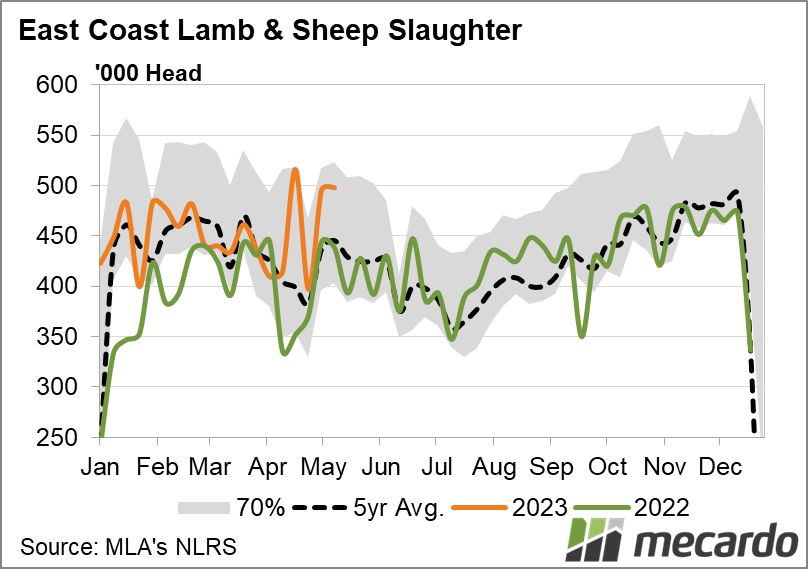

Both lamb and sheep slaughter continue to track in the upper range of what we have historically seen at this time of year. For the week ending the 12th of May, lamb slaughter in the east was 2% higher than the five-year seasonal average and 3% above the same point last year. With over 135k sheep processed in the east last week, we have to go back to 2014 to find sheep slaughter this strong in May.

Saleyard throughput is also running well above normal levels for this time of the year. Last week both sheep and lamb yardings exceeded the historical range for this point in the season. In the east, lamb throughput last week was 10% above the seasonal average, and while sheep throughput was down slightly on the week prior, was 51% above the seasonal five-year average. The total number of sheep and lambs processed in the east last week was even higher than in the peak slaughter weeks of December last year.

The week ahead….

There’s not much rain on the forecast for the next week according to the BOM and the three-month outlook is still pointing to a dry winter. Processors seem to be operating at (or near) capacity so we will be waiting for supply to tighten up for a price improvement.

Have any questions or comments?

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: MLA, BOM, Mecardo