The question of premiums in agricultural commodities is often up for discussion, and the recent weaner calf sales provides the opportunity to examine the existence or not of an “EU” premium for weaner calves.

A disclaimer first, this initial analysis is based only on the Nutrien/Elders sale at Hamilton, on the 5th of January this year. To remove other possible impacts on price, for this analysis we only looked at the possibility of an EU premium on the Angus steers offered on this day.

There were a total of 1,017 non-EU Angus steers offered, and 243 EU accredited steers offered, while the average pen size was 15.4 for the non-EU & 18.7 for the EU steers.

We are fortunate to be able to use the data collected and provided by AuctionsPlus, who successfully (and with some impact on the market) provided an interface presence which allowed access to remote buyers letting them compete with buyers at the sale.

In Australia, EU cattle meet the specifications under the European Union Cattle Accreditation Scheme (EUCAS) by guaranteeing full traceability of animals though NLIS that they have never been treated with Hormonal Growth Promotants (HGP’s) at any time during their lives.

Specifically, EU cattle are born and raised on accredited farms, and, furthermore, are sold in one of the 49 accredited saleyards across the country, which includes Hamilton.

Last year AuctionsPlus Market Insights had a look at this question over multiple years and calculated that EU premiums vary significantly year on year, ranging between 1 and 30 cents/kg liveweight. They found EU premiums not only varied randomly from year to year, but also across weight ranges.

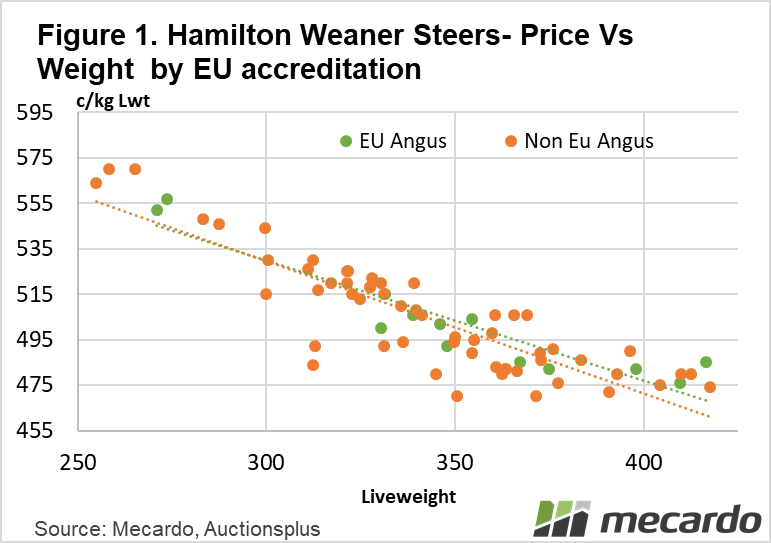

The first point to note is that while the weaner calves this year are heavier than usual, it is the lighter calves that were achieving the highest price (¢/kg) (Figure 1). This was true for EU or non-EU accredited cattle. With buyers from as far away as QLD, freight became an important factor with small cattle allowing more bodies per load, providing an incentive to those buyers from a long way away trying to build herds.

Every year & season is different, and with the strong restocker demand from northern buyers this year, light steers achieved prices north of $5.00 per kg, with their aim to purchase “any” cattle to restock & build numbers trumping any EU premium.

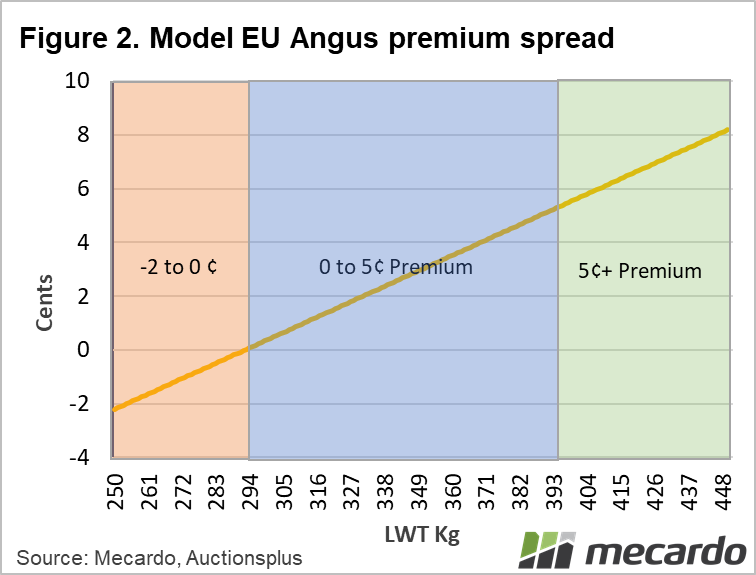

While acknowledging this is a small data set, the available data allowed us to run a linear regression analysis, the results of which described the relationship between total liveweight, and cents per kilogram premium related to EU accreditation; enabling a clear view of the sales performance (Figure 2).

This model demonstrates that in this market, any price premium for EU Angus steers only started at 298 kg lwt and above, steers below this weight actually achieved a 0 to 2¢ discount.

Above 394 kg lwt, a premium of 5¢ building to 8¢ for the heaviest steers was paid. It was in the heavier cattle where the value was identified, with $20 to $30 per head achieved for vendors.

In searching for best practice and year on year improvement, some breeders have pursued the EU accreditation pathway. This should be encouraged in the future despite the modest premium paid this year, as the previously published data shows that the EU premium varies year to year.

What does it mean?

This year, based only on the Hamilton Nutrien & Elders Angus weaner calf sales using AuctionsPlus supplied data, the premium for EU accredited cattle only kicked in at the 300 kg lwt level, increasing for the heavier cattle.

EU accreditation however should remain an objective of cattle breeders, as the best policy is to open your stock up to as many potential buyers as possible.

Have any questions or comments?

Key Points

- AuctionsPlus collect EU accredited cattle price data

- Premiums paid for heavy EU accredited steers

- EU accreditation still a worthy exercise

Click on figure to expand

Click on figure to expand

Note: this model uses a dataset from a single sale at Hamilton.

Data sources: AuctionsPlus, Mecardo