There is plenty of conjecture as to how much is too much in terms of lamb prices. We know that current price levels are impacting domestic demand, but export demand is becoming more and more important in terms of setting our prices.

Export markets now take a majority of the lamb produced in Australia. In the last five years, domestic lamb consumption has fallen from 45% of total production in 2015, to an estimated 32% in 2019. Meat & Livestock Australia (MLA) forecast domestic consumption to fall further in 2020, albeit only by 1 point to 31%

Rising prices are the main driver behind falling domestic consumption. As supply tightens, and export demand strengthens, export markets have more buying power. As such, it is not so much how much local consumers can pay for lamb which will limit prices, but how much export markets are willing to pay.

The falling Aussie dollar has meant the recent high lamb prices, which are approaching records, are not unprecedented in export markets.

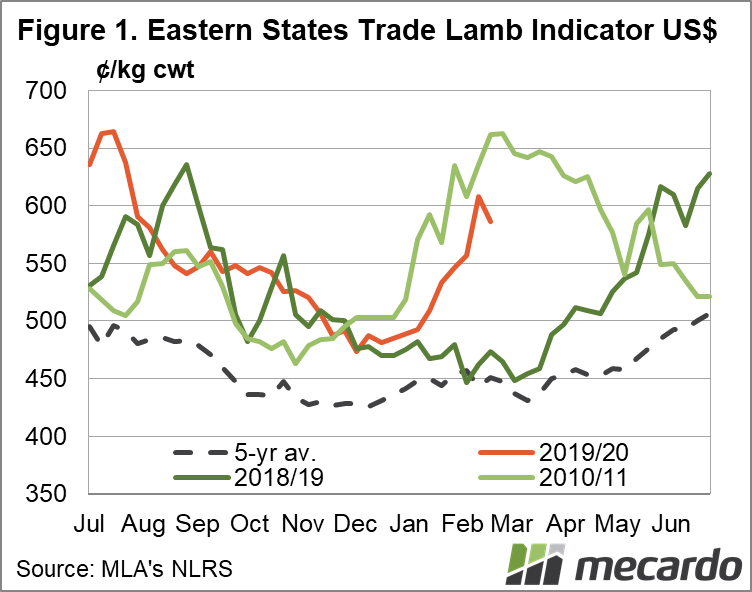

Figure 1 shows the Eastern States Trade Lamb Indicator (ESTLI) in US dollar terms. From June to August in 2019, lamb prices were stronger than current levels in US terms. Back in 2018 lamb prices peaked higher in US terms, and as long ago as 2011 lamb prices maintained levels above 600US¢ for three months.

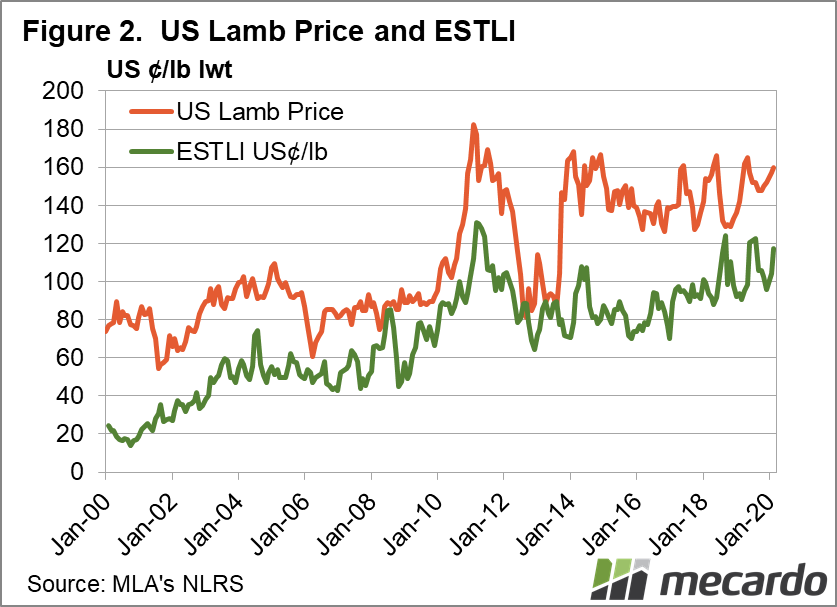

Figure 2 shows the price of lamb in Sioux Falls, South Dakota, and the ESTLI converted to US¢/lb. Since tanking in 2013, US lamb prices have remained at the top of the historical range as their flock continues to shrink. US lamb prices are still at a strong premium to Australian values.

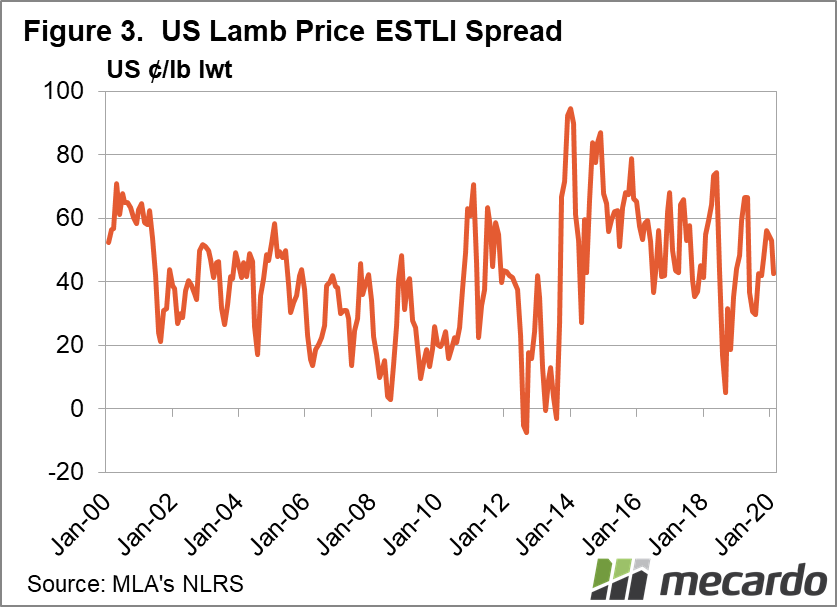

Figure 3 shows that despite close to record prices here, the US premium has been lower in the past, which suggests that our lamb might not yet be too expensive in export markets.

What does it mean?

Australian lamb prices remain at a discount to US lamb markets, which is part of the reason why prices have managed to reach current levels. There might still be some potential for prices to rise further on the back of export demand, but based on recent history, prices will be finding resistance at current levels. Having said that, solid support for prices is not far away, and given the outlook for supply, there is little reason to think prices are going to fall substantially in the short term. Have any questions or comments?

Key Points

- Domestic lamb consumption is being impacted by prices, but exports markets remain strong.

- The lower AUD and continued strong US prices see Australian values at a discount.

- Lamb prices should find support on the back of strong export demand.

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: MLA, Mecardo