When discussing finished cattle prices in their latest beef industry projections released last week, Meat & Livestock Australia described the situation as an “uncertain, evolving and challenging scenario”. Which doesn’t exactly fill one with confidence heading into the spring. Luckily for those already in the game, a historically high heavy steer indicator means there is still some breathing space if the price starts to head south.

The current numbers are much more positive. The national heavy steer indicator, while having dipped from its peak of 383¢/kg live weight in June, is trading at a more than 50¢/kg premium to the same time last year (currently 364.3¢/kg). This price has been supported by the lack of finished cattle available over winter – and with national cattle slaughter now forecast to be 1.4 million lower for 2020, the supply equation is likely to stay on the side of the seller. As we pointed out HERE, Victoria’s small share of the national cattle kill means their processing slowdown shouldn’t have a big impact on the market in the short term.

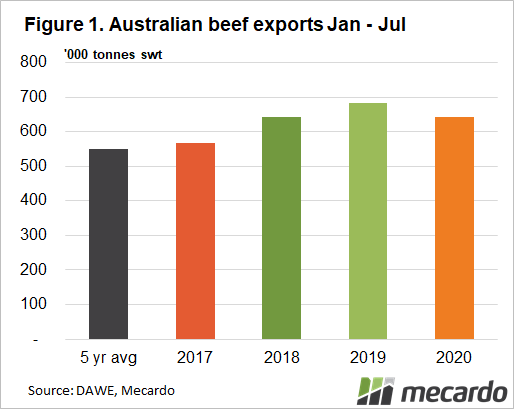

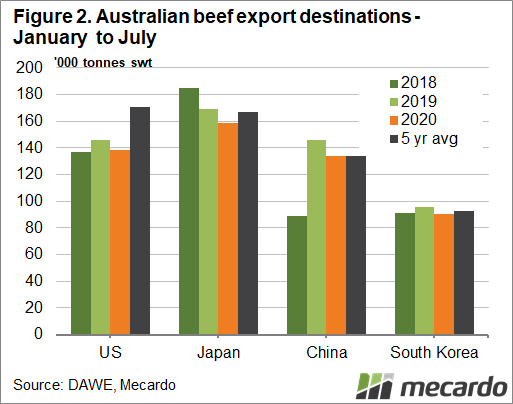

Demand is more complicated. Australia’s beef export volumes are yet to feel the impact of Covid-19 restrictions and global economic downturn, tracking only slightly below year-ago levels for the first seven months of 2020. And at above 642,000 tonnes shipped weight, it is the second highest volume for that period in the past five years. Dollar returns are harder to scrutinise, with only year to May data currently available, but the first quarter of 2020 reached a record high value (for the January to March period). This can be put down to another illness that has long been overshadowed – African Swine Fever. China’s decimated pig herd (pork production fell 21 per cent in 2019) means the value of Australia’s beef exports to that country rose by 27 per cent for the year to May.

However, the global economic downturn won’t go unnoticed by the Australian beef industry and its already internationally out of kilter prices, predominantly supported by a small herd and a cracking season. MLA points out that 11 out of 15 of the most valuable beef export markets are predicted to enter recession this year. If you team that with extra supply coming out of the US thanks to a Covid-19 impacted processing backlog of fed cattle, and Australia’s diminishing supply of cattle being turned off, it won’t come as any great surprise if our export beef markets start to look at lower-priced options for their protein.

What does it mean?

Domestic impacts will continue to support cattle prices in the short term, however the global Covid-19 impact will hit sooner rather than later. The cattle herd being slower to move into a strong rebuilding phase (female slaughter was still 56 per cent in May) will offer some reprieve, but with close to 70 per cent of Australia’s beef production heading offshore, the contracting economies of our key export markets will be one to watch.

Have any questions or comments?

Key Points

- Beef exports volumes dip only slightly for the year-to-date, and remain above the five-year average.

- Volumes of beef sent to China this year have dropped 3 per cent, but the value of that market has risen by 27 per cent.

- Low supply on sellers side, but export markets economies will start to slow.

Click on graph to expand

Click on graph to expand

Data sources: MLA, DAWE, Mecardo