Cattle markets and prices are complicated, with plenty of fundamentals having input to the prices at saleyards. In the current environment, demand is extremely unpredictable, but last week we saw that Meat & Livestock Australia (MLA) tried to put some numbers on supply, so we can look at what that means under demand scenarios.

As outlined last week, MLA expects Australian cattle slaughter to plumb 24 year lows in 2020 and 2021. While supply is a key driver in cattle markets, we have found in the past that it only goes so far. Beef is a global market, and it has been well documented in the past, that local supply can only push prices so far around the base price. The base price is set by export beef markets, which are driven by global beef markets.

Manufacturing beef is one of Australia’s biggest exports, and we have a very good historical price series to compare to cattle values. The 90CL Frozen Cow export price indicator has historically had a good relationship with the Eastern Young Cattle Indicator (EYCI). When the 90CL export prices are strong, cattle prices are strong, and vice versa.

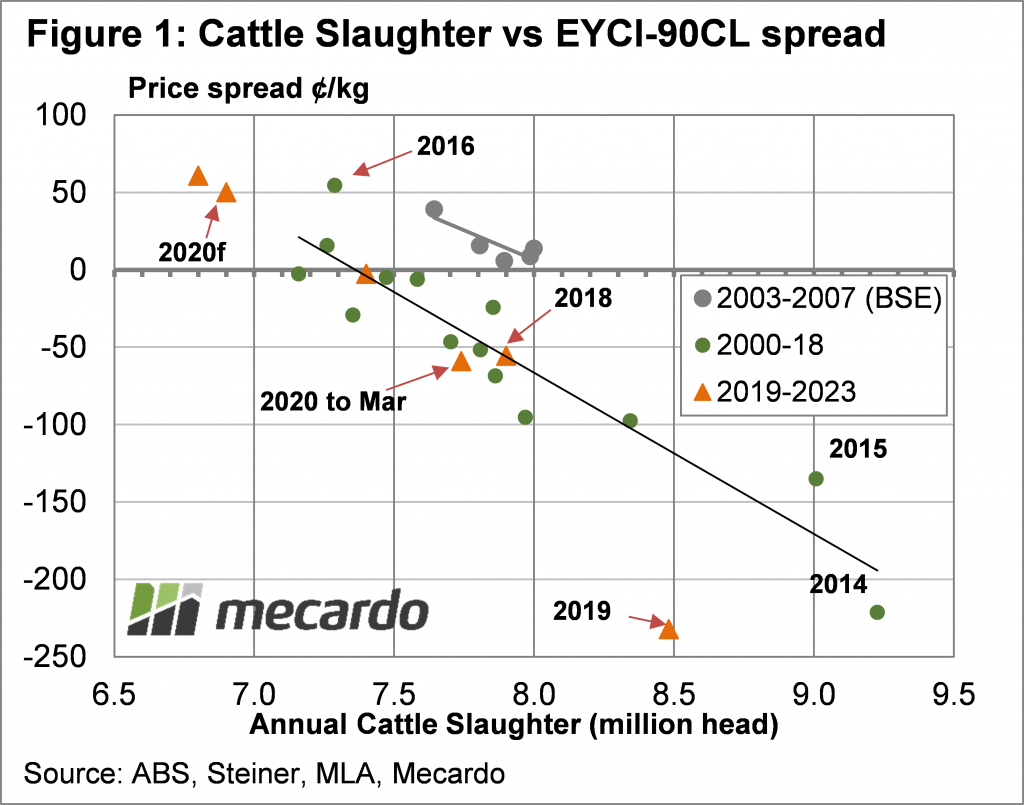

Local cattle supply tends to move the EYCI around the baseline price set by the 90CL. This makes sense, with tight cattle supplies forcing strong competition for cattle, and tight processor margins, with prices in saleyards close to export beef values. When cattle supply is high, prices fall relative to export values as more cattle are on the market than can be slaughtered.

Figure 1 shows the EYCI premium or discount to the 90CL, charted against annual slaughter. The higher slaughter, the larger the EYCI discount. Last year was somewhat extreme. After 2018 was right on the trendline, the relative value of the EYCI slipped to very low levels as the 90CL hit extreme highs, and ongoing drought saw demand for young cattle from restockers extremely weak.

The three months to March this year has seen demand return back towards the trendline. The figure is simply the average EYCI discount to the end of March and the three months slaughter multiplied by four to give a value as if it was a full year.

The forecast slaughter for 2020 suggests the EYCI will average a 50¢ premium to the 90CL, however, this could be skewed this year by the weaker demand for high value cuts, with the 90CL an indicator for lower value beef.

What does it mean?

The most volatility in prices is likely to come from export beef values. The 90CL has jumped higher in recent weeks, but we have all heard about the issues with beef supply in the US. This analysis also can’t factor in the reduction in demand for high value cuts in both export and domestic markets, which will likley see cattle prices at lower levels relative to the 90CL than we might normally expect.

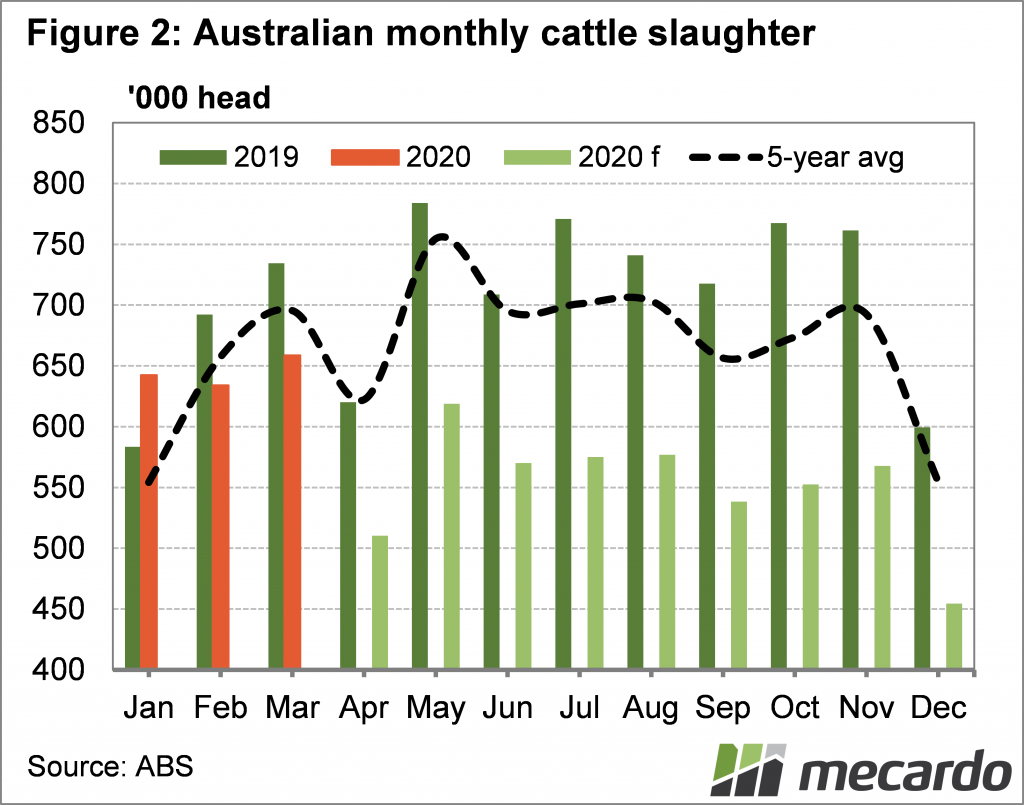

However, cattle prices in general and young cattle, in particular, will find solid support, from the fact cattle slaughter will have to tighten significantly to hit the 2020 forecast. Figure 2 shows how slaughter will pan out if average seasonality holds, and it will have to be very low, which bodes well for producers with cattle to sell.

Have any questions or comments?

Key Points

- The forecast for cattle slaughter in 2020 is expected to get close to 24 year lows.

- Cattle prices are largely set by export beef prices and cattle supply.

- Lower demand for high-value beef will skew demand curve, but very tight supply will provide price support.

Click on graph to expand

Click on graph to expand

Data sources: MLA, Mecardo