While apparel fibre prices, including wool, plumb new cyclical lows, fine merino premiums continue to increase. This article takes a look at fine micron premiums, taking into account supply which is a factor often overlooked when discussing changes in the price structure of the greasy wool market.

In early June Mecardo looked at micron premiums and discounts in the market, showing how supply is helping to widen the price differences between micron categories. Some of these changes have been unexpected, with the gap between the 19 and 21 micron categories actually narrowing during the past three months. The finer micron category premiums however, have continued as expected.

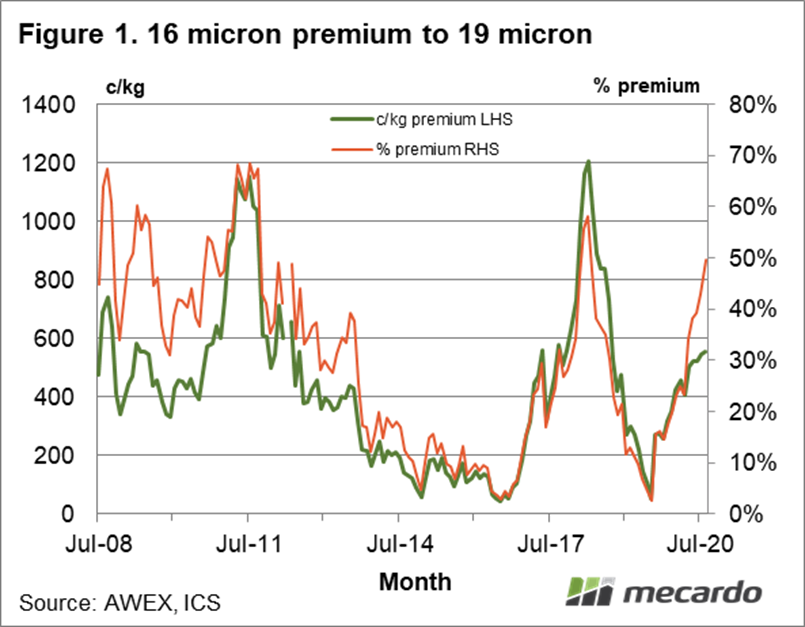

Figure 1 shows the premium between a standard 85 mm length (actually 70 to 85 mm) 16 micron fleece with a staple strength around 35 N/ktx and its 19 micron equivalent from 2008 to this month. The premium is shown in both cents per kg terms and proportional (percentage) terms. The 2013 to 2016 period stands out as a time of depressed fine micron premiums, with a brief return to these levels in 2019. Since mid-2019 the premium has risen from a miserly 3% to 50% (from 54 cents to 550 cents clean). The premium has returned to a level which prior to 2013 would have been considered “normal”. In the time from mid-2019 to now the 19 MPG has fallen from 2100 to 1083 cents, nearly by half.

Demand tends to drive the dominant cycles and trends in the market with the COVID-19 pandemic effect on demand a classic example of this phenomenon. Change in supply tends to alter the relative prices of different wool categories. Think of vegetable matter (VM) discounts when there is a lot of VM in the clip or discounts for staple strength when staple strength is low and the associated mid-point break is high.

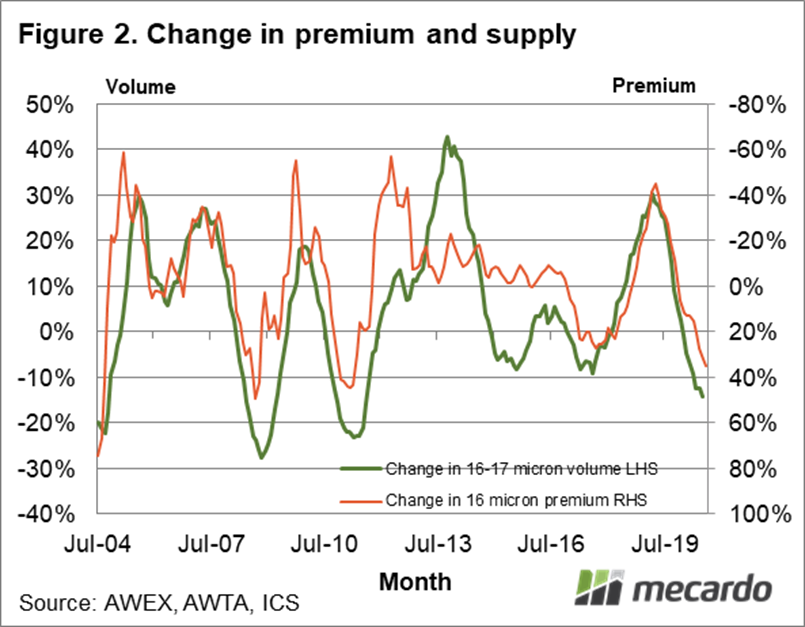

In Figure 2 the key driver behind the change in the fine micron premiums is shown, the change in supply of fine merino wool. The change in volume of 16 to 17 micron wool (as measured by the AWTA) is shown on the left hand scale. The change shown is the change in the rolling 12 month supply of this wool. The right hand scale shows the year on year change in the premium for the 16 micron category to the average merino micron category, smoothed by three months and reversed to accentuate the correlation between the change in supply and premium. As the change in supply weakens, so does the change in premium. As a rough rule when the change in supply starts to fall we can expect the premium to start rising. With good August rainfall in eastern Australia, in particular NSW which has endured a run of extremely dry springs the supply of 16-17 micron wool should continue to fall through to 2021, maintaining pressure on the 16 micron premium.

What does it mean?

Rising fine micron premiums are helping to offset some of the fall in the overall market. For fine wool producers this then rules out the use of most hedging tools unless the micron category of the hedge instrument is close to the expected average micron of the wool to be produced. The rise in the premiums is a good example of how supply influences market premiums and discounts but not the overall trends and cycles of the greasy wool market.

Have any questions or comments?

Key Points

- Fine merino premiums have been rising since mid-2019.

- Supply is falling as the fibre diameter of the merino clip broadens as a function of improved seasonal conditions.

- This trend should persist into 2021 so the upward pressure on fine merino premiums will be maintained until the second half of the season.

Click on graph to expand

Click on graph to expand

Data sources: AWEX, AWTA, ICS, Mecardo