The female slaughter rate, or FSR provides a good proxy for indicating the ongoing strength of the cattle herd rebuild in Australia. Foetal calf blood markets are linked to the number of females being slaughtered each week, with high prices a potential leading indicator for a low FSR, and a continuing herd rebuild.

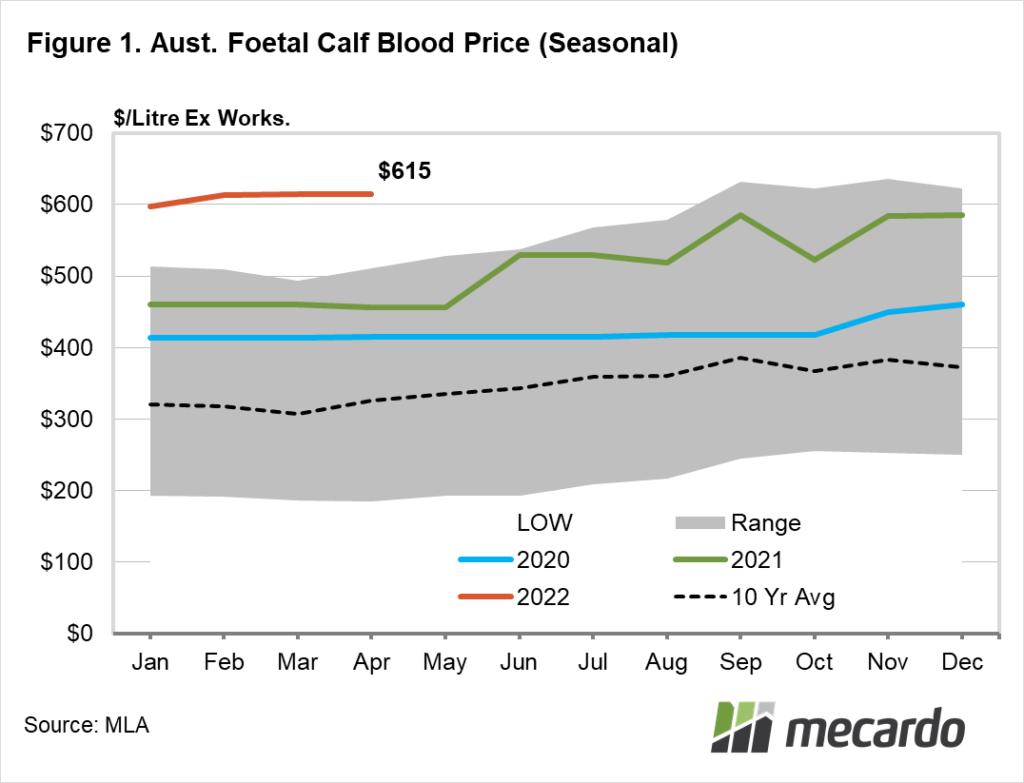

We last looked closely at the mechanics of foetal calf blood (BFS) markets back in September 2020. At the time the latest herd rebuild phase was only just starting to gain momentum as pastoral conditions undertook a huge and welcome reversal from the drought, and prices sat at a heady $415/L (figure 1). In retrospect, supply was only just starting to tighten at that stage, with prices lifting from $300/L in 2019. This may also have been supported by increased pharmaceutical demand due to a surge in biomedical research and vaccine development in response to the COVID-19 pandemic.

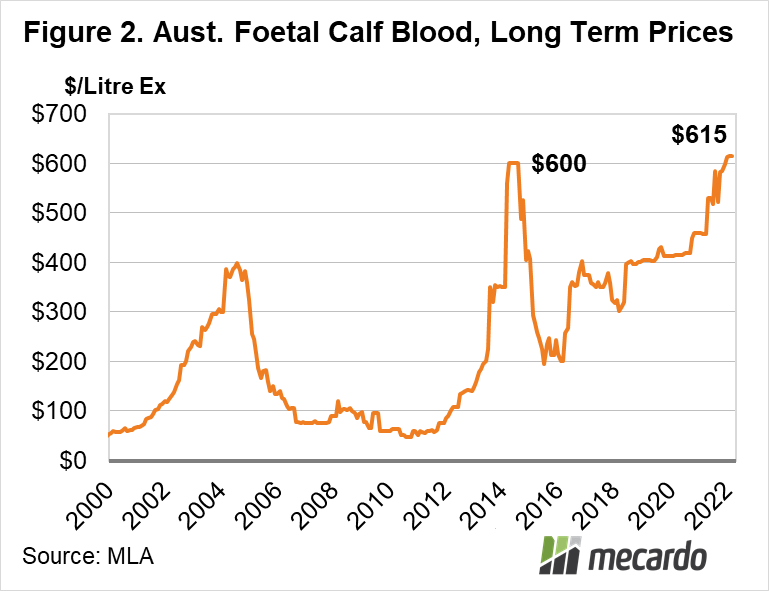

We noted that prices spiked to a massive $600/litre back in 2014 (figure 2) when the peak of an extended rebuild cycle occurred, assisted by strong European BFS demand. This peak has now been surpassed, hitting a new record high of $615/ litre, with prices still trending upwards.

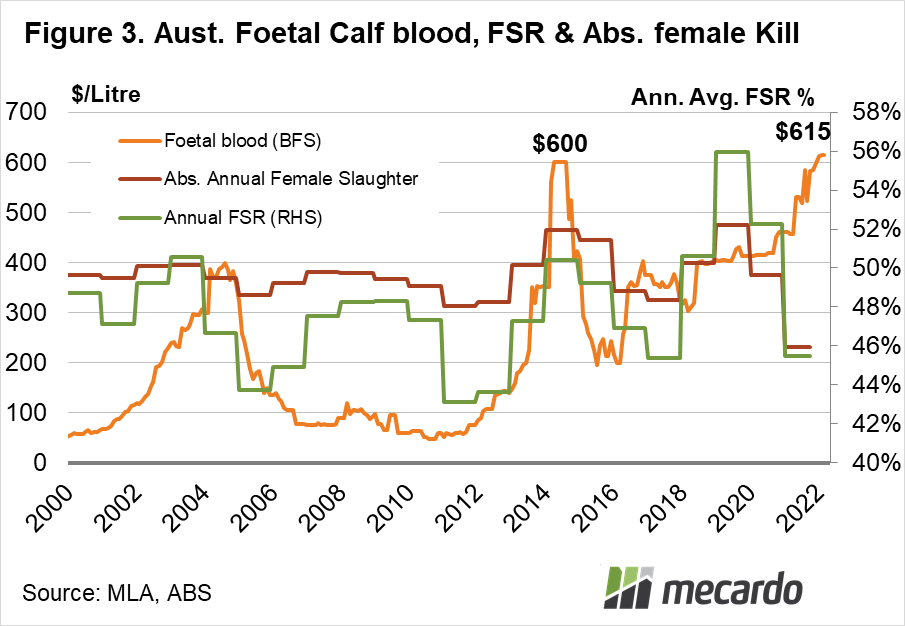

If we examine the female slaughter ratio (FSR), foetal calf blood (BFS) prices, and the absolute number of female cattle being slaughtered, it can be seen that, in many cases, a dip in the FSR ratio and a reduction in female slaughter rates is often accompanied by a rise in BFS prices as a result. This relationship makes sense. If less females are slaughtered, supply of BFS will reduce, causing prices to rise (figure 3).

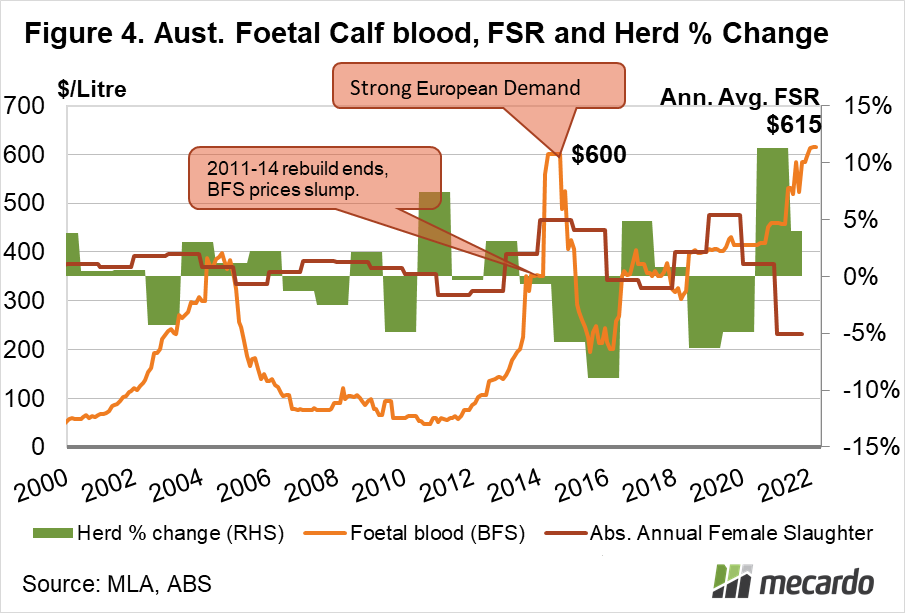

If we bring the annual percentage change in the Australian cattle herd into the equation, over the last decade at least, we can see that herd rebuild cycles are generally related to lower FSR ratios, and seen alongside higher BFS prices. Conversely, herd liquidations are typically related to falling BFS prices (figure 4).

How is this information useful to producers though? BFS is sold by processors, and sellers generally do not get a direct slice of the action in this market. Female cattle slaughter data that provides guidance on whether the herd rebuild is continuing is only released quarterly, and with a significant delay. The BFS price quotes can be used as an indicator of the health and strength of the rebuild.

The uptrend in BFS prices we can see now is somewhat indicative that female cattle supply is tight, supporting the rebuild. If we start seeing a sustained fall in BFS prices, it could mean that the rebuild drive has reached a peak, and the outlook on cattle prices will be substantially softer.

What does it mean?

High foetal calf blood (BFS) prices point towards only one thing – relatively low numbers of pregnant cows going to slaughter. While we don’t have data on monthly female slaughter rates anymore, the ongoing strong foetal calf blood market indicates that producers are holding onto their girls, and that the FSR, is still in low territory supporting the rebuild. It’s worth watching BFS prices as a substantial fall could be indicative of the end of the rebuild cycle, which has some negative implications for the cattle market, particularly for cows and restocker steers.

Have any questions or comments?

Key Points

- Foetal calf blood prices are trading at a record high level of $615/litre .

- Prices are inversely related to female slaughter volumes.

- Any significant fall in foetal calf blood prices could be a leading indicator of the herd rebuild reaching its peak, and females being liquidated in greater numbers.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo, ABS.