A common theme in all markets at the moment is uncertainty, and it’s no different in lamb markets. Given the uncertainty, it was little surprise to see forward contracts offered last week taken up very quickly. Here we take a look at how forwards compared to recent pricing, and that of this time last year.

Lamb prices have weakened from the extreme highs of late February and early March, and this is especially the case for export lambs. A couple of export processors have taken the opportunity to put out some forward contracts.

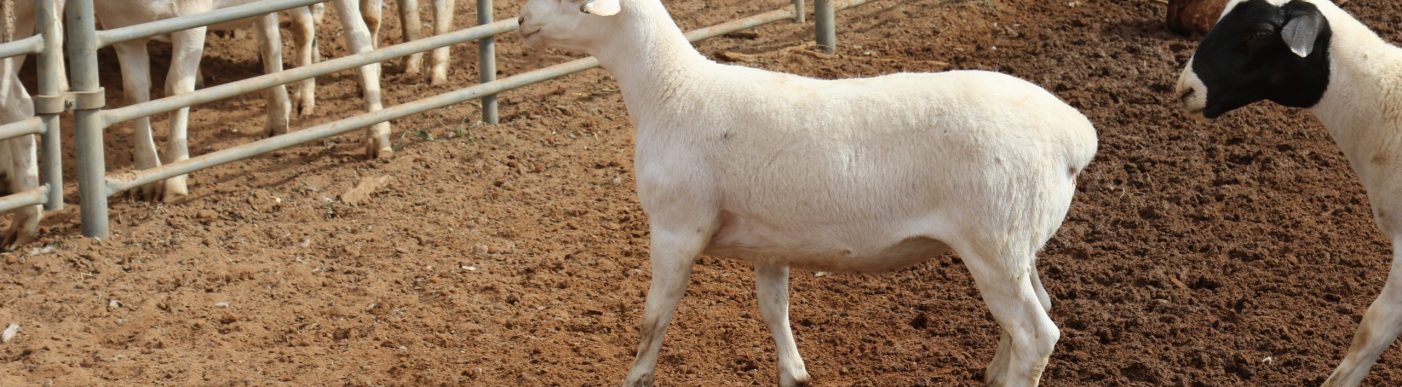

The price levels of forwards are no doubt very strong on historical levels, but compared to the 950¢ plus saleyard pricing of early March they are comparatively cheap. Figure 1 shows forward price have been pitched in the 800-900¢ range, following levels seen at saleyards last year, without the July peaks.

Comparing export processor prices with the Eastern States Trade Lamb Indicator (ESTLI) is a little like comparing oranges with apples, especially in the current environment. Domestic lamb demand is strong, while in export markets there are issues with demand and credit. Things appear to be turning around in China, however, which should provide some support.

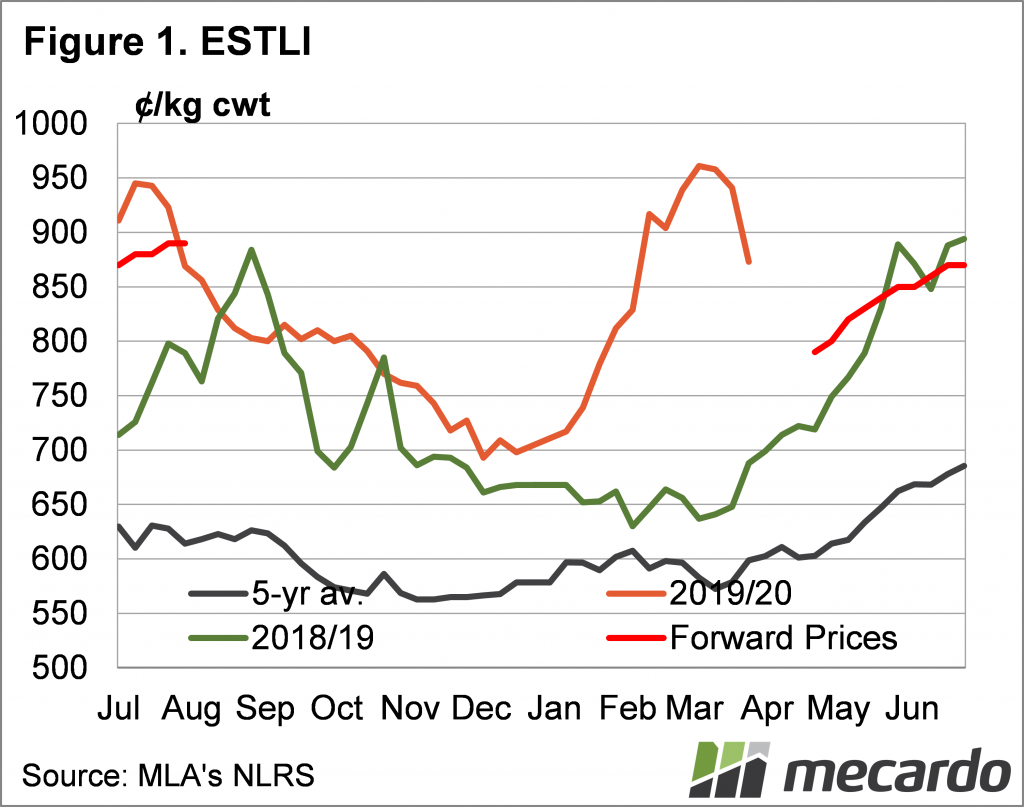

Merino lamb forward prices are the pick of the pricing. At a 30¢ discount to crossbred lambs, Merino forwards look like good selling compared to last year (figure 2). While Merino forward prices are lower than the March peak, over the hooks forwards look likely to outstrip saleyard pricing, where they are usually more highly discounted.

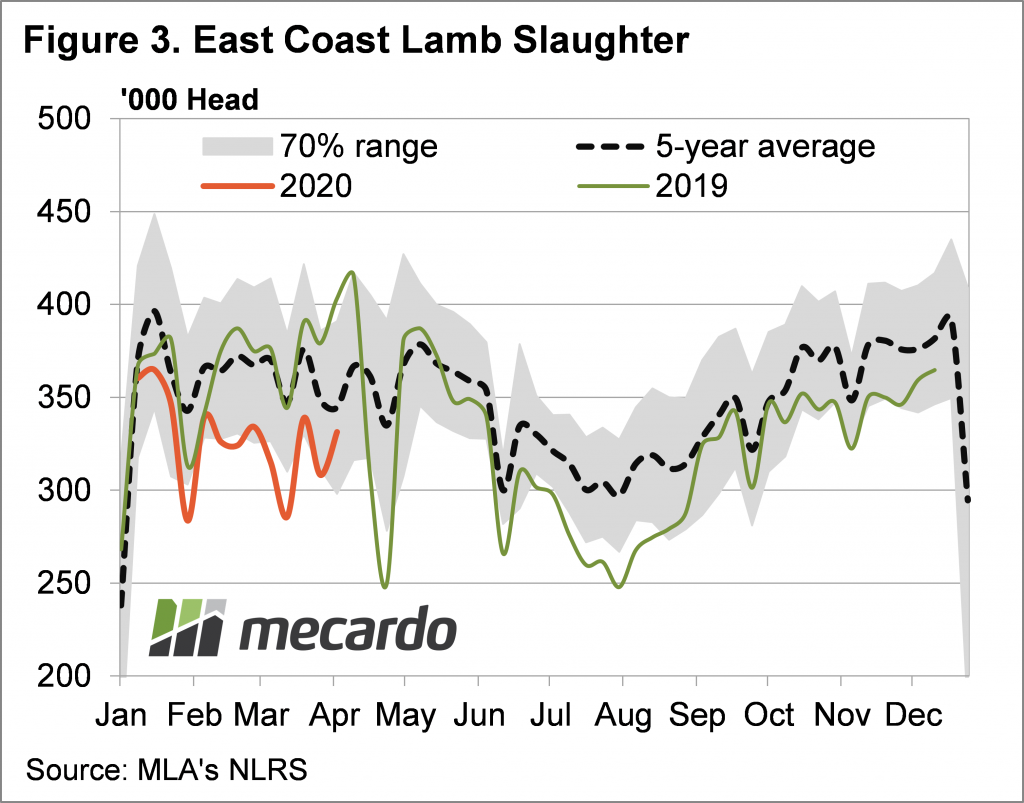

We know demand is likely to be weaker than late February and early March, and supply is going to drive prices at these new levels. Lamb supply will have to fall below current levels to see prices move higher. Figure 3 shows winter lamb supply was last year was well below current levels, and this might be what processors are guarding against. With sheep supply likely to be very weak, lambs will be required to fill kill chains.

What does it mean?

Forward contracts at rates similar to last year are good news for growers, but the fact that they filled so quickly could be a worry for those holding lambs. While there is little pointing towards stronger lamb supply this winter, weaker demand will limit how much processors are willing to pay before cutting kills.

On the other hand, any improvement in export demand, when combined with tight supply and a weaker Aussie dollar, could see lamb prices rally past last year’s levels.

Have any questions or comments?

Key Points

- Autumn and winter lamb forward contracts were released in the last fortnight at levels similar to last year.

- Forwards filled quickly, with growers opting for certainty in the current environment.

- Lamb supply is likely to weaken, but the potential upside is limited by export demand.

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: MLA, Mecardo