With the buoyancy of the Australian cattle market in 2021, it will come as no surprise that female slaughter dropped further in the final three months of the year. ABS released its official slaughter figures for quarter four, or October through December 2021, last week, showing cattle fell across the board compared to the same period the previous year. The female slaughter ratio (FSR) dropped by 1% from the previous July-September figure to 43.4% - about 3% below the 10-year average for the fourth quarter.

With the buoyancy of the Australian cattle market in 2021, it will come as no surprise that female slaughter dropped further in the final three months of the year. ABS released its official slaughter figures for quarter four, or October through December 2021, last week, showing cattle fell across the board compared to the same period the previous year. The female slaughter ratio (FSR) dropped by 1% from the previous July-September figure to 43.4% – about 3% below the 10-year average for the fourth quarter.

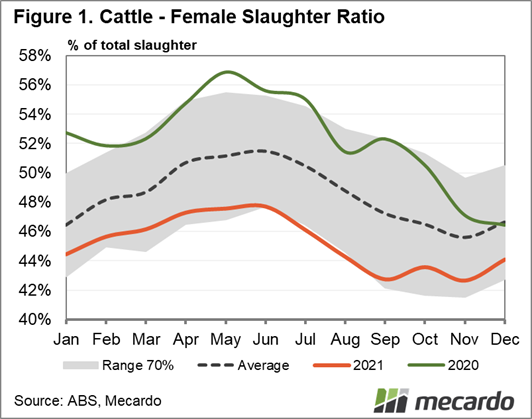

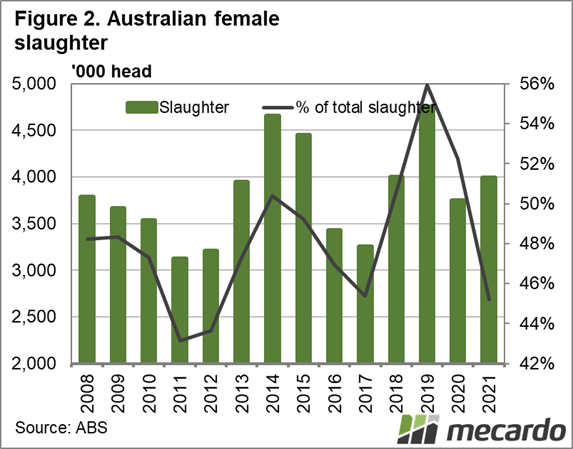

We calculate monthly figures from the quarterly reporting, as you can see in Figure 1, which demonstrates the FSR did sit within the 70% range for the last three months of 2021, but was well below both year-ago and average levels. However, it is the annual FSR that we can see in Figure 2 which gives us a good representation of industry intent when it comes to further building up cattle herd numbers. The FSR for the 2021 calendar year was 45.2%, its lowest figure since 2012. The last time we experienced similar seasonal and price conditions, in 2017, the FSR was very close to 2012, at 45.4%. The FSR was at 52.3% in 2020, having hit its highest point for the previous 10 years of 55.9% in 2019. The 10-year average annual FSR is 48.5%.

All the major states recorded a lower FSR in the December quarter compared to their annual figure, with Queensland once again leading the charge for female retention. They had the lowest FSR for quarter four of 33.8%, nearly 3% below their annual figure of 36.6% for the year. But it wasn’t just the females the state was keeping on in the final three months of last year. According to AuctionsPlus analysis, southern Queensland purchased the highest volume of any region, picking up 23% of all cattle sold through the platform for that period – which was 43% more than they purchased in that quarter of 2020, and 272% more than 2019. However females only made up 42% of their purchases, compared to the rest of the top five regions, where females made up 53-66%.

The other four top purchasing regions on AuctionsPlus for the quarter were all in NSW, which had an FSR of 43.6% for October-December, and a 2021 total figure of just above that at 44.1%. In Victoria, the FSR dropped by more than 3% for the quarter but remained above 60%, and averaged 62.8% for the year.

What does it mean?

Current tumultuous weather conditions on the east coast may impact cattle numbers and slaughter in the short to medium term – all our thoughts are with those affected – the 2021’s FSR falling below the historical rebuild FSR marker of 47% bodes well for herd growth in 2022, with Meat and Livestock Australia forecasting cattle numbers to increase 6% year-on-year. It also hopefully indicates that cattle prices have now been consistently strong enough that producers are back in the black, and willing to sacrifice short term returns to ensure more females stay in the paddock.

Have any questions or comments?

Key Points

- The Australian cattle herd continued rebuilding in the final quarter of 2021, as slaughter dipped below year-ago levels for the period.

- The female slaughter rate fell further to 43.4% of total cattle slaughter, down from 4% in the previous quarter.

- Victoria bucked the national trend, with a FSR of 61.2%, while Queensland was well below the rest of the east coast at 33.8%.

Click on figure to expand

Click on figure to expand

Data sources: MLA, ABS, Mecardo