Lamb exports are expected to power through the impacts of both drought and pandemic, thanks to the growing population and level of wealth of consumers in our biggest markets - primarily Asia. Meat and Livestock Australia’s Global Sheep Industry & Trade Report released this month forecasts global sheep consumption would grow at an average of 1.4% each year through to 2024, and Australia - the largest supplier in the international market - will reap the benefits.

We’ve already looked at the predicted export volumes for lamb this year here, but as a reminder, we are expected to send an extra 10% of lamb overseas for 2021, compared to last year. This would make lamb exports 4% higher than that of 2019, which was a record-high volume. So, with tight supply keeping domestic prices historically high, and the strong Australian dollar not doing importers of our lamb any favours, how will we get there?

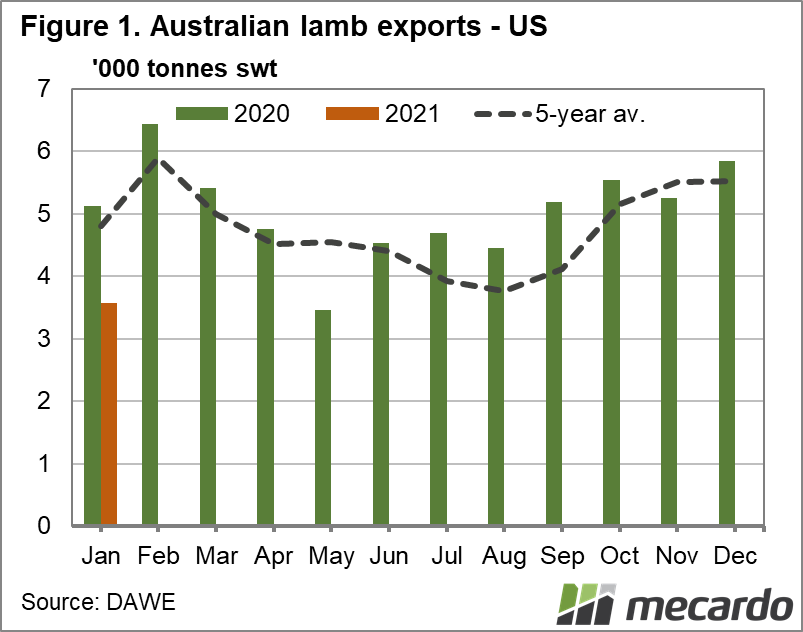

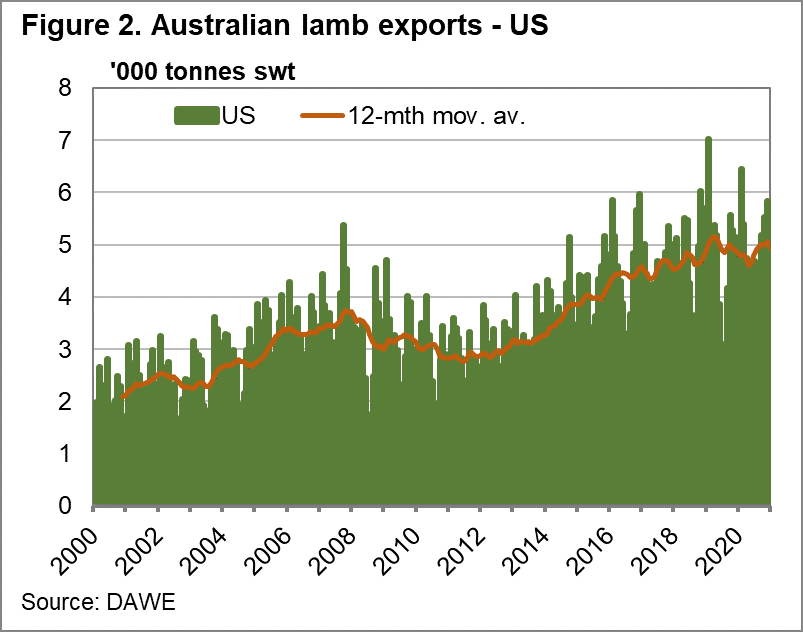

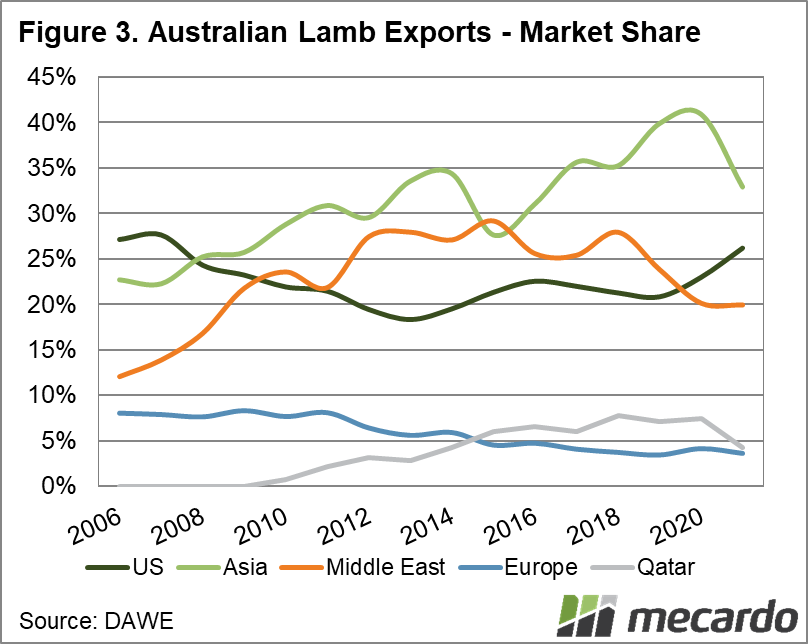

The US will play a key role, having imported 70% of all the sheepmeat they consumed in 2020. Of those imports, 79% came from Australia, making us their biggest lamb supplier. The US is also the fastest growing major importer, up 127% since 2012. Then there is Asia, the Middle East and Africa, all Australian lamb customers, and all with increasing numbers of consumers moving to a higher income, and looking for high-quality and safe protein.

Hurdles? So far, the impact of the Australia-China trade tensions has been minimal on red meat (they remained our biggest market for lamb in 2020), but the relationship remains sensitive. Then there is the African Swine Fever. In 2019 and 2020, this led to increased demand for Aussie sheepmeat and beef, especially in China. China has the world’s largest sheep flock and produces a third of all sheepmeat globally, despite also being one of the biggest importers. Chinese producers could be encouraged to replace their pigs with sheep and cash in on ASF-heightened returns.

What does it mean?

If we can breed it, then the world will buy it. There seems to be little on the horizon to dampen the demand for Australian lamb – the usual Covid-19 footnote of course. The production forecasts for lamb will need to eventuate, however, to ensure we can keep up supply, and in turn prices in check.

Have any questions or comments?

Key Points

- Long-term look at global sheepmeat market paints a positive picture, with consumption to grow 1.4 per cent annually until 2024.

- Lamb exports are forecast to rise by 10% in 2021.

- Short supply and high prices will be the Australian lamb export market’s biggest challenges.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo