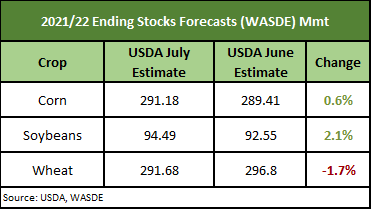

Adjustments to US supply forecasts were the feature of the USDA’s July World Agriculture Supply & Demand Estimates (WASDE) report. The report adopts the June US acreage estimates, which made some small changes to S&D but the changes were largely in line with expectations.

Wheat

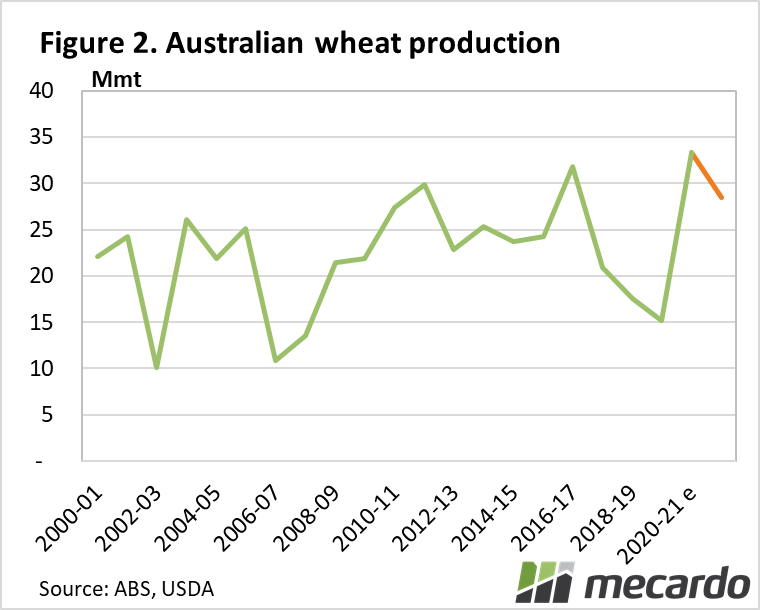

- Australian wheat production for 2021/22 was increased by 1.5Mmt to 28.5Mmt due to favourable rainfall.

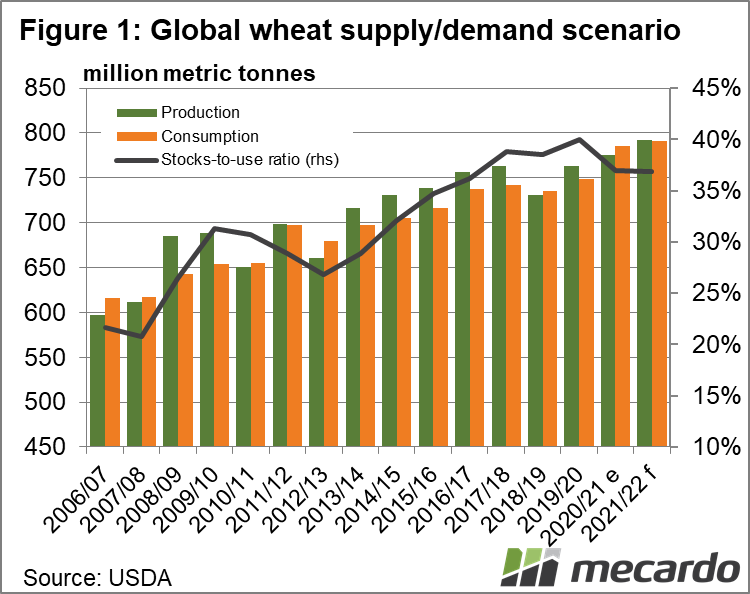

- The June Acreage estimates (46.7 M) for total US wheat planted area were slightly higher than in March (46.5 M), however this was more than offset by a 5 bushel decrease to expected yields. The reduced yields are because of the extremely poor spring wheat conditions, due to the lack of precipitation and above average temperatures experienced during the growing season to date. The net changes to projected 2021/22 US wheat supply and demand resulted in projected wheat ending stocks being reduced by 105 million bushels to 665 million bushels.

- Notable changes to the USDA’s 2021/22 global wheat S&D forecasts included reduced Russian production (-1 Mmt) due to freezing conditions and increased production in the EU and UK (+1.4 Mmt) due to favorable growing conditions. Additionally, Canadian wheat production and export estimates were both lowered 0.5 Mmt due to the drought conditions growers currently face in the region. Projected Chinese wheat demand was unchanged.

Corn

- This month the USDA adopted the June acreage estimate of 92.7 million corn acres, up from 91.1 million. With no change to yields, estimated 2021/22 production increased by 175 million bushels. Due to the lower beginning stocks, estimated total supplies were only 150 million bushels higher. On the demand side feed and residual use was projected 25 million bushels higher and exports were projected 50 million bushels higher compared to last month. The net result of the changes was a 75 million bushel increase to projected 2021/22 corn ending stocks, which marginally increased the forecasted stocks to use ratio from 9.2% last month to 9.6% this month.

- The most notable change to global corn supplies came in Brazil, where the USDA lowered their 2020/21 production forecast from 98.5 Mmt to 93 Mmt. Brazil’s corn exports were also lowered by 5 Mmt to 28 Mmt. Brazil’s drought has significantly reduced safrinha corn production, and due to the late planting the safrinha corn was also negatively impacted by a frost event. Many market analysts have forecast the Brazilian corn crop will be even smaller than the USDA’s estimate, in the high-80 Mmt range. Argentina’s estimated 2020/21 corn production and exports increased by 1.5 Mmt slightly offsetting the Brazilian decrease. The smaller production and exports from Brazil are likely supportive for demand of US new crop corn exports.

Soybeans

- The most notable changes to global soybean forecasts are for South American exports and Chinese imports. For the 2020/21 crop both projected Argentinian (-2.65 Mmt) and Brazilian (-3 Mmt) exports were reduced due to lower Chinese imports (-2 Mmt). The reductions in trade are attributed to the high soybean prices leading to reduced Chinese shipments. Projected South American exports were unchanged for the new crop (2021/22), but projected Chinese imports were lowered 1 Mmt to 102 Mmt.

What does it mean?

Crop commodity markets received mildly positive price support following the July WASDE as the report was generally neutral, and in-line with trade analysts’ expectations. There were some rumblings in the markets that the USDA may cut corn yields this month due to the dry weather in June (which would be unusual). Although precipitation was lower than average in June, the key pollination period for most of the US corn crop is during July, and precipitation in July will be of greater importance. The USDA will begin to make changes to corn yields based on survey data next month.

Have any questions or comments?

Key Points

- New crop Australian wheat production estimates increased by 1.5Mmt to 28.5Mmt.

- 20221/22 global wheat ending stocks estimates decreased by 1.7%.

- Brazilian corn production lowered.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: USDA, CME, Mecardo