It is time for the seasonal flush of lambs coming out of Western Victoria and South East South Australia. While many of the suckers appearing in the yards and online will be at finished weights, there will be plenty of store lambs, and ongoing rains and good potential margins are supporting the market.

According to the latest Australian Bureau of Statistics (ABS) numbers there are over 8.5 million head of sheep in South West Victoria and South East South Australia. AWI/MLA Survey data suggests that most of these sheep are ewes and over half of the 8.5 million head are used for prime lamb production.

When the spring growing season starts to wane, a lot of the southern lambs come to market as suckers, which are soaked up by restockers and feeders across the southern half of the country.

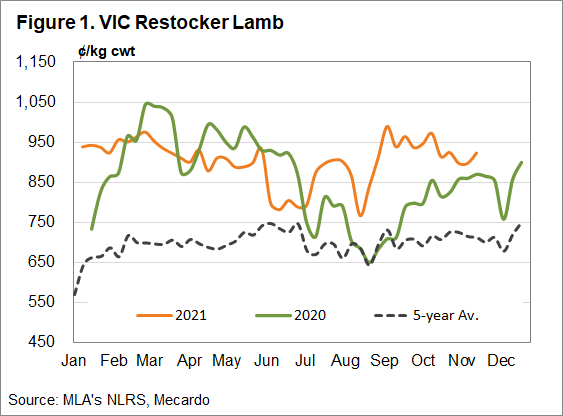

The continued wet conditions, and expectations of stronger prices, has held restocker lamb prices at relatively strong levels through most of spring. Figure 1 shows the Victorian Restocker Indicator, which is the price of lambs bought by restockers in Bendigo, Ballarat and Hamilton. There was tick up last week with rain, but they haven’t gotten all that cheap.

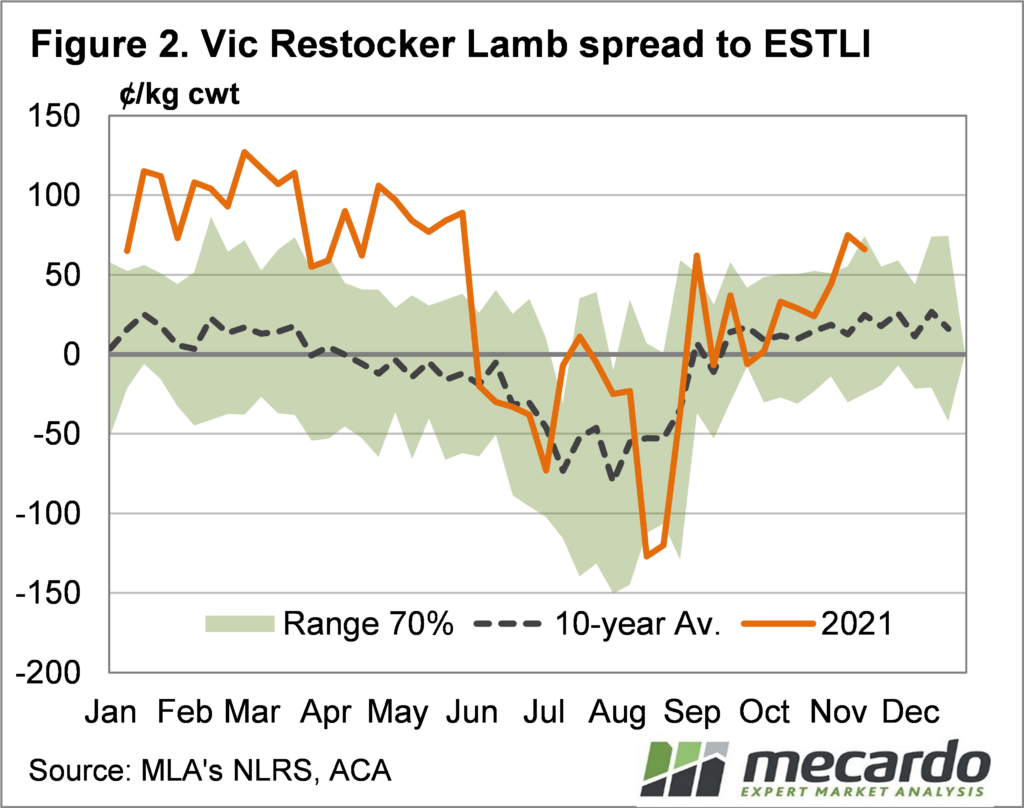

Figure 2 shows the Victorian restocker price relative to the Eastern States Trade Lamb Indicator (ESTLI), and it is predictably trading at a stronger than usual premium, but it’s not nearly as strong as earlier in the year.

On Auctionplus, store lamb prices are more expensive. Composite wether lambs around 35kgs are making 1000-1100¢/kg cwt, and at 30kgs they are costing up to 1200¢. There were a lot of white Suffolk/Merino cross lambs on Auctionplus last week, which made prices closer 950¢/kg cwt, and these types of lambs will be holding the Victorian Restocker Indicator back.

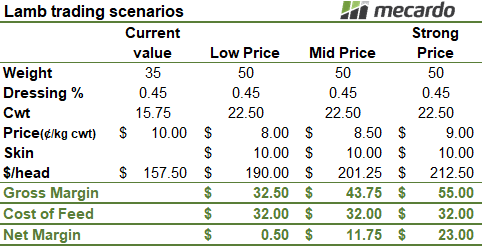

If lambs can be finished on green feed or stubbles, if the crop ever comes off, there is good margin in it and this is helping support store values. Figure 3 shows a basic trading margin of taking a lamb from 35kgs to 50kgs, using a grain cost of $350/t.

What does it mean?

Store lamb prices are historically strong, but with the green feed on offer up and down the east coast, there is little incentive for producers to sell at current strong levels. Pasture quality will start to deteriorate in the south in December, which will see lambs come to market, and at current rates it offers very good returns for them, along with a good margin for buyers.

Lambs bought to go onto grain will need finished prices to rally to turn good profits, but it doesn’t look like they’ll be able to push prices lower unless there is a big glut of supply.

Have any questions or comments?

Key Points

- Southern Lamb supplies are due to increase strongly, lifting store lamb stocks.

- Store lamb values are currently very strong, in absolute and relative terms.

- There are very good margins in finishing lambs on green feed, with grain feeding tighter.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, ABS, Mecardo