What a difference a year makes! A phrase uttered by many producers in the south east over the past few months, as one of the worst seasons recorded in 2019 was replaced by one of the best in 2020. For those who spent last summer suffering from fires, smoke and crippling dry, the phrase no doubt got thrown around quite a bit over the holiday period. And indeed, it is true, 2021 has kicked off quite differently to 2020 - and if you’ve got livestock to sell, it's all for the better!

Despite the Covid-19 pandemic continuing to worsen internationally, rioters at the gates of the US Capitol and Australia having ended the year on China’s ‘naughty’ list, the grass-filled paddocks at home have ensured livestock commodity prices have opened with the best kind of bang. A quick glance at the opening physical sale reports from the National Livestock Reporting Service this week, and the trend is clear. In NSW, lambs were up to $30 dearer at both Forbes and Corowa, while in Bendigo, Vic, most categories were up $20, “with a lot of lambs making in excess of 900¢/kg”.

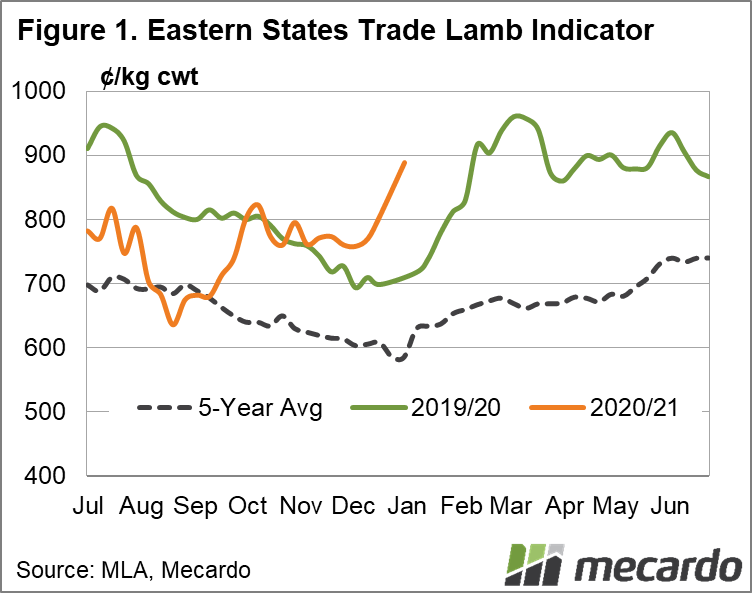

All eastern state lamb indicators opened Monday stronger, up between 45¢/kg and 117¢/kg on the final price of 2020. The trade lamb price in the east, the ESTLI, was at 888¢/kg on Monday, a rise of 157¢/kg (or 18 per cent) compared to the same time 12 months ago. As we pointed out here at the close of last year, there was a 70 % chance that lamb prices would rise in January. But the strength out the gates when prices were already historically strong, and international factors murky, should be a confidence boost for those who have purchased or retained more ewes soon to be joined.

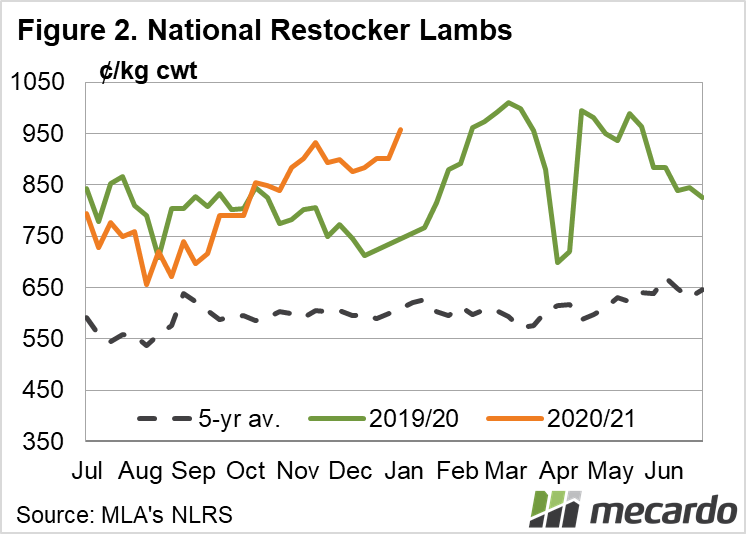

The difference in the year in terms of lamb is perhaps best highlighted by the restocker price. On this very day in 2020, we reported that store lambs could have been “considered cheap”. Limited restocker enthusiasm online and the yards had them selling for $124-$135 a head. This week, the national restocker lamb price was 957¢/kg, up 34% year on year. In NSW, the restocker price sits at 1065¢/kg – an increase of 455¢/kg on the same time last year.

What does it mean?

Without getting ahead of ourselves – it is the first trading week of the new year for lamb – producers should feel positive about where prices are sitting. Up-to-date slaughter figures will allow us to look in more depth at the supply and demand equation, but contract grid prices of 840¢/kg for 18-23kg lambs currently being offered is a good indication that 2021 won’t be a one-week-wonder, and processors expect prices to stay where they are for now.

Have any questions or comments?

Key Points

- Lamb prices opened strong in 2021, climbing higher throughout the first week of physical sales for the year.

- Restocker lambs particularly reflect the change from 12 months ago, sitting 34 per cent higher than the opening week of 2020.

- Trade lambs reported at being up to $30 dearer, showing strong processing demand despite continued international uncertainty.

Click on graph to expand

Click on graph to expand

Data sources: MLA, Mecardo