A fortnight ago we took a look at local wheat prices with the conclusion that they were good in absolute terms, but not in relative terms. The Australian wheat discount to Chicago values was at the weaker end of the spectrum, today we look at how to take advantage of this.

Wheat is a global commodity, and given it is freely traded most global wheat prices tend to track in the same direction most of the time. When wheat is cheap in a particular country, it will stimulate demand and push prices up.

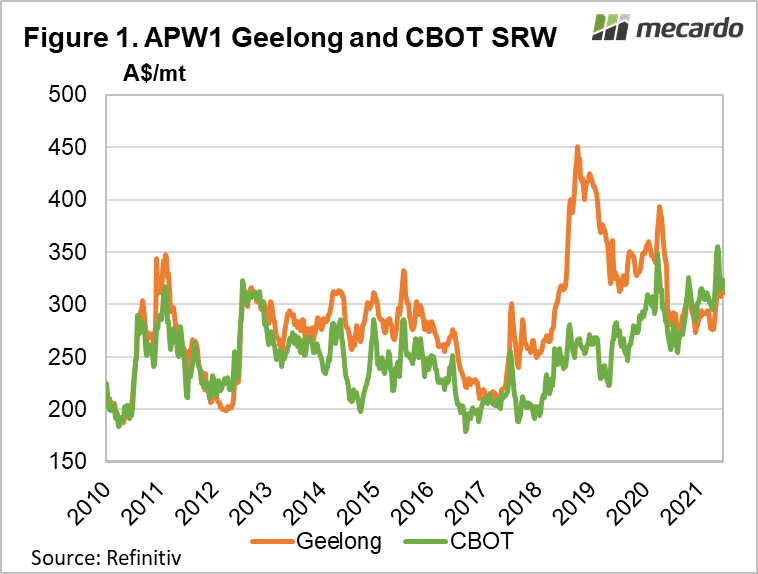

Figure 1 shows Chicago Soft Red Wheat Futures (CBOT) spot values versus Geelong APW wheat. We can see that the two prices largely move in unison, as Australian and US prices compete in the same export markets. In general, we can see Geelong APW tracks at a premium to CBOT, with the large premiums for 2019 and 2020 due to tight local supply.

When local supply is tight, Australian wheat prices can revert to ‘import parity’. Import parity is the price of bringing wheat into Australia. Normally our wheat is priced at the value of the export destination minus freight. Import parity puts local prices at the cheapest export country, plus freight, and hence at a strong premium to CBOT.

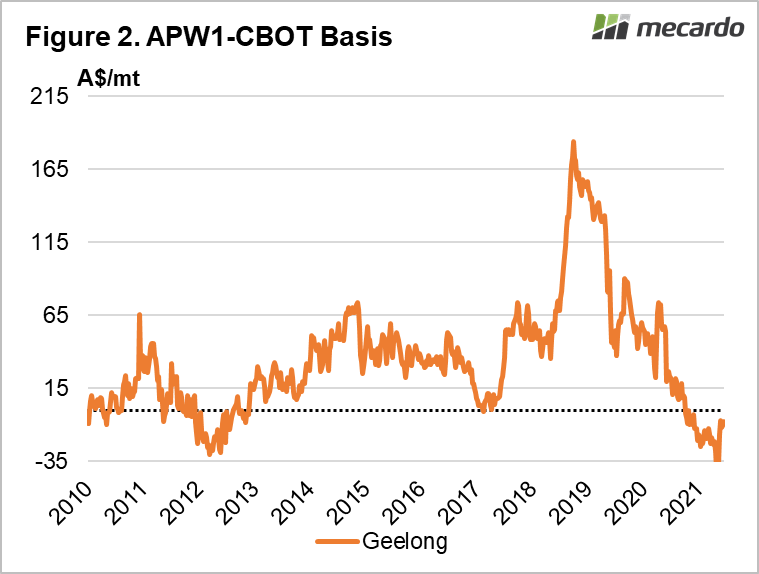

Over the last six months, we have seen Australian wheat values at a discount to CBOT (Figure 2). The record crop in 2020 has seen more wheat supplied than can be exported, and as such Australian prices have been lower than usual relative to CBOT. The opportunity for grain consumers is in looking at new crop pricing, and taking advantage of the weak ‘basis’ or Australian price relative to CBOT.

If the 2020-21 crop yields turn out to be around average, there is a good chance local prices will go back to a premium to CBOT, the 10-year average is $26.

To ‘lock in’ basis, wheat consumers simply need to buy ASX Wheat Futures as a proxy for local values, and sell CBOT futures. Buying ASX at $310/t and selling CBOT swaps at $324/t gives basis of -$14. Under an average harvest scenario, CBOT falls to $300, and ASX stays steady at $310. The payoff comes from a $24 profit on the CBOT swap.

What does it mean?

The worst-case scenario in selling ASX and buying CBOT to lock in basis is further falls in basis, leading to a loss. However, figure 2 shows that even with a record crop at harvest basis was still around minus $20. A dry spring and a weaker than average crop could easily see basis at or above average, which would result in a $30-50 profit, which can be put towards grain purchases at harvest.

Have any questions or comments?

Key Points

- Relatively weak local wheat prices create opportunities for wheat consumers.

- Buying ASX wheat and selling CBOT wheat effectively ‘locks in’ basis at historically low levels.

- The worst-case scenario is a small loss, with best case a profit which can be put towards grain purchases.

Click to expand

Click to expand

Data sources: CME, ASX, Mecardo