The Meat & Livestock Australia (MLA) and Australian Wool Innovation (AWI) Wool and Sheepmeat survey is conducted three times a year, but October is the most important. This year’s October survey did deliver the expected stronger marking rates, but there was only the same number of lambs born.

While the February and June surveys tell us how many ewes are out there, and going to be joined, they only account for just over 30% of the lambs marked for the year. Most of the lambs, and this year it was 68%, are marked from July to October, and as such it gives a great indication of lamb supply in summer and autumn.

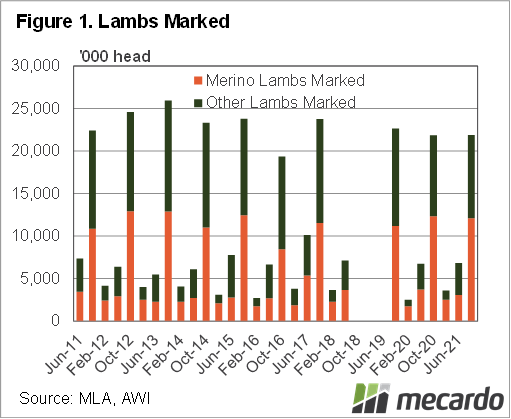

This October the expected stronger marking rates did eventuate, but it was a little unexpected to see fewer ewes joined. Figure 1 shows the number of lambs marked was within 8,500 head of October 2020. A minuscule variation over 21.86 million head. There were 2% fewer Merino lambs marked, and 2% more ‘other’ lambs.

Marking rates lifted, as there were 3% fewer ewes joined to produce lambs for July to October marking. This was across both Merino and other breeds, which is interesting as there wasn’t the expected swing to ‘other’ lambs, but a drop in both.

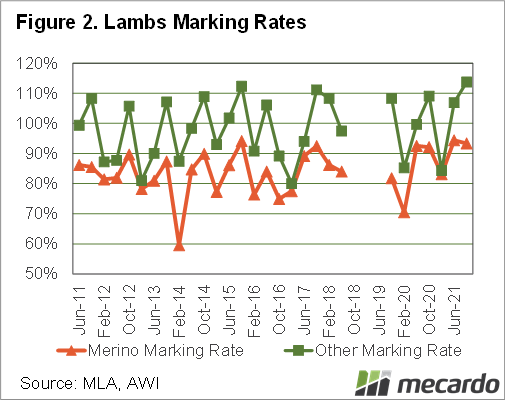

Figure 2 shows lamb marking rates for ‘other’ lambs lifted to a new record of 114%. The previous high from this survey was 112% back in 2015, so it’s taken a while to beat it. Merino marking rates in October were 93%, up by just 1 point on October 2020.

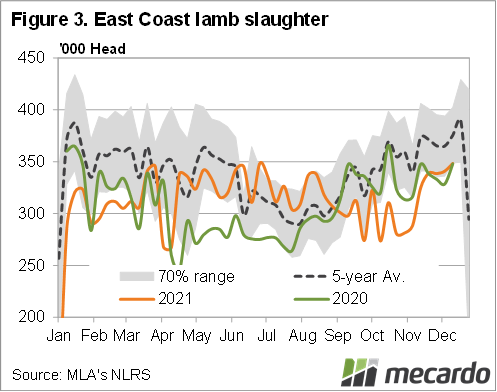

If there were the same number of lambs marked, does it mean there will be the same number slaughtered in summer and autumn? It depends on how many ewe lambs and Merino wethers are retained. The survey said 34% of respondents are looking to increase flocks, and 55% of those will do it through retaining more ewe lambs than ‘normal’. But we saw that last year as well.

It’s interesting to see lamb slaughter has been very similar to last year on the east coast since mid-November (figure 3), and it’s not silly to think this will continue.

What does it mean?

The season will obviously change producer intentions since October, but based on the number marked it looks like supply will be similar to last year unless a poor autumn causes more ewes or Merino wethers to hit the market.

In terms of price, we know that demand has seen prices sit higher than last year at the end of December, and it’s likely we’ll see that continue into 2022. Demand from restockers could push prices higher, in a similar fashion to what we saw in 2011.

Have any questions or comments?

Key Points

- The MLA/AWI Wool and Sheepmeat survey showed lambs marked from July to October were steady on 2020.

- Marking rates were up, but the ewes joined were down.

- Lamb supply is likely to be similar to last year in summer and autumn, keeping prices strong.

Note: no data was recorded for the period in 2018/19. Click on figure to expand

Note: no data was recorded for the period in 2018/19. Click on figure to expand

Click on figure to expand

Data sources: MLA, AWI, Mecardo