When the war in Ukraine plunged world food security into doubt by taking a huge chunk of world production & export trade out of the global breadbasket, India looked to be emerging as a saviour to fill part of the trade gap. There has been a sudden turnaround though, with India effectively banning wheat exports.

Only weeks ago, India was shaping up to produce a record crop of wheat for the 2021/22 season, at 111.32mmt, with in excess of 12 mmt pegged to be released onto the world wheat markets as bulk exports over 2022/23. After the outbreak of war in Ukraine, the ensuing paralysis of export shipping out of the black sea left over 10 countries, mainly in north Africa with serious food security issues. With what was thought to be a bumper crop in hand, officials from India quickly stepped in to commence talks with the impacted nations to take delivery of Indian wheat. Countries targeted by Indian government representatives included Turkey, China, and Egypt, as well as numerous other North African countries.

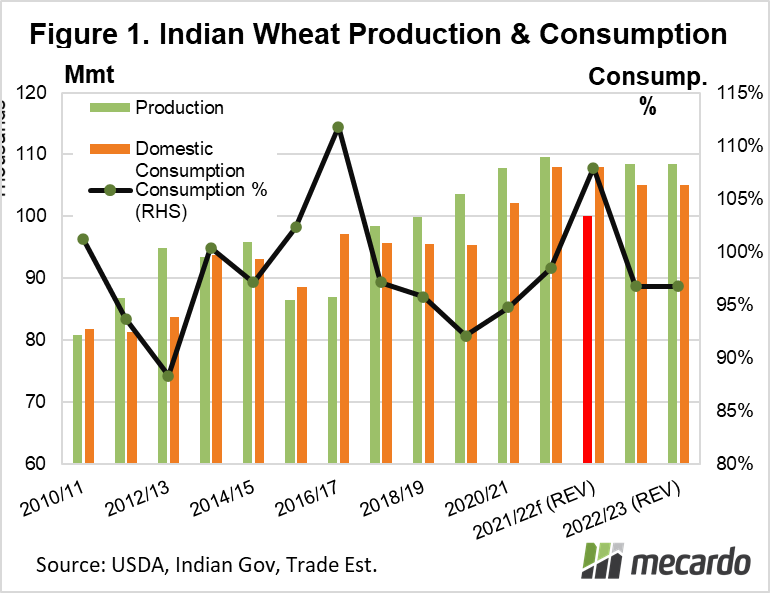

However, disaster struck, with a punishing heatwave sweeping across key wheat growing areas of India, shrivelling up to 80% of government contracted grain. Official production estimates fell to 105mmt, but the trade expects a savage cut in production forecasts by over 12mmt to occur, bringing the total below the 100mmt line. (figure 1)

Domestic Indian wheat prices have reached peaks of 25,000Rs compared to the government minimum support price (MSP) of 20,150Rs. General Indian inflation has also reached 8 year highs in April 2022 and they also have some of their own food security issues to work through.

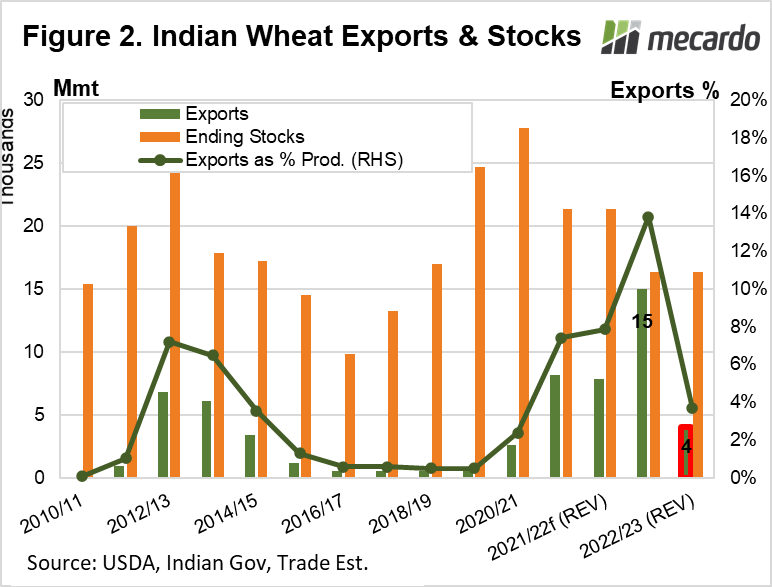

Exacerbating the food security issue in India, was the fact that their grain storages had been run down over the COVID period through distribution of free grain and pulses to 62% of the population, or over 800 million people. Also, sales to the government at lower prices than export traders offer are just not attractive to Indian producers. (figure 2)

All these factors combined to force the Indian government to act immediately, prohibiting wheat exports with instant effect, as of the 13th of May, 2022. This is far cry from enthusiastic Indian government export targets for 2022/23 of 15mmt.

India has been fair however in terms of how sovereign risk will impact traders; and will allow export deals already signed to go ahead, which are expected to total around 1.5mmt for the month of May. Traders have until the 28th of May to register these arrangements with the Indian government. The Indian government has also applied compassionate policy settings of exemptions in relation to other neighbouring countries who are in need to meet their food security needs, if their governments reach out and request it.

Given that many of Ukraine & Russia’s former customers have all been placed in difficulty, that definition has potential to cast a very wide net, or narrow, depending on the Indian government’s discretion. At this stage, though, Indian exports for the April-March 2022/23 crop year are looking like around 4mmt. We can only wait and watch for developments in this space to see how the exemptions are implemented in practice.

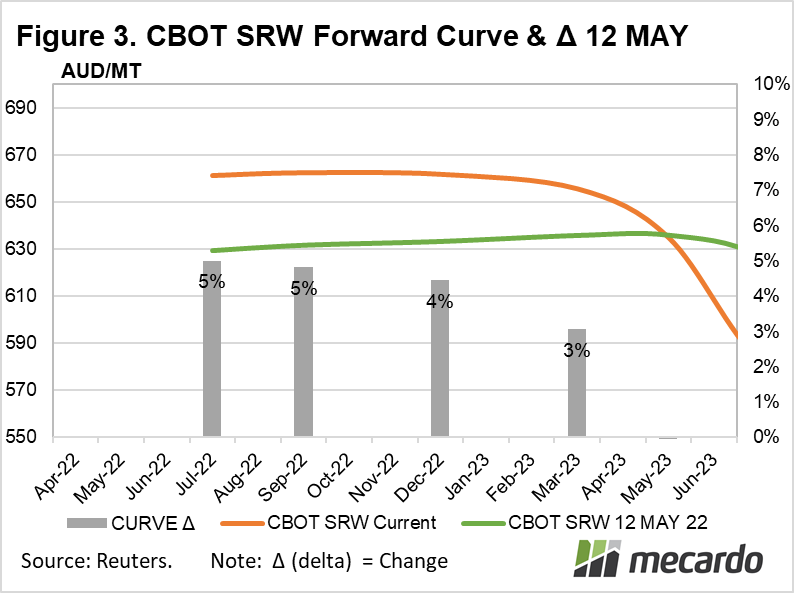

Not surprisingly, wheat markets reacted dramatically, with nearby CBOT SRW wheat increasing 5% since the announcement to reach $661 AUD / mt (figure 3) and Euronext Paris milling wheat rising 9% to an all-time high of 438.25 euros / ton. ($653 AUD)

What does it mean?

The potential withdrawal of over 10 mmt of wheat from world markets at a time when wheat market demand is already outstripping supply, will lend further support to international export prices. If logistical snarls are able to be negotiated, Australia is well positioned to export to countries such as Indonesia and Egypt where any ability to rely upon Indian wheat may have abruptly run aground.

All eyes will be on the Indian government to see how many exports are allowed to leave the country in practice over the next few months.

Have any questions or comments?

Key Points

- India has prohibited wheat exports, although will allow for some export deals to continue that have already been signed.

- Tight global wheat supplies further stretched with India’s export ban, pushing global wheat prices even higher.

- If shipping availability increase or backlog is worked through, Australia will be well positioned to provide countries already experiencing food security issues.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Government of India Ministry of Commerce & Industry, Reuters, www.worldgrain.com, The Hindu, Grain Brokers Australia, The Teller Report.