India has suspended tariffs on imported lentils (Masoor Dal) from several countries, including Australia. What does this mean for prices, and is this likely to increase the area planted by producers given it officially ends before the 2022 crop will be harvested?

On the 13th of February 2022 India announced that the effective 11% tariff on imports of Australian lentils has been removed, until the 30th of September 2022. This opens the gateway for our product to better compete with other countries already enjoying a 0% tariff rate.

This measure is expected to be temporary, as the tariffs may be reintroduced again in the future, with the Indian governed expected to review the change in September 2022 however, there is no guarantee that an alteration may occur sooner without warning. Any move to increase the tariffs again will be related to the desire to protect the profitability of local Indian farmers. Ultimately, this change is expected to increase the supply of lentils entering India, pushing prices down, combating general food inflation for the populace.

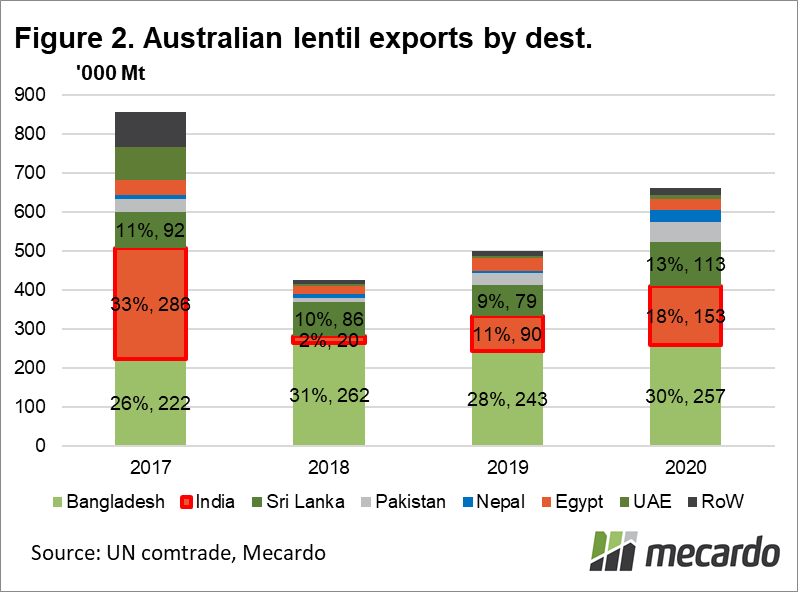

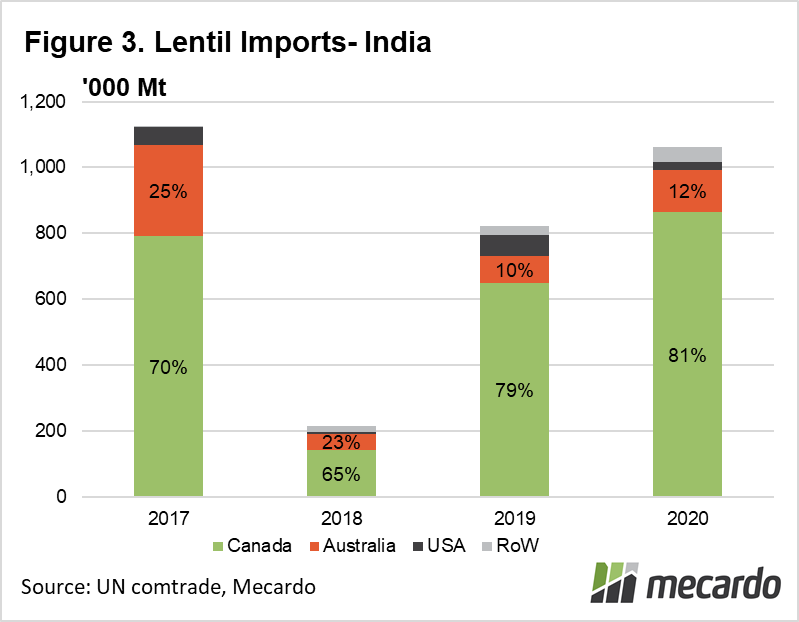

India holds the crown as Australia’s second biggest lentil customer in 2020, importing 153Kmt, representing 18% of our market (figure 2). More recently, Australia exported 107Kt of lentils to India in the second half of 2021 alone. India imported 1,060kmt of lentils in total in 2020, (figure 3) and 725kmt of lentils in 2021, 77% of which was supplied by Canada.

Australian growers now have production decisions to make in terms of whether they choose to change the area planted to lentils. Lentil planting within India since October, particularly the key states of Madhya Pradesh and Uttar Pradesh can provide guidance as to the tonnage expected to be harvested within India in early 2022. A large crop will place downward pressure upon Indian lentil prices, reduce import demand, and increase the potential for political risk in the form of tariffs being unexpectedly jacked up again to protect Indian farmers.

The Indian agricultural ministry is forecasting a near record lentil crop of 1.58mmt this season, 10% above 2021. There is some contention in India though about the accuracy of the government estimates. Vivek Agarwal of JLV Agro claims that the trade fraternity in India believes that actual production may be as low as 1mmt in reality (35% less), hence why the Indian government has cut tariffs despite the alleged bumper crop coming.

The Australian 2022 crop will also not be harvested until summer, meaning that the tariff suspension will need to be extended into Q4-22 and beyond for Australian producers to capture the benefit for the next crop.

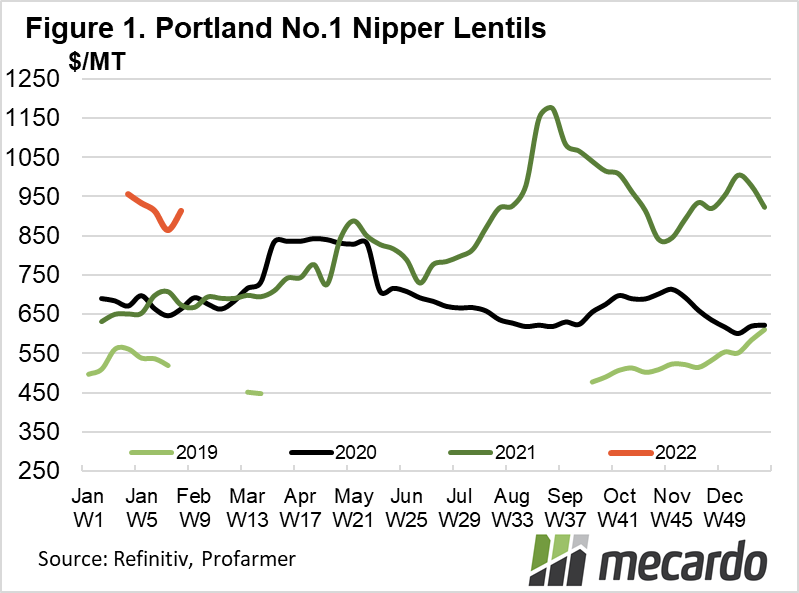

The Indian government guarantees minimum support prices (MSP) for 22 commodities, to support its farmers. The MSP for lentils is 51K Rs ($945 AUD) per ton in the 2021/22 cropping year. The lentil MSP was boosted by 6% from the prior year to encourage additional production and reduce import requirements. Currently, Australian lentils are trading at $913/ton, having risen $50 (6%) in the last week on the tariff change news (figure 1).

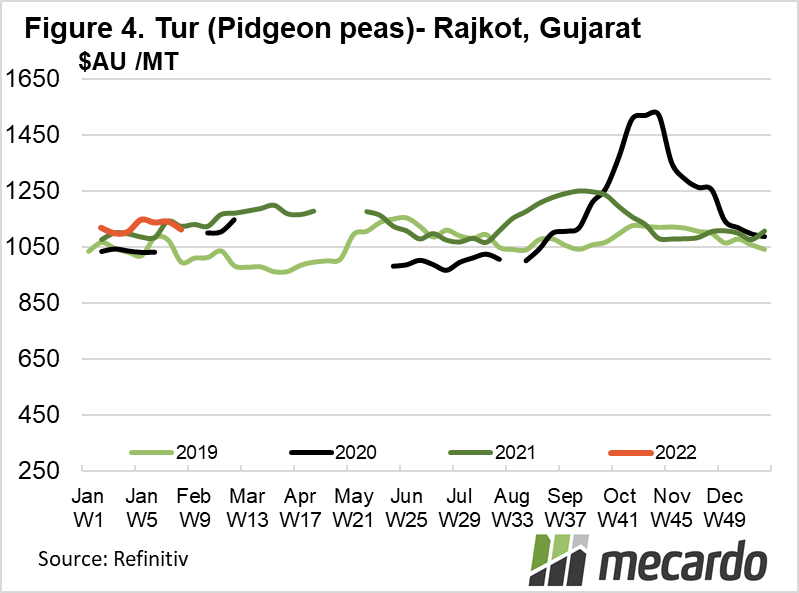

Tur, (Pidgeon peas) or Urad can be substituted by lentils if their prices rise too high, adding to lentil demand within India, creating a price linkage between these commodities. Excessively wet weather in Dec/Jan is expected to have reduced production by 20-25%, and farmers are holding stocks. There are reports of prices trading above the 63KRs ($1,150 AUD) MSP at 65K Rs/ ton ($1200 AUD) in some markets but are trading at 59K Rs / Mt ($1,100 AUD) in Rajkot (Figure 4).

The Indian government has extended the temporary removal of import volume limits of other pulses including Tur (Pidgeon peas), Moong (Mung beans) and urad (black lentils) until 31 March 2022 also to suppress prices.

What does it mean?

The suspension of tariffs on Australian lentil exports into India has improved the competitive position of Australia for imports of this commodity, and prices for old crop have lifted in response. If you have lentils in storage, it’s time to think about your marketing decisions. The tariff suspension ends on September 30th 2022, so the new 2022 crop may not enjoy the zero-tariff environment unless the change is extended. There may be controversy over Indian government production figures, but market prices should be reflective of reality.

Have any questions or comments?

Key Points

- India has suspended import tariffs on Aus lentils till 30 September.

- India is expecting a near record lentil harvest of 1.58mmt- up 10%.

- High domestic production may curtail Indian import demand.

Click on figure to expand

Data sources: Refinitiv, Comtrade, Saskpulse, Western Producer, India times