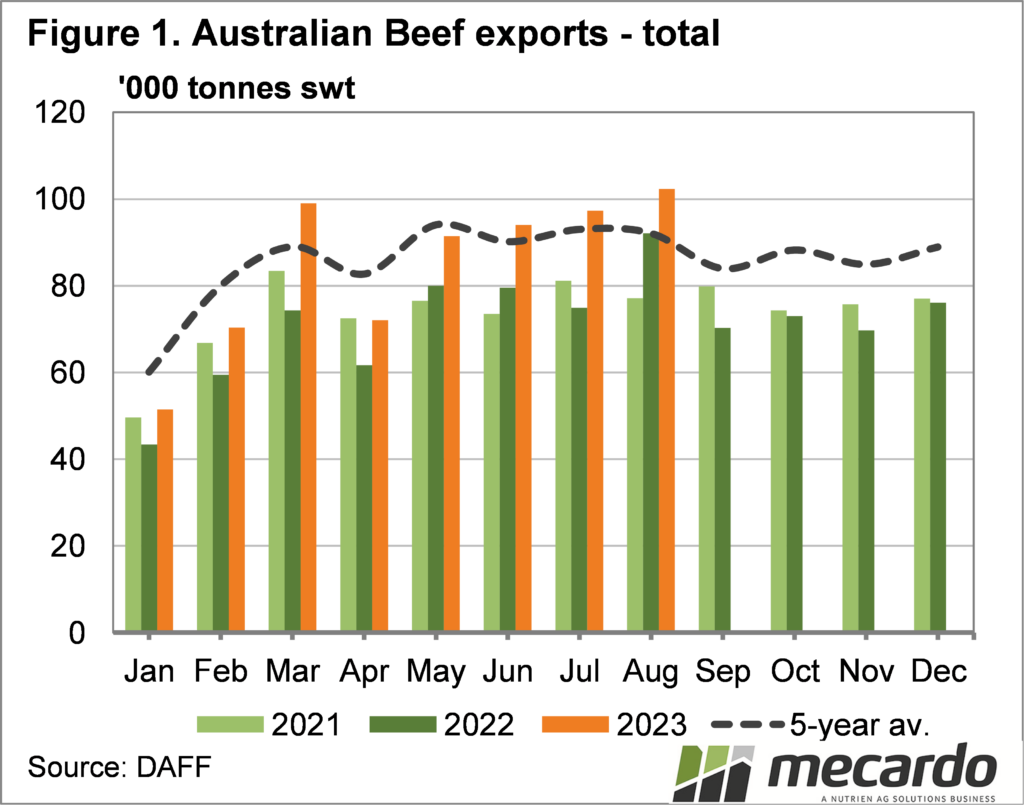

The herd has been rebuilt and is at least entering a steady state, if not a light liquidation. As such we can expect some new four or five-year highs in terms of beef exports. In August we saw just that, but it’s the destinations which are more interesting.

Total beef exports hit their highest level since December 2019 in August, breaking the 100,000-tonne mark and posting an 11% increase on 2022. Figure 1 shows that August 2022 was itself the largest export month for 2022, so the peak seen this August was significant.

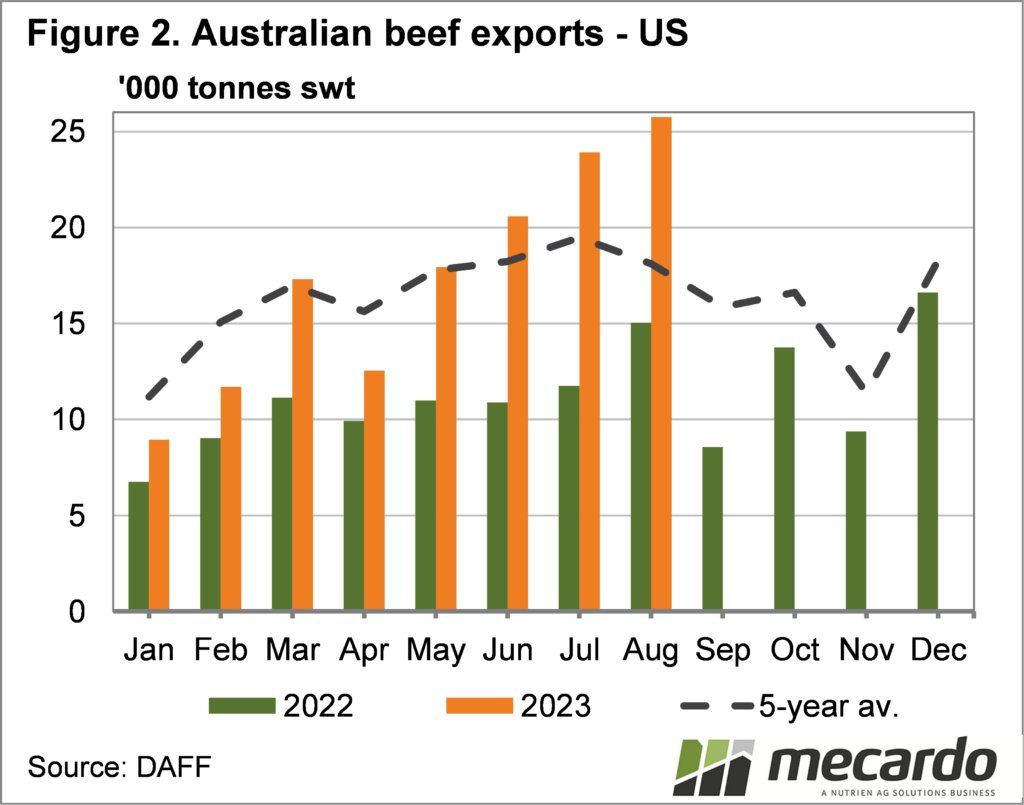

When we look at export destinations, we can see the global cost of living crunch playing out, and can even tie in lamb markets. Figure 2 shows beef exports to the US. We know female cattle slaughter is on the increase, and in the US there is plenty of demand for low-quality beef.

Figure 2 shows beef exports to the US posting a four-year high, accounting for a quarter of our beef exports. In 2022 the US took 16% so it is a large shift in both volume and share. The year-on-year increase in August was 42%.

With the cost of living pressures in the US, we are seeing the third iteration of the shift to low-quality beef in fifteen years. When things get tough consumers shift from expensive cuts, and alternative proteins, such as lamb, to cheap burgers and mince, along with chicken and pork. Combine this with lower cow slaughter in the US as the herd rebuild starts, and we get strong demand for our beef.

Unfortunately for lamb producers, the shift has come at the expense of lamb demand, and we are seeing this play out in markets.

More expensive beef cuts are still finding it hard, and this, along with strong supply, is keeping a lid on cattle prices. Beef exports to Japan were down 23% on 2022, but Korea was still reasonably strong.

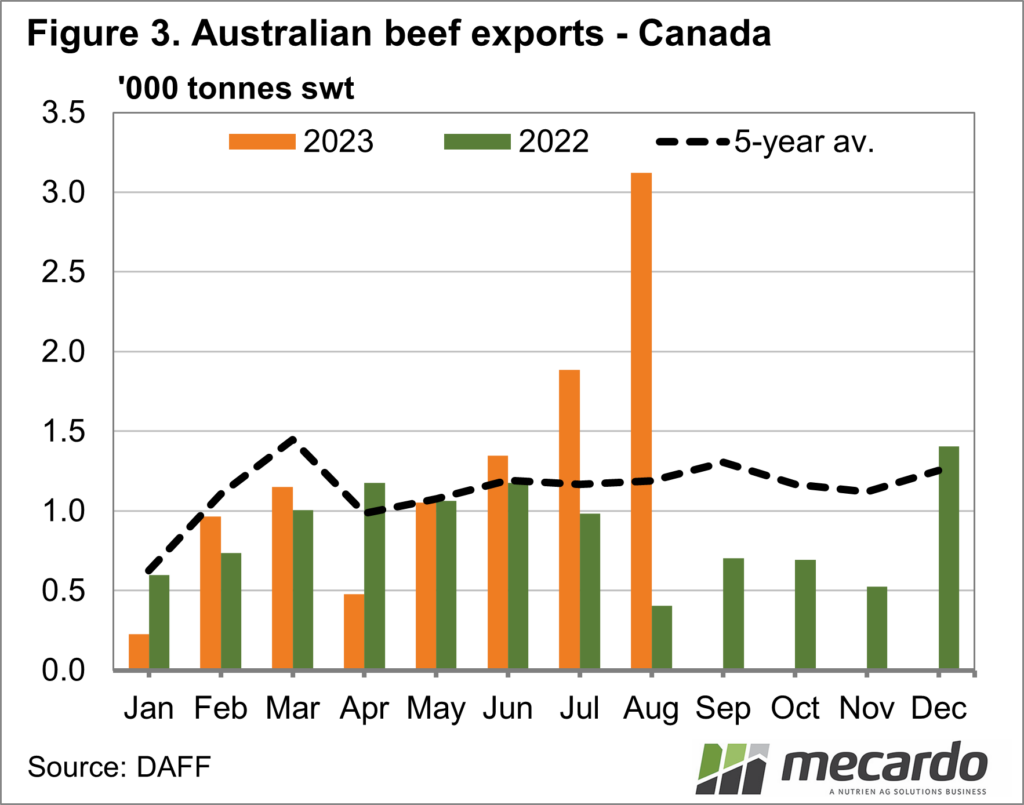

Canada was the big mover in the export market. Taking 3,000 tonnes for the first time since 2015 (Figure 3). Canada has been taking more high-quality grassfed beef, as drought impacts production domestically. It’s not enough to counter declines in Japan, however.

What does it mean?

While it is positive that the increase in lower-value beef coming from stronger cow slaughter is finding strong demand, there is some concern around the higher-value markets, especially with close to record numbers of cattle on feed. A strong supply of cattle will no doubt keep a lid on prices until economic conditions turn around, and lower US beef supplies start to impact our major high-value beef markets. This might be the middle of next year, but it will come with a rush.

Have any questions or comments?

Key Points

- August beef exports hit a four-year high as stronger slaughter flowed through the chain.

- The US market took 25% of our beef exports in August, with strong demand matching supply.

- Higher-value beef markets are struggling, but there are some positive factors on the horizon.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: DAFF, MLA, Mecardo