As if there wasn’t enough happening in global red meat markets, this week it was a cyber-attack on JBS Swift. There has been plenty of commentary on the cause of the issues, and impacts on JBS’s processing operations, here we take a look at what has happened with pricing this week.

The cyber-attack on JBS has impacted operations both here and in the US. The price reactions we have seen show how different the markets are at the moment.

According to Steiner Consulting JBS slaughter a massive 23% of US cattle. Monday was a public holiday in the US, but on Tuesday all cattle plants were closed, and this saw a reaction similar to the Covid inspired plant shutdowns last year.

CME Live Cattle Futures started Tuesday limit down, before recovering to finish down 2%. There was apparently only going to be one days disruption in the US, but this is still enough to create a backlog of cattle.

Not surprisingly, US beef prices were up early this week. The Choice Beef Cutout hit yet another high for the year on Tuesday, gaining 1% to $US334.5 per 100 pounds. With US beef demand already very strong, any disruption to supply was going to see prices rise.

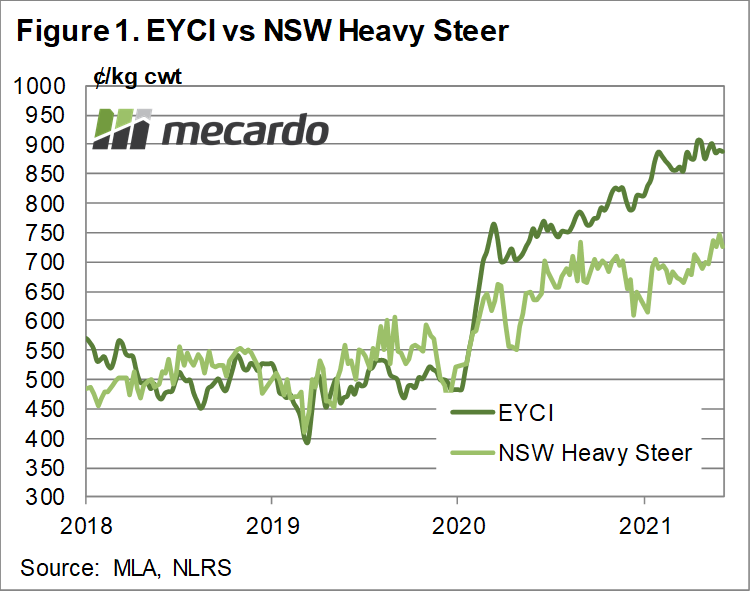

Cattle prices here haven’t reacted in the same way. In the first three days of this week the Eastern Young Cattle Indicator (EYCI) has remained steady this week (figure 1), while Heavy Steers have eased in NSW, but rallied in Victoria and Queensland. Both the EYCI and finished cattle are at the top of the range.

We haven’t seen any beef prices yet, and given 90CL prices were up in the US last week, it will be hard to tell whether lower slaughter here will result in higher values in the beef market this week.

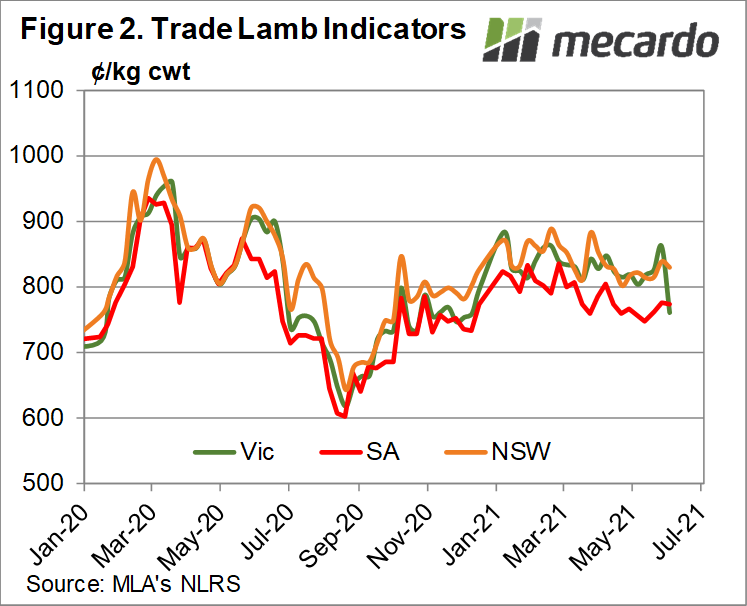

JBS’s lamb and sheep processing plants are in southern states, and it seems we have seen some impact of the shutdown in Victoria at least. Figure 2 shows the Victorian Trade Lamb Indicator has collapsed this week, losing 90ȼ to hit 761ȼ/kg cwt. Mutton prices have also been hit in Victoria, but has only lost 16ȼ for the week.

What does it mean?

Tight cattle supply, and the fact a large proportion of slaughter cattle are coming out of vertically integrated feedlots at the moment, has helped support cattle prices in spite of decreased slaughter capacity.

Lamb has held in the north, but in the south the lack of a major buyer seems to have hit markets this week. The length of the shutdown will determine the size of the hangover, but it’s the time of year that supply tightens so prices should bounce back when JBS is up and running again.

Have any questions or comments?

Key Points

- The JBS Swift cyber-attack has shutdown processing plants in the US and Australia.

- Cattle prices have fallen in the US, and beef prices have risen, but cattle price impacts here are minimal at this stage.

- Victorian lamb prices have fallen heavily at saleyards but should bounce back when processing resumes.

Click to expand

Click to expand

Data sources: USDA, Steiner, MLA, Mecardo