August is traditionally a slow month for lamb exports as slaughter hits its annual low point. Kill space usually opens up for mutton in August, and there is a subsequent lift in exports, but this year lamb has outperformed and mutton hit a new low.

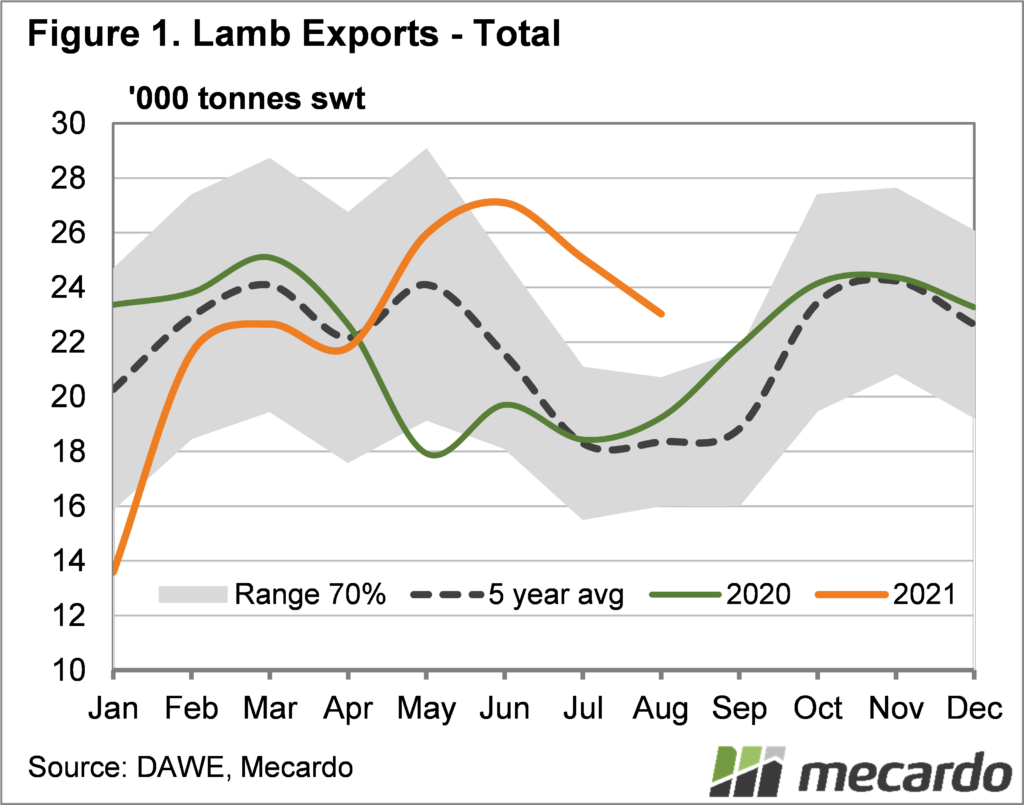

Lamb exports did decline in August relative to July, but the actual number is still very strong. With 23,032 tonnes of lamb exported in August, it was a record number for the month. Lamb exports were down 8% on July, but up 20% on August last year and 25% on the five-year average.

Figure 1 shows that after starting the year slowly, relative to 2020 and the five-year average, lamb exports have more than compensated over the winter. For the year to August lamb exports are now up, with 5% more lamb heading overseas.

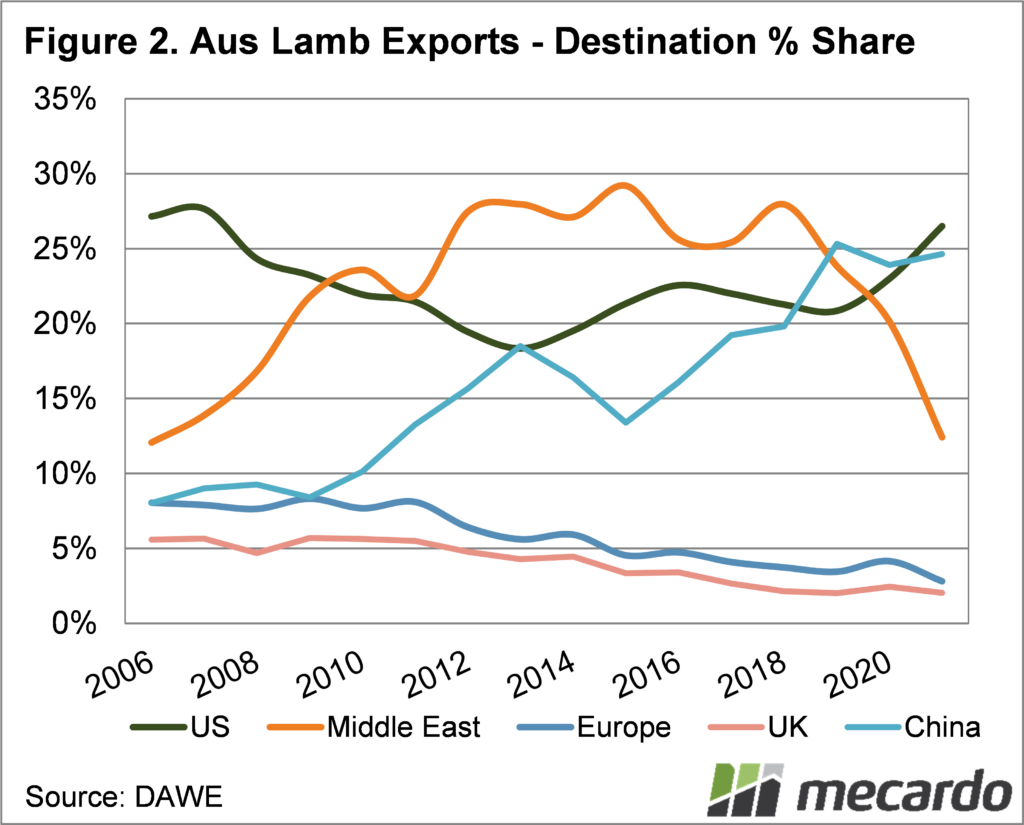

As outlined last week, demand from the US has been one of the key drivers in rising exports. The US took 38% more than the period in 2020, and 63% more than the five-year average. It has been 14 years since the US has taken more than 25% of our lamb exports (Figure 2).

Back in 2007, the US accounted for 28% of lamb exports, but it was a much smaller pie. For the year to date, the total volume of lamb exported to the US is 74% higher than in 2007, which points to the extraordinary growth of the market.

Exports to China were also very strong, up 33% on 2020 and 49% on the five-year average. With such strong demand from two major players, it’s little wonder prices remain strong.

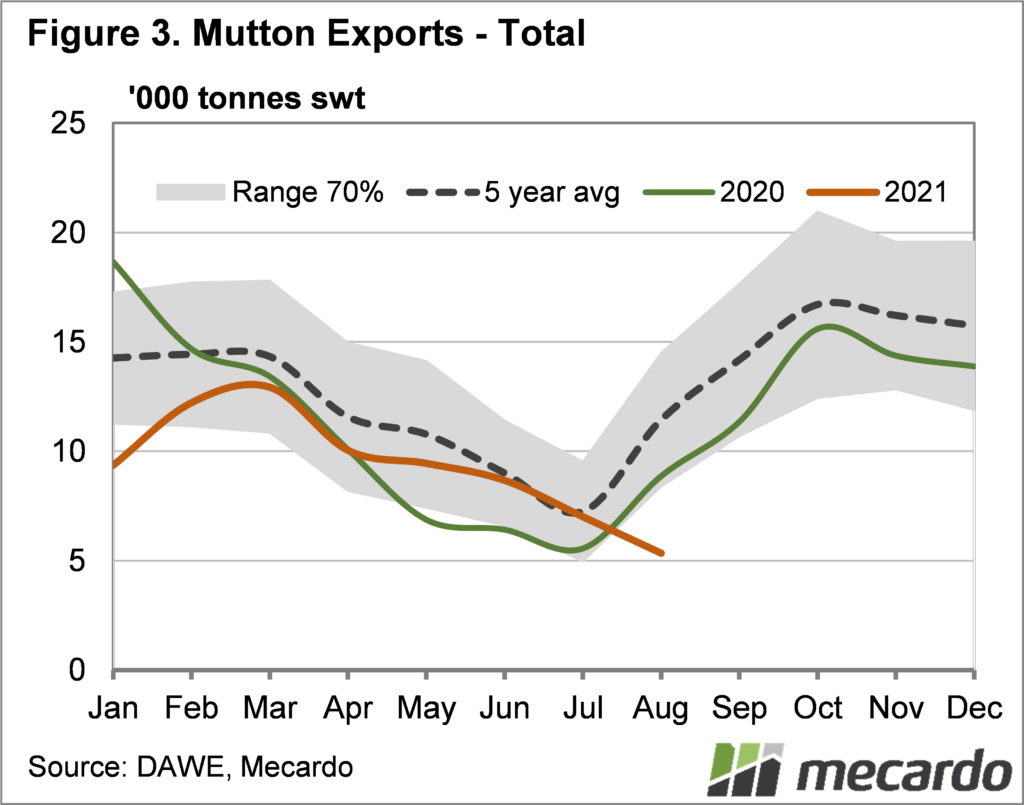

Weaker sheep slaughter in WA saw mutton exports hit 10-year lows in August. Figure 3 shows mutton exports were following the usual trend, before continuing lower in August, at a time when they normally head higher.

Australian mutton exports were 40% lower than last year, and 53% lower than the five-year average. The last time exports were this was in July 2011.

WA sheep slaughter has been around 55% lower than 2020 in August. With plenty of sheep heading east in recent years, and a flock rebuild starting sheep slaughter was likely to be lower, but August was a dramatic reduction.

What does it mean?

August lamb exports in particular, and winter exports in general, are very positive for lamb demand. With prices strong, and still plenty being shipped offshore, it bodes well for prices for the coming spring.

Mutton export figures are very low, but there is no issue with losing markets, with few exporting countries that buyers can turn to for mutton supplies.

With sheepmeat demand strong, the main issues remain bottlenecks in the supply chain. Processing capacity has been spoken about, and issues with shipping space another create another issue getting lamb from farm to consumers.

Have any questions or comments?

Key Points

- Lamb exports in August were very strong historically, indicating continued strong demand.

- The US market, along with China are driving year on year export increases.

- Mutton exports were very low in August, as supplies of sheep were weak in WA.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: DAWE, Mecardo