Lamb and sheep slaughter has managed to post consecutive year-on-year increases in monthly levels for the first time since winter 2020. Slaughter was not all that high, but last year’s Covid induced uncertainty helped. Here we look at how many there are to come.

The Australian Bureau of Statistics (ABS) doesn’t produce monthly data anymore, but we can derive something close using Meat & Livestock Australia’s (MLA) weekly data.

After posting slaughter year-on-year declines of 9% and 8% in January and February respectively, lamb slaughter rallied in March. In fact, it looks like March might have seen the most lambs slaughtered in a month since October 2019.

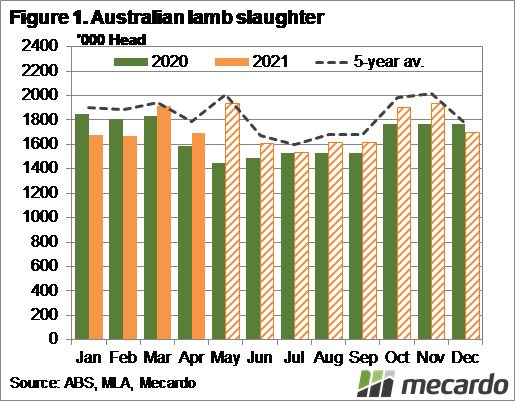

March lamb slaughter figures were up 4.5% on last year, while the increase in April looks like it will be stronger, at 7.2%. Figure 1 shows that April slaughter looks like it has been lower than March, this is to be expected given the public holidays. Despite this, April slaughter will be similar to January and February.

The good news for the market is that lamb prices have managed to hold their ground despite rising slaughter rates.

Figure 1 also shows how slaughter will pan out for the rest of the year if MLA’s projected target of 20.8 million head is to be hit. Over the next 8 months, lamb slaughter will have to be 8% higher than 2020, with the remaining lambs divided into months based on historical seasonality.

May is usually the biggest lamb slaughter month of the year, and if normal seasonality holds will see it 33% higher than last year’s Covid depressed levels.

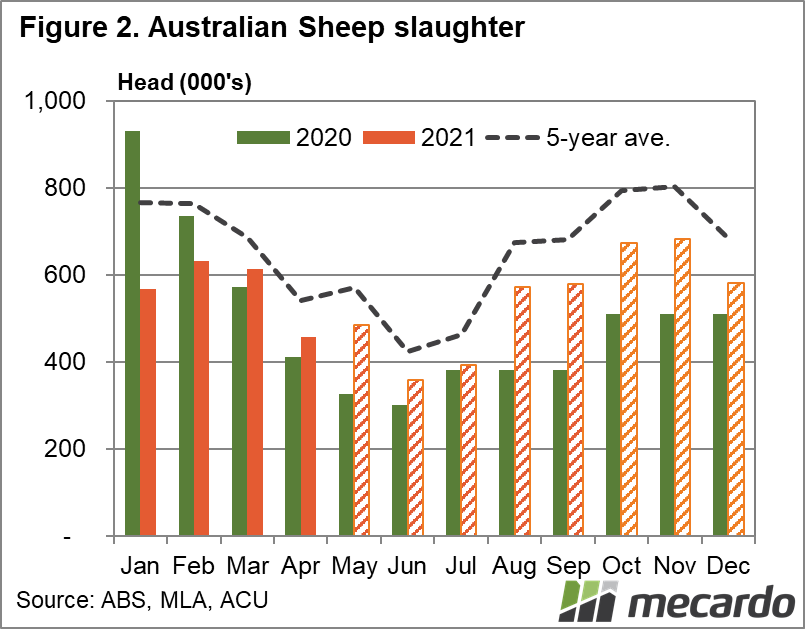

For sheep, the early year slaughter trends were similar to lamb (Figure 2). Sheep slaughter was much lower than last year in January and February but managed to outstrip last year in March and April. Sheep slaughter is still historically low, however, which has helped support prices.

If sheep are to hit the 6.6 million head target for slaughter, it will have to be 31% higher than last year. Much will depend on the season in the second half of the year, but at this stage, it looks like it might be hard to see such a strong rise, with flock rebuilding intentions strong.

What does it mean?

Even if lamb slaughter manages to hit the close to 20.8 million head target, the lift in slaughter should depress prices. We have already seen relatively strong slaughter levels in April, and the Eastern States Trade Lamb Indicator (ESTLI) managed to stay above 800₵.

For sheep the story is similar. February and March slaughter was strong relative to the end of last year, and prices largely remained better than 600₵. It will take the supply peaks of spring to see mutton values fall too far into the 500₵ range.

Have any questions or comments?

Key Points

- Lamb and sheep slaughter has been strong relative to 2020 in March and April.

- For the rest of the year, slaughter rates are expected to increase on last year’s levels.

- Prices haven’t been depressed by strong slaughter months early in the year, which is a good sign.

Click to expand

Click to expand

Data sources: MLA, ABS, Mecardo