There is plenty of seasonality in lamb markets, but it doesn’t always show up. This year plenty of lambs have been booked up for July in anticipation of tight supply and higher prices, and it now seems there are more lambs than kill space.

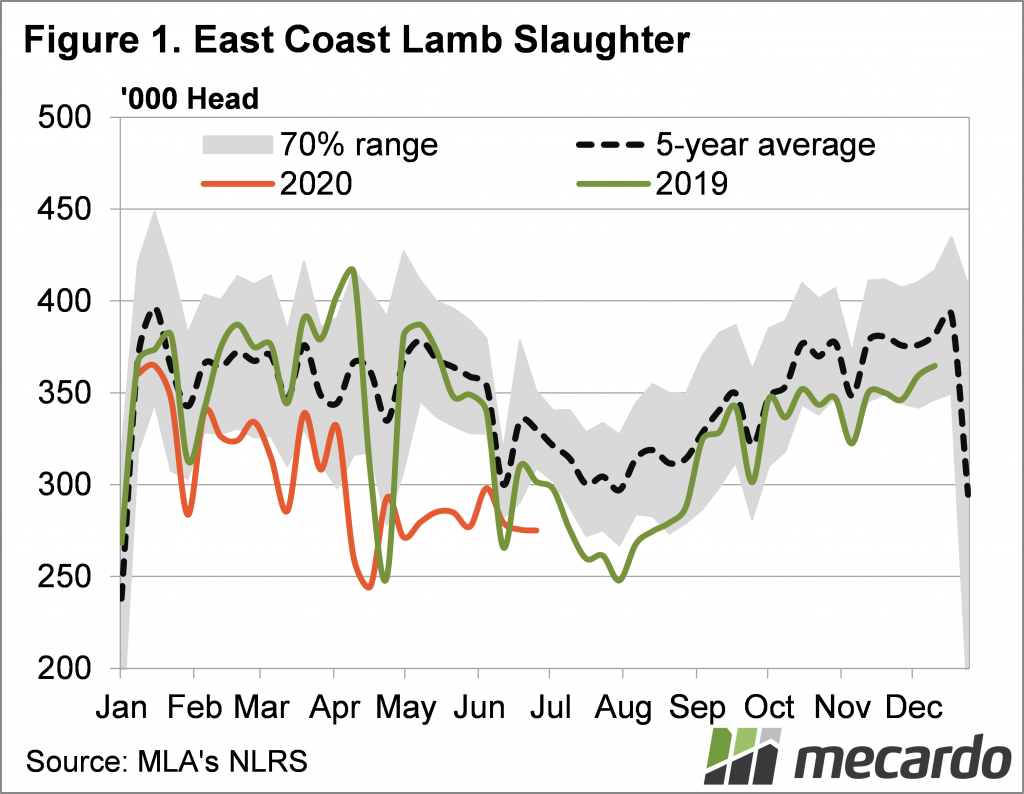

Figure 1 shows just how far lamb slaughter has been cut in response to tight supply and weaker export demand. Last week east coast lamb slaughter was 7% below the extreme lows of last year and 14% below the five-year average.

There were plenty of expensive store lambs bought in April and May which are now hitting the market, and those that weren’t sold on forward contracts are coming through the saleyards, and they have more weight than usual.

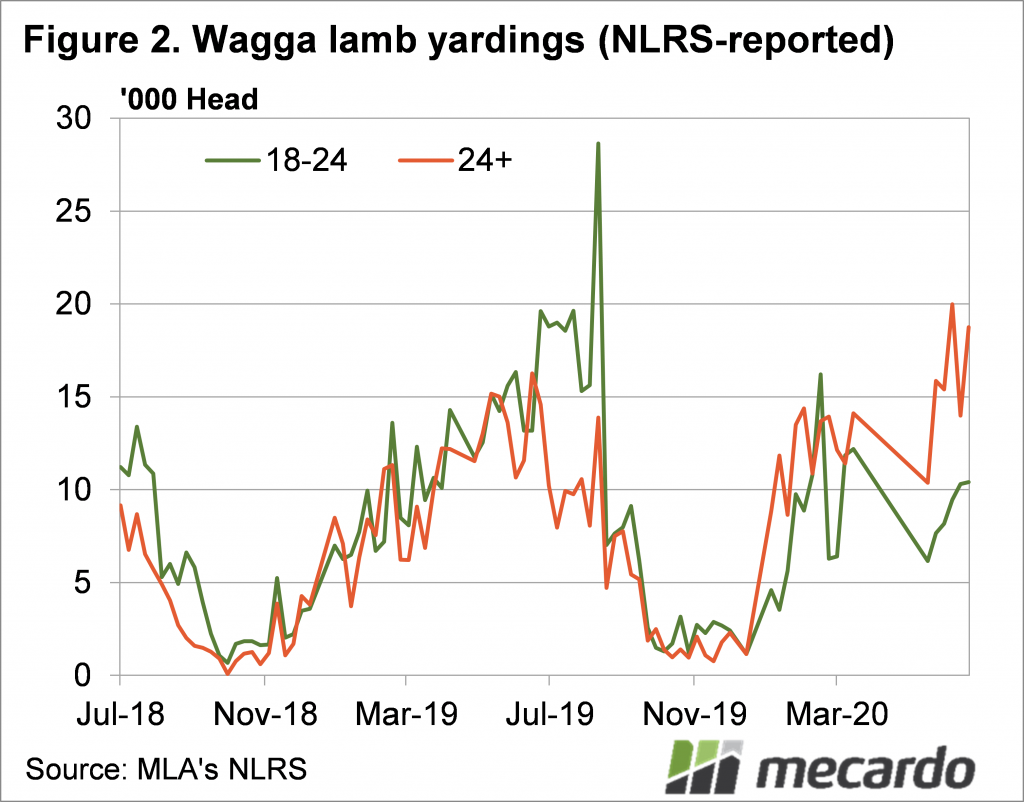

We took a look at one of the largest saleyards, Wagga, and the trend towards putting more weight on lambs is showing up. Figure 2 shows that while Wagga’s total yardings for June were down 7%, yardings of lambs over 24 kilograms were up 28%. Obviously trade lamb yardings were way down, with 18-24 kilogram lambs 38% lower.

With processors either running at reduced capacity, or having lambs booked up, the supply of heavy lambs hitting the saleyards is not only depressing heavy lamb prices, but has flowed through to trade lambs.

On Wednesday the East Coast Heavy Lamb Indicator sat at 774¢/kg cwt, down 176¢ on the same time last year when they were in extremely tight supply. The Eastern States Trade Lamb Indicator (ESTLI) is performing a little better, but figure 3 shows it has still lost 71¢ since last week, and at 806¢/kg is 97¢ below this time last year.

We haven’t seen lamb prices fall in June and July since 2017, and that year the decline was 10%. Since early June this year the ESTLI has lost 13.9%, and looks like it might be lower by the end of the week the way saleyards performed on Wednesday.

What does it mean?

There is a reasonable chance lamb prices could bounce over the coming weeks. It will be a month or so yet before there are enough new season lambs to push prices lower, so much will depend on whether old season lambs can fill the kill. Demand might respond as well, if prices are low enough to work into export markets.

Even if markets do bounce, we are seeing an early preview of how prices might react when new season lambs are ready to market.

Have any questions or comments?

Key Points

- Falling lamb prices are against the usual seasonal trend.

- Heavy lambs are hitting saleyards and demand is low with plenty of lambs booked early.

- Lamb markets could bounce over the coming month, but $9 looks a long way off.

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: MLA, NLRS