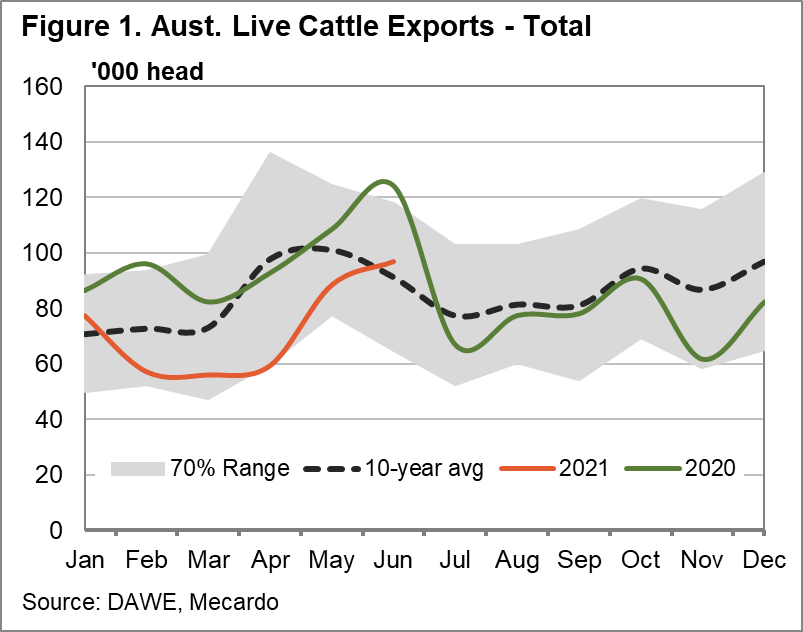

Australian exports of live cattle appear to be back on track, with monthly volumes suddenly rocketing up above 10-year average levels. However, is the sudden uplift transitory, or permanent? And what impact will COVID-19 lockdown restrictions and a curtailed religious festival in Indonesia have on ongoing demand?

June 2021 saw Australian exports of live cattle notch up a 10% month-on-month gain to reach a total of almost 97K head, bringing numbers 6% above the 10-year average for the first time since February. 52% of export cattle were bound for our key market of Indonesia, which saw growth of 10K head, or 25% compared to May. Vietnam continued its strong May return to importing slaughter cattle, though numbers were 27% below May.

Volumes to China also doubled, taking in 15K breeder cattle, ex Portland, VIC, for the month.

This return to normal volumes is in stark contrast to the situation earlier in the year, when total live cattle export volumes were languishing at around 60K head per month from February to April, down 20-40% from the last decade’s average before staging a sudden recovery in May, where volumes lifted 50% to 88K.

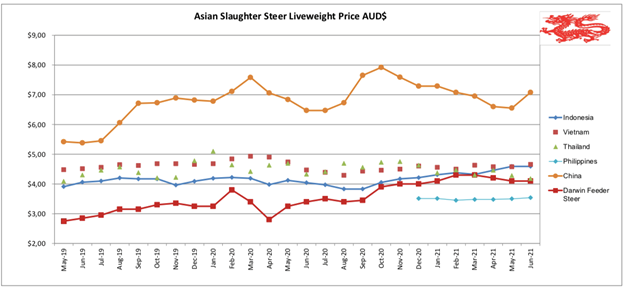

Higher volumes in the last two months have not appeared to have been a result of compromising on prices. MLA’s quoted prices for live export Townsville light feeder steers bound for Indonesia were up marginally from April levels to track at 400ȼ/kg lwt, with light heifer prices remaining static at 375ȼ/kg lwt for most of 2021.

Dr Ross Ainsworth’s Southeast Asian beef market report indicates that Vietnamese slaughter steers are still consistently fetching $4.66/kg, and Indonesian slaughter steer prices have backtracked slightly over June, to $4.59/kg lwt. However, Indonesian beef demand is weak due to the dual impact of high prices, and domestic travel restrictions being imposed as COVID-19 control measures. A recent major outbreak of infections has resulted in a stringently enforced lockdown being imposed from July 3rd to the 20th, with the aim of reducing daily cases to below 10,000 per day. However, with daily case numbers still over 40,000, it was announced that the lockdown will be extended further, to at least the 26th of this month.

The Muslim Eid al-Adha, or “festival of sacrifice” lands on the 20th to 22nd July this year, where Muslims offer Qurban by way of cattle, sheep and goat sacrifices, with the meat distributed equally to family, friends and relatives, and as charity to the poor. All Muslims of sound mind, sufficient age and wealth are required to offer Qurban and the Indonesian government has estimated that over 375K cattle and ~930K sheep and goats were slaughtered in 2019 for this celebration. Domestic 2-year-old Indonesian cattle will be utilised for sacrifice, not imported Australian steers, but it is likely that the ramp-up in live exports in recent months is related to the need to replace some of the expected Qurban sacrifices.

Lockdown is likely to curb the ability for Qurban to be carried out effectively and it cannot be delayed. Some shifts have already been made towards online livestock purchases, but overall; it is likely more Muslims will be opting for making donations to other countries instead of making cattle sacrifices locally. This means that Indonesian cattle stocks will remain inflated, increasing beef supply in the medium term while the stocks are drawn down, putting negative pressure on beef prices, and hence ongoing demand for imported live cattle from Australia.

What does it mean?

Have any questions or comments?

Key Points

- Live export cattle volumes recover to above 10-year average.

- Preparation for Qurban festival sacrifices may have temporarily driven up exports to Indonesia.

- Beef prices high in Indonesia, COVID-19 lockdowns may dent July beef demand.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, DAWE, Southeast Asian Beef market report, Mecardo