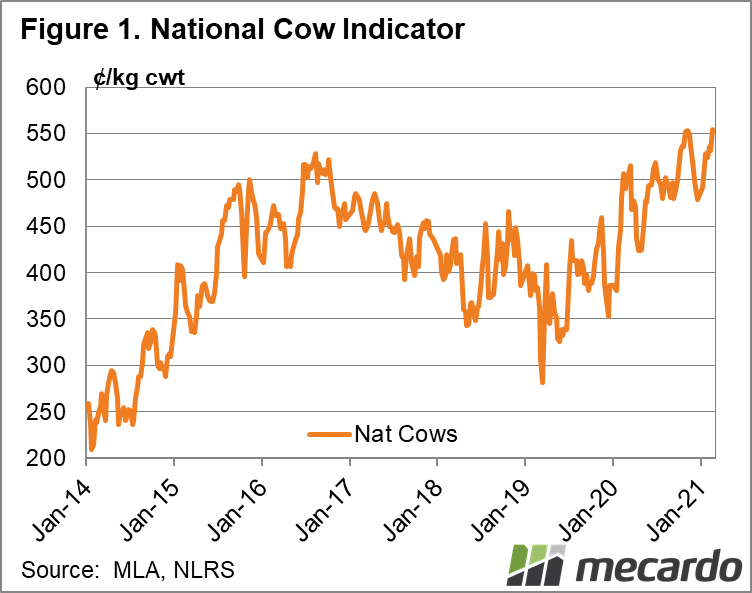

With a majority of the summer weaners now off the market, there seems to be a renewed focus on the cow market. While processors haven’t been getting much of a look at the saleyards, the over-the-hook national indicator for medium cows have regularly broken monthly records since June 2020, and are on the increase again this month. And demand coming from the US for our grinding beef (where much of the cow product is directed) isn’t waning, despite our stronger dollar.

The national saleyard Medium Cow Indicator opened this week at 293.7¢/kg lwt, up 6.5¢/kg on last week, and 30¢/kg year-on-year. Not much of a climb if compared to the restocker or processor yearling steer indicators, both currently trading around 100¢/kg higher than the same time last year, but still more of an increase than the export orientated heavy steer price, up just 20¢/kg. The monthly average for February (while only including data up to Feb 16) paints more of a picture at 288¢/kg lwt – the second highest average on record, only averaging higher in November last year at 294¢/kg lwt.

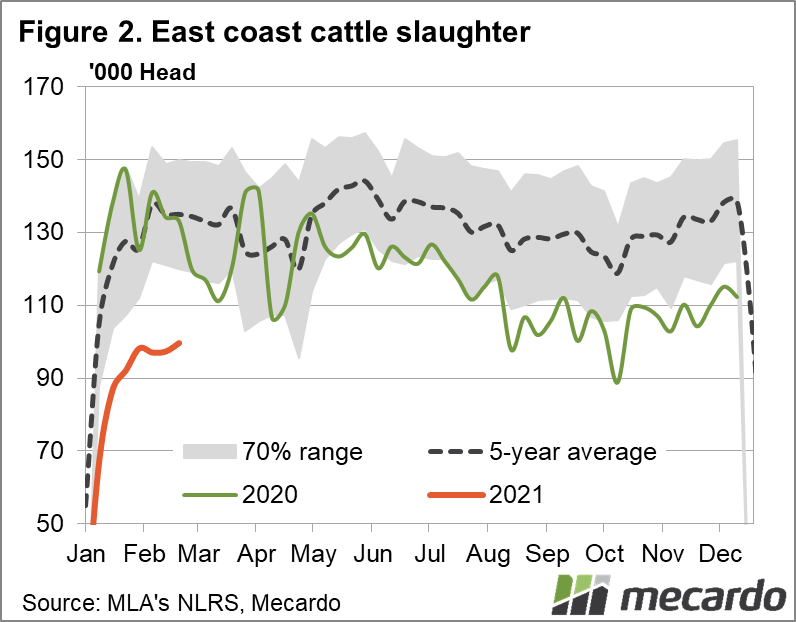

Sending direct is paying off even more for those with cull cows, with the over-the-hooks Medium Cow indicator averaging 536¢/kg in January – just below the record 540¢/kg also achieved in November 2020 – and up to a 547¢/kg average for February so far. Queensland is leading the charge, with OTH cow prices averaging 582¢/kg for February. Total slaughter volume for the figures we have for the year-to-date is down 44% in Queensland, compared to the national total which is down 30%. Processor cow saleyard throughput is down 52% year-on-year according to Meat and Livestock Australia, showing they are keen to secure them direct.

The 90CL price did dip slightly last week, but according to Steiner this was impacted by buyers hesitant to risk transport disruptions due to the extreme weather the US was experiencing. This extreme weather also meant US cattle slaughter was down 12% year-on-year last week. Team that with 20% less grinding beef being imported to the US compared to a year ago, and an estimated 30% less Australian beef headed to the US for February because of the lack of supply, and the price outlook remains firm for that market.

What does it mean?

Last week we looked at female slaughter rates being slow to reflect the seemingly obvious herd rebuild, but with cow prices surpassing even those rates seen in the 2016/17 cycle, there is clear incentive to turn off under-performing females, and breed up rather than buy in. Meat and Livestock Australia is also reporting average cow weights are 40kg higher than the same time last year, putting even more dollars in your pocket if you are willing to let them go.

Have any questions or comments?

Key Points

- National saleyard and over-the-hook indicators for medium cows tracking at close to record monthly averages for February so far.

- Processor cow throughput down more than 50 per cent year-on-year.

- US grinding beef imports (from all countries) are down 20 per cent from a year ago.

Click to expand

Click to expand

Data sources: MLA, Mecardo