The last time we looked at lotfeeder margins was just before harvest, and with harvest comes some relief. Despite paying record prices for feeder cattle, lotfeeders are enjoying improved trading conditions, thanks to lower grain values, and strong finished cattle prices.

Often good rains in the northern wet season are not good news for lotfeeders. Good rain generally means tighter supplies of feeder cattle, and usually little impact on feed costs.

This year, the extremely tight supplies of finished cattle and cows for slaughter has seen grainfed cattle prices maintain their highs. Additionally, the abundant paddock feed has seen demand for grain dry up at farm level, meaning it’s all heading to port, and upcountry discounts are again in play.

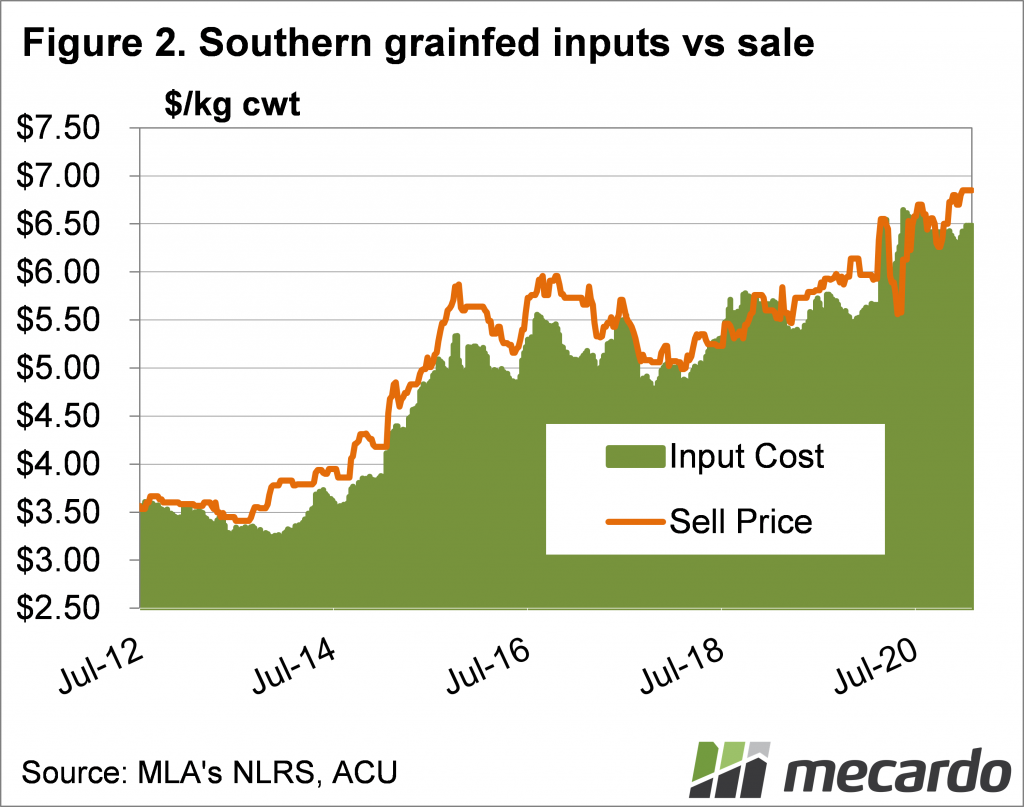

The biggest beneficiaries of the big harvest have been feeders in the south, where feedlots are a long way from port. The last time feed wheat was under $300/t was back in June 2018, and this harvest it has fallen as low as $250/t at times.

This time last year feed wheat in the Riverina was $400/t, and the fall in grain price has stripped roughly $200/t out of the cost of producing a grainfed steer. On the Darling Downs the decline in feed price has been similar, although feed wheat is still costing close to $300/t.

After a brief fall on the back of declining seasonal conditions and improved supply late in 2020, grainfed steer prices have rallied back to highs. The MLA’s Queensland Over the Hooks 100 day grainfed steer indicator is sitting around 680¢/kg cwt, but there are prices of 700¢ available.

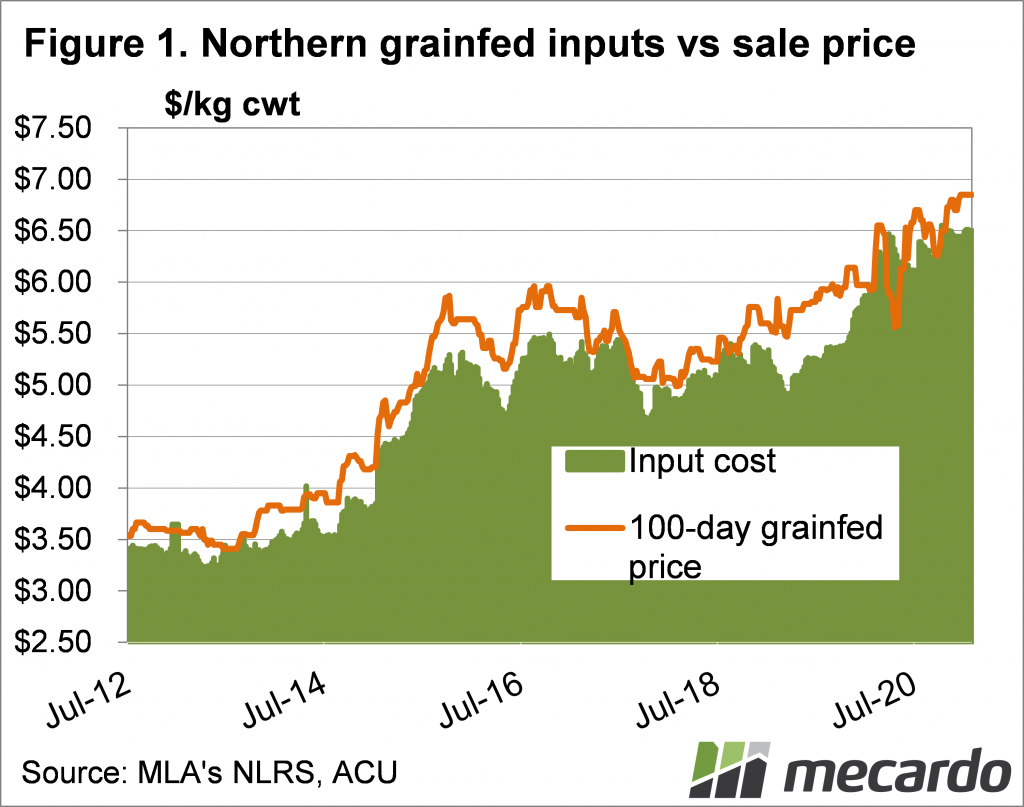

The movements in grain and finished cattle prices has allowed feeder prices to reach new records without impacting margins in a negative fashion. Figures 1 and 2 show input costs versus sale prices, with a small margin opening up between the two.

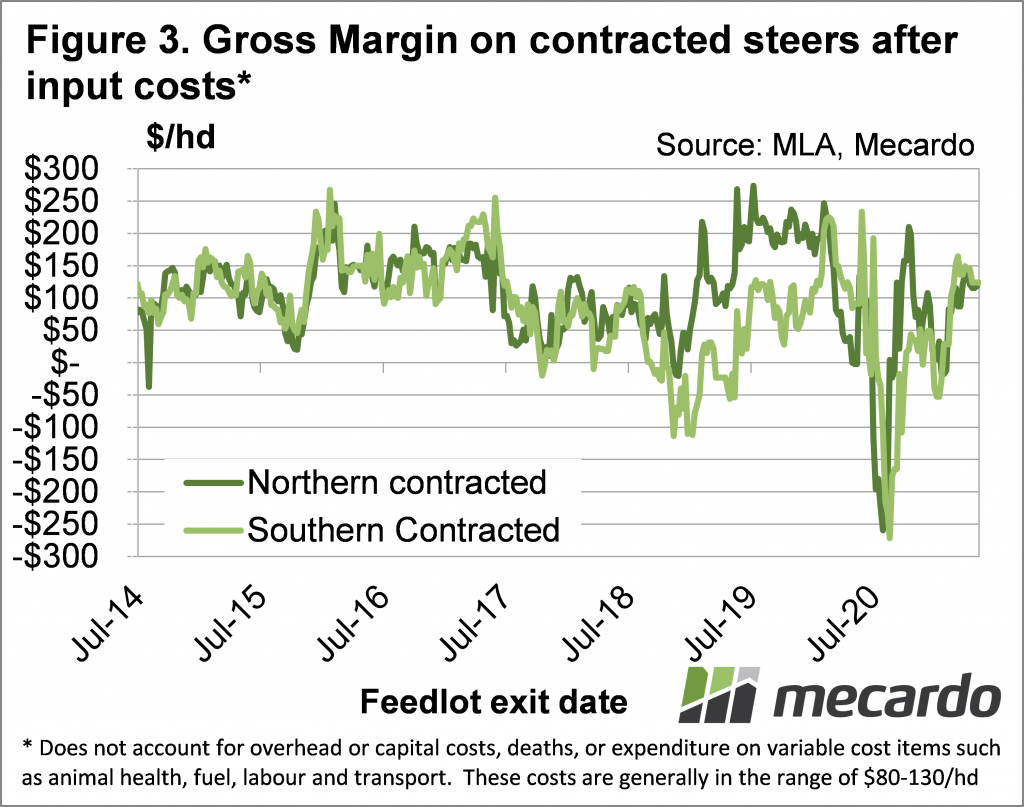

Figure 3 shows a rough margin, and the two things to note are that it’s over $100 per head, and has been relatively steady for a couple of months. Compared to the volatility and, at times, highly negative trading margins of most of 2020, the last few months have been a lot better for lotfeeders.

What does it mean?

While light cattle prices continue to rise, feeder values have found some sort of equilibrium in supply and demand. This is not surprising with sellers looking at record feeder prices or risking the prime market later in the year, and feeders achieving a small profitable margin.

If the supply of feeders tightens there is a little room for upside in price, but it remains limited, as we know finished cattle prices will find it hard to reach any more increases in value.

Have any questions or comments?

Key Points

- Feed grain prices fell with harvest, and are well below the same time last year.

- Grainfed cattle prices are close to record values, as are feeder prices.

- There could be a little more upside in feeder values, but it remains limited by slaughter values.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, ALFA, Mecardo