Earlier this week Mecardo looked at 15-year micron premium and discounts using AWEX MPGs with a couple of finer micron categories added, in response to a reader request. This article extends the analysis by looking at comparable micron premiums and discounts for short, long and tender wool.

AWEX MPGs do a good job of reflecting the value of full length fleece wool produced in Australia. As an aside the industry is well served in market reporting by AWEX. To highlight this, look for comparable greasy wool information from New Zealand and South America. You will be looking for some time. Not everyone produces wool which matches wool used in the AWEX MPGs (AWEX wool market indicators). For this article a short series (58-63 mm long), a long series (106-115 mm long) and low staple strength series (20 to 27 N/ktx) have been used.

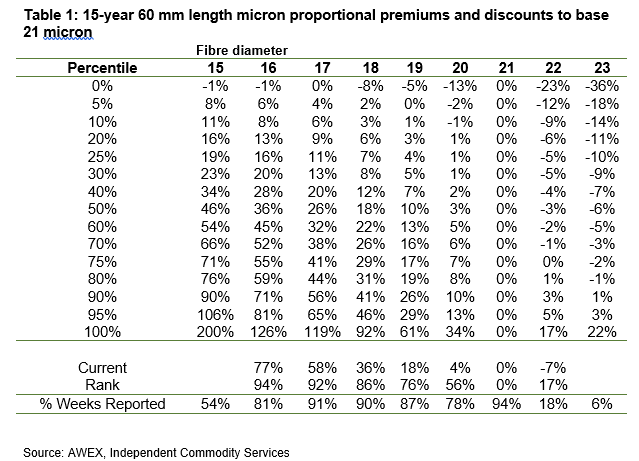

The lookback period for the percentile analysis was held at 15 years, to be consistent with the earlier article. 21 micron was used as the base for the two staple length based tables, with 20 micron used for the low staple strength table. At the bottom of each table the number of weeks a micron category was reported during the past 15 years is shown, as a way of weighting the validity of the basis. In Table 1 for example, which shows the micron premiums and discount 15 year percentiles for 60 mm length merino fleece wool from 15 to 23 micron, the 22 and 23 micron categories were quoted less than 18 and 6% of the time.

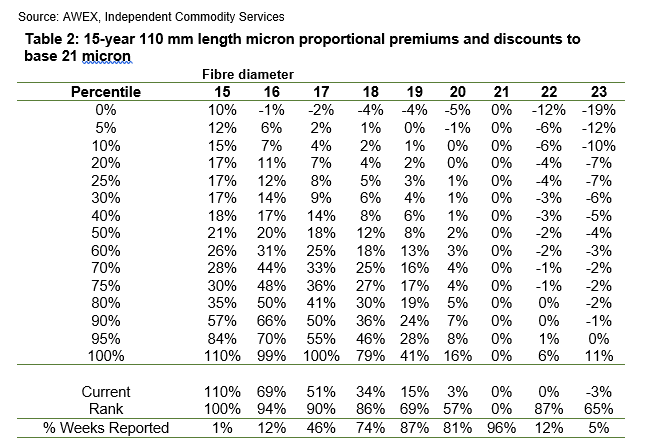

Table 2 repeats the analysis for longer length (110 mm) wool. Due to the long staple length there is not a lot of data available for 15 micron (quoted 1% of the time) nor 16 micron (quoted 12% of the time). The 23 micron was only quoted for 5% of the time due to low volumes.

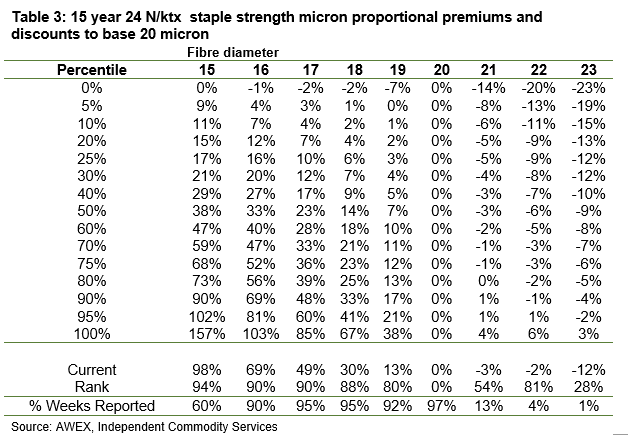

In Table 3 the micron premiums and discounts use merino fleece ranging from 70 to 95 mm in length with a staple strength between 20 and 27 N/ktx, lower strength fleece wool. Mecardo has shown how discounts for staple strength have been trending lower since the 1990s. Where discounts were once punitive they have been in recent years negligible. Short and long staple wool prices tend to be linked which shows up with the median low staple strength premiums and discounts comparable to those for the 60 mm length data in Table 1.

While merino cardings are enjoying strong micron premiums and discounts (view previous Mecardo article ‘Microns matter to cardings’ article) this is not always the case, so cardings prices will have a different set of micron premium and discount percentiles.

What does it mean?

There is enough price data available to look at historical micron premium and discounts for a range of specifications such as staple length, staple strength and vegetable matter, or a combination thereof. A brief look at premiums and discounts in this article suggests that the premiums and discounts will be similar across the different combing wool specifications.

Have any questions or comments?

Key Points

- The median micron premiums and discounts for varying staple length and low staple strength are comparable, although limited price quotes for length 15 and 16 micron limit the comparison.

- The saying “a rising tide lifts all boats” looks to apply to micron premiums and discounts for merino combing length in that rising and falling micron price curves impact various permutations of staple length and strength.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: AWEX, ICS.