Australia is on track to produce the second highest wheat crop on record, on the back of the highest wheat crop on record. You would think back to back extremely strong production would see stocks building, but the official estimates show the efficiency of the export program in getting wheat out.

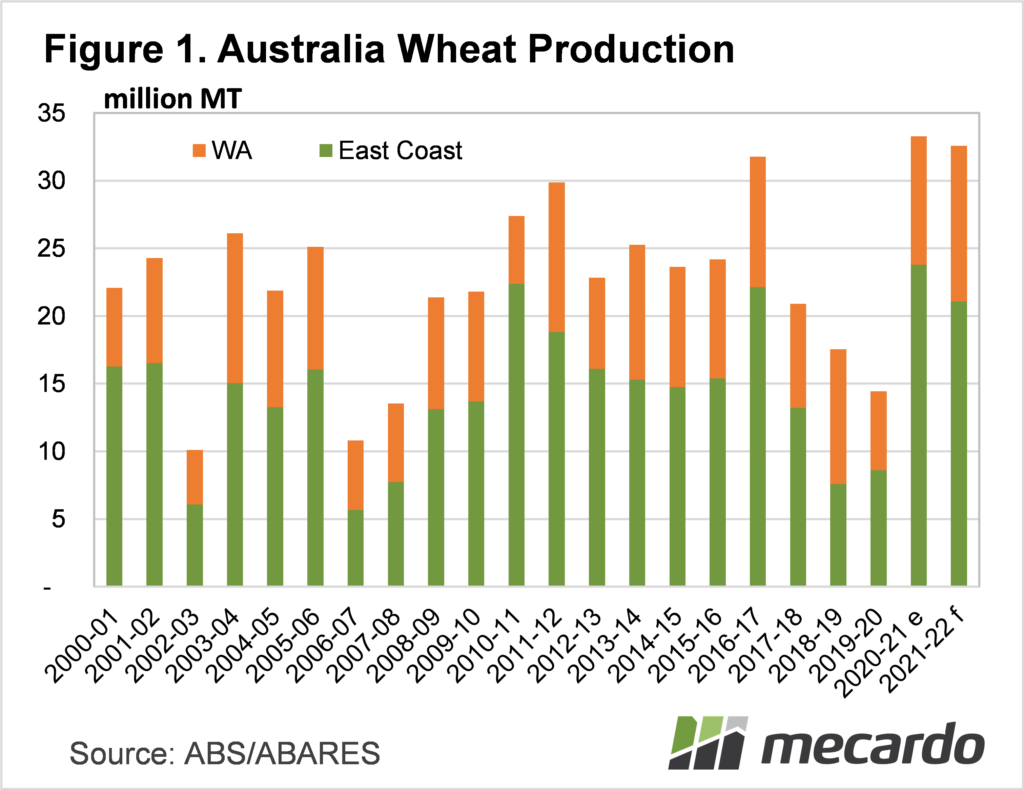

The latest Australian Bureau of Agricultural and Research Economics and Sciences (ABARES) Crop Report has forecast wheat production at 32.63mmt. Last year the crop was 33.34mt, with figure 1 showing these two years are going to the two biggest on record. Back in 2016 Australian wheat production was over 30mmt, but it was only for one year.

Figure 1 also shows that this year the crop is expected to be 11% smaller than last year in the east, and 21% larger in the west. This is important when we look at how the crop is used.

On average over the last 20 years 69.5% of the Australian wheat crop has been exported. In drought years the amount exported has been as low at 50% of the crop, while in 2011-12 just over 80% of Australian wheat was exported.

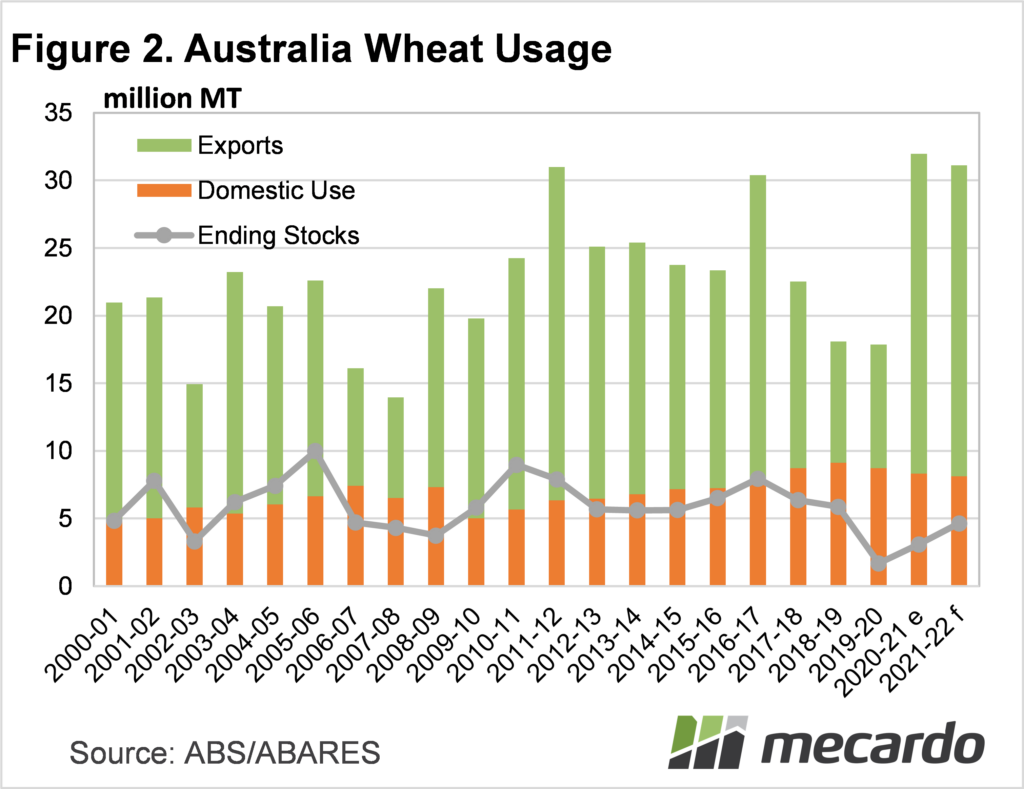

Figure 2 shows wheat exports and ‘apparent domestic usage’, which is basically production minus the change in stocks and exports. Domestic wheat usage has been on the rise since 2009-10, peaking in 2018-19.

Domestic usage has stayed relatively high despite the breaking of the drought. Having not been above 8mmt ever prior to 2017, it remained above 8mmt last year and is expected to this year. Having over 1 million head of cattle on feed helps keep grain consumption high, while other domestic intensive feed industries are also likely to be increasing wheat use.

Domestic wheat consumption is relatively steady, while exports vary wildly with production. The wheat export record was set in 2011-12, and even with the record crop last year, we couldn’t see higher exports. The rise in domestic consumption might see the 2011-12 record stand for a while yet.

Strong exports and domestic consumption means ending stocks of wheat haven’t managed to recover back to previous levels. Figure 2 shows ABARES are expecting 4.6mmt in stocks at the end of 2021-22, when the 20 year average is 5.8mmt.

What does it mean?

With less wheat being kept in stock, we might have seen a shift, with production being more reliable, even in dry years, less wheat is held over seasons. It might just be that good growing seasons see wheat moved, while in drier years it is held over.

A forecast of weaker than normal ending stocks is good for basis for the next crop. While local basis is currently weak, which normally happens in big export years, new crop should be priced a bit better with lower than normal stocks expected to be held over.

Have any questions or comments?

Key Points

- Australia is on track to have two years of extremely high wheat production

- Export markets take a majority of wheat, with domestic consumption expected to fall.

- Wheat ending stocks have risen but will still not be back to historic averages.

Click to expand

Click to expand

Data sources: ABS, ABARES