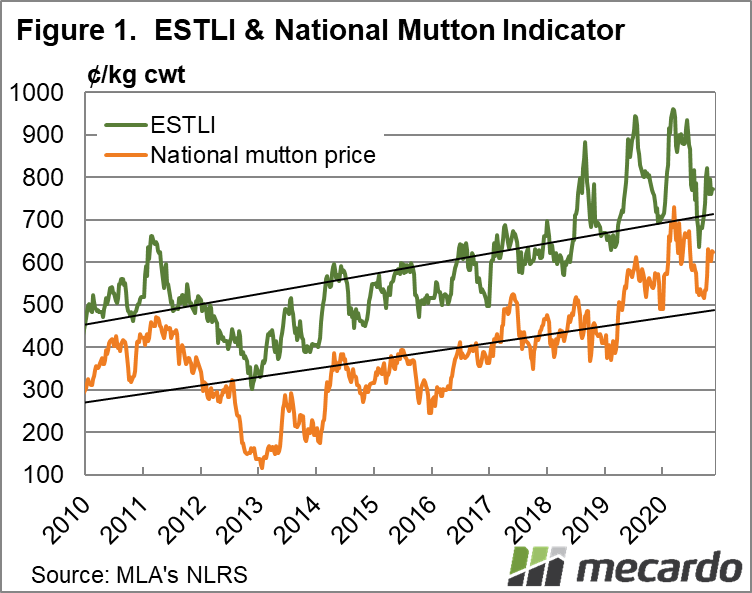

Mutton has moved even closer to lamb thanks to a wet end to spring and continuing export demand. While sheep and lamb prices are both coming out the end of the spring strong, with their national indicators trending higher than the same time last year, the gap between the two has tightened, and is expected to move even closer in the coming month.

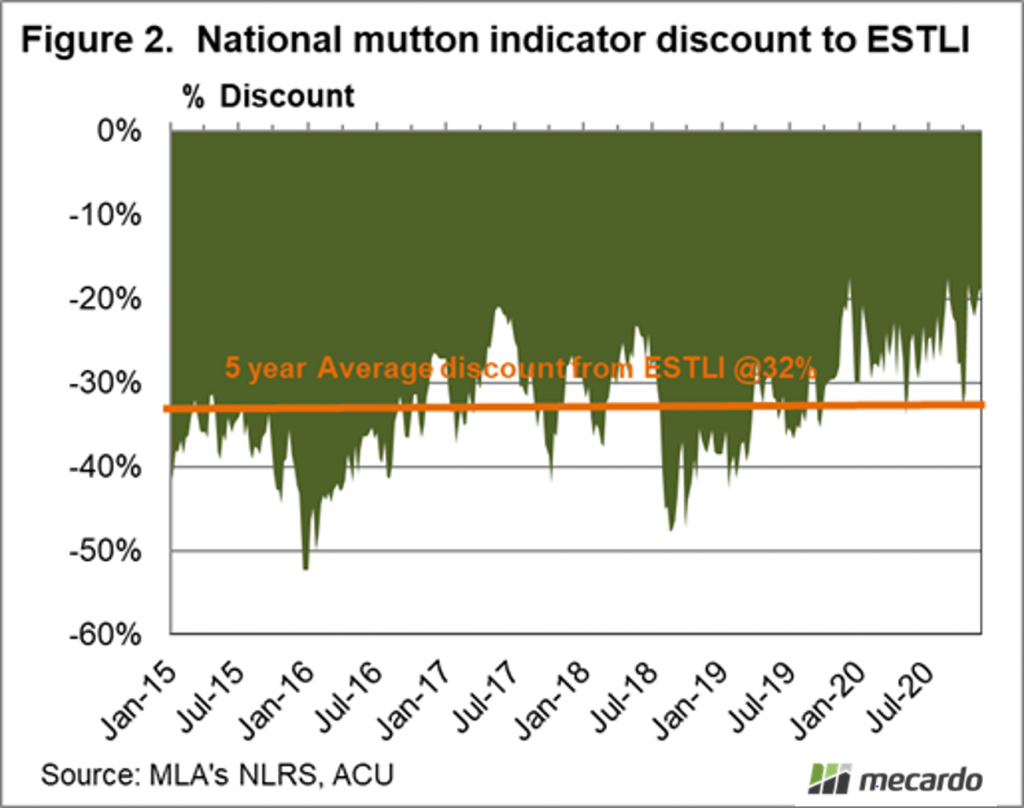

The lamb price premium over mutton closed last week at 20%, after having been down to just 17% the week prior – the closest the two national indicators have been since they began. According to Meat & Livestock Australia, the last time the two prices were within the 20% zone was in the last flock rebuilding phase back in 2011, and the five-year average price differentiation is 32%. Proving this is being caused by more love for mutton and not a dramatic lamb drop-off, while having come back from the record highs earlier in the year, the national trade lamb indicator is averaging 811¢/kg for the year to date, having averaged 761¢/kg for 2019.

Back in August we reported the national mutton indicator and the NTLI as having a 22% price spread, due to extra export support (the mutton export value had jumped 65% since 2018) and restocker demand. As breeding ewe prices soar and rain continues to fall in the east, these factors have only been amplified further. Export demand for mutton is also looking positive, as our Asian markets look to a cheaper price point to fill the protein void left by the African Swine Fever’s impact on pork supply.

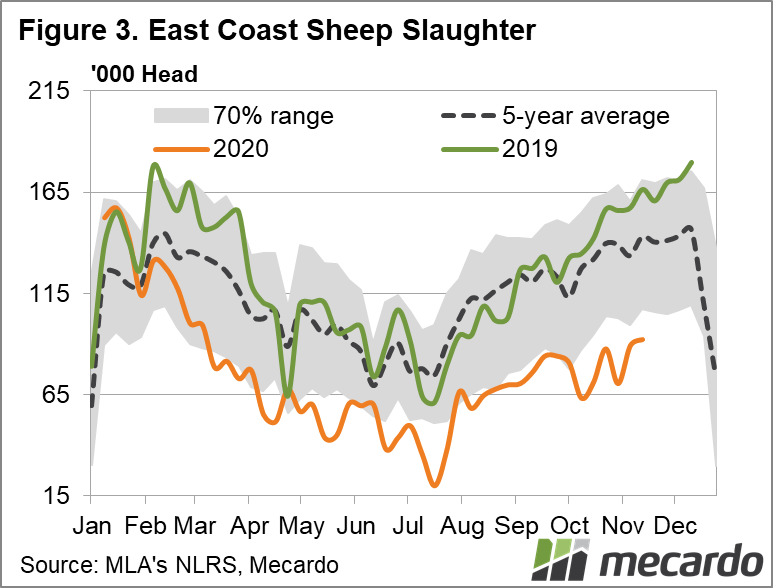

The supply factor, especially in the east, also points to further tightening of the price gap. Nationally, close to 40% less sheep have been slaughtered for the year-to-date compared to 2019, while the same lamb figures are down just 10%. The most recent weekly slaughter totals on the east coast had lamb slaughter down just 1% on the same week in 2019, while sheep slaughter was down 45%.

What does it mean?

With lamb yardings and slaughter expected to only go one way in the next month (and that’s up) as Victorian turnoff kicks into gear, the mutton versus lamb price gap could again enter record territory. While annual feature sales of breeding ewes have boosted recent sheep yardings, it will be interesting to see if the mutton price – averaging 606¢/kg for the year to date (25% higher than last year) will be enough to entice any more ewes onto the market this year. With the plethora of feed in paddocks, and consistently high lamb prices, you’d think not.

Have any questions or comments?

Key Points

- Price gap between sheep and lamb shrinks further as mutton market rises

- Both mutton and lamb are trading at above year-ago levels, but Victorian sucker flush is likely to see lamb price come under pressure.

- Continued tight sheep supply should mean little downward pressure on mutton price in the short term.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo