While steaks, silversides and stirfrys are the types of cuts most Aussies look forward to from beef production, there are plenty more parts of the cow in demand internationally. Co-products, both those more commonly used in meals overseas such as tail and tongue, and those used for the likes of leather and oil - have been increasing in price. June and July saw beef offal exports out of Australia plummet, and prices responded accordingly.

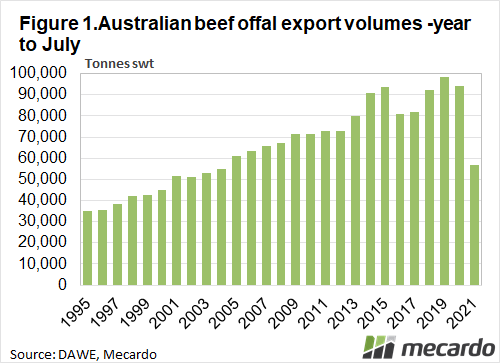

According to Meat & Livestock Australia, slaughter numbers have fallen in Brazil and Argentina as well as domestically. This, teamed with an easing Australian Dollar, averaging 74.25US¢ in July, all pushed prices higher according to the latest co-product report available. A quick look at beef offal export volumes gives plenty of insight on the supply front. Total volumes for the year-to-July were down 40% year-on-year, with the exports in July alone down 91% compared to the previous year. Indonesia and South Korea were Australia’s biggest offal markets by volume over the past 12 months, and they took 25% and 32% less product respectively.

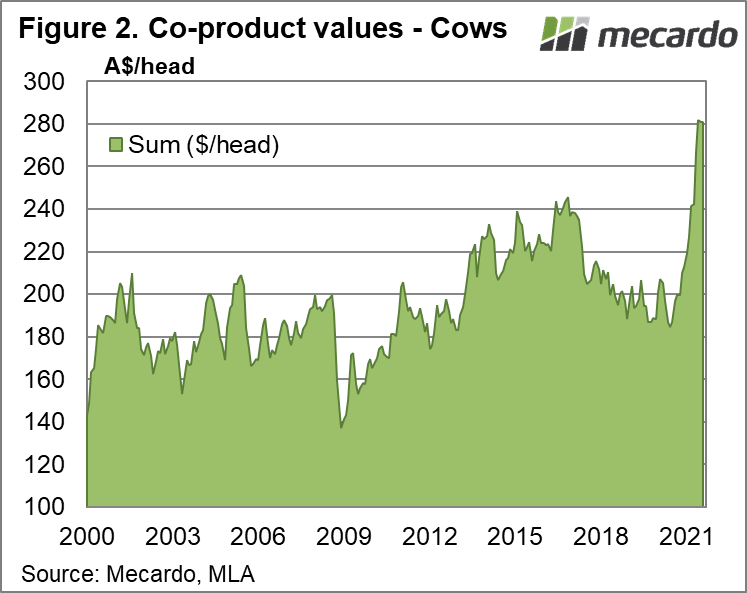

Using the average yield of each major co-product from a 500kg live weight cow, current co-product total returns per head equate to around $281.74. This is an increase of close to $100/head compared to July 2020, and a jump of more than $15 on the previous month. Making up 30% of that total return in July was tallow, which rose $143/tonne on the previous month. At $1723/tonne, tallow (the 1% Free Fatty Acids product) has risen 77% year-on-year, or $750/tonne. Tallow is commonly exported to Singapore for biofuel production, which links its pricing to the cost of oil – which has also been rising.

Another strong performer has been tongue, which makes up 11% of the total co-product return. The price of tongue (swiss cut) has skyrocketed from $9.48/kg in July 2020, to $26.23/kg this July, a jump of 176% year-on-year. It has climbed 18% month-on-month, and hasn’t reached prices this high since 2005. Tail (7% of total return) is also in hot demand, lifting about $5/kg annually, to reach $15.48 – the highest price in our records going back to 2000. The cost of hides has also risen significantly in the past 12 months, however still remain historically low.

What does it mean?

Co-products are well and truly keeping pace with strong beef prices internationally, and no doubt playing a role in maintaining Australia’s historically high cattle prices. This will see them having an increasing role in Australian beef production and export, and the focus on co-products in our domestic industry start to move from cast-offs to money makers – especially if supply remains tight in the medium term.

Have any questions or comments?

Key Points

- Co-product prices have risen along with cattle returns in the past 12 months, as Australian exports of beef offal have plummeted.

- In July, total beef co-product price reached $281 per head, which our analysis shows as the highest value in the past 20 years.

- The price of tallow has risen by more than 70% year-on-year, while returns for tongues have climbed 176% higher.

Click to expand

Click to expand

Data sources: Mecardo, Meat & Livestock Australia