Meat and Livestock Australia’s (MLA) sheep industry projections released a fortnight ago made some adjustments to sheep and lamb slaughter for 2021 to the downside. With slaughter having been stronger than last year from April to June, slaughter for the rest of the year looks positive for prices.

It was this time last year that things were getting dire in Victorian meat processing. Weak export demand had processors cutting kills, and the Covid related issues soon put the handbrake on capacity.

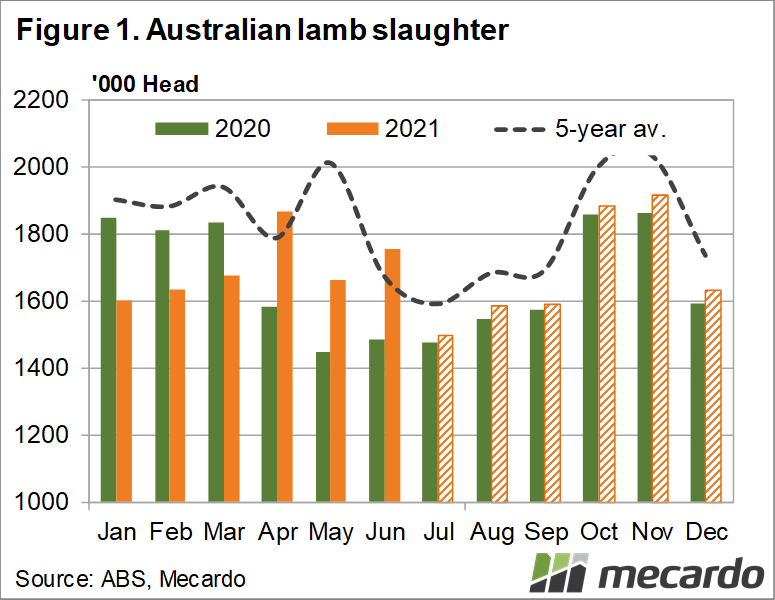

Figure 1 shows east coast lambs slaughter was well below the five-year average, with both demand and supply issues causing the low throughput. This year things have somewhat returned to normal, in terms of supply and demand. The flock rebuilding boom saw first quarter lamb slaughter well below 2020, but second quarter slaughter (as estimated from MLA weekly slaughter) has been much higher.

In fact, for the year to date, lamb slaughter is likely to be slightly higher than last year, to the tune of 2%. MLA’s forecast for total lamb supply in 2021 was revised down half a million to 20.3 million head. This is just 300,000 head or 1.5% higher than last year.

If we take the forecast for 20.3 million head and deduct what has been slaughtered so far, and split the remaining lambs by seasonal spread, it gives us the projection in figure 1.

Despite expected higher lamb marking rates, based on MLA’s forecast, there will only be a slight lift in lamb slaughter over last year for the rest of 2021. A dry spring would see more of a lift in second half lamb supply.

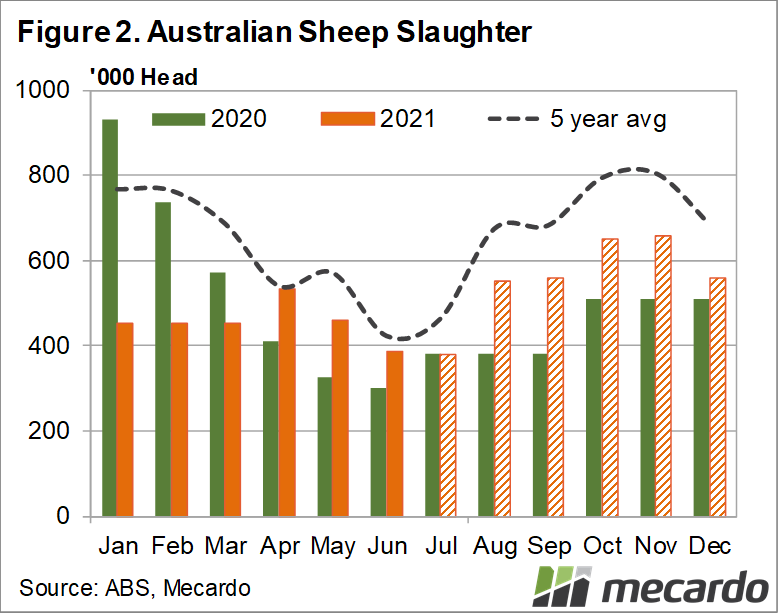

Mutton slaughter has been much weaker than last year in the first half of the year, to the tune of 17%. Despite this MLA are still forecasting just a 6% annual fall in sheep slaughter, compared to 2020.

Figure 2 shows that sheep slaughter will have to be 26% stronger than last year in the second half to make up the numbers. Sheep slaughter will still be well below the five-year average, but given the restocking drive, it will be interesting to see if spring supplies manage to pick up.

What does it mean?

Given export markets for lamb have improved since last year, we can expect slaughter around the same level as last year to deliver better prices. This won’t be hard in early spring when lamb prices are weak, but it would mean an ESTLI north of 750ȼ during the peak supply period.

Mutton demand remains very strong, and it can’t get much stronger without lambs improving. The supply forecasts in figure 2 suggest prices might ease back to a more normal spread to lamb. If supply remains tight we might see mutton values remain at the top of the historical range.

Have any questions or comments?

Key Points

- Lamb slaughter has been stronger than last year in the first half of 2021, and is expected to stay strong.

- Mutton slaughter forecasts are for much higher supplies in the second half of 2021.

- Stronger export lamb demand could mean stronger year-on-year prices.

Click to expand

Click to expand

Data sources: ABS, MLA, Mecardo