Traditionally it is last week that marks the low for lamb supply. NSW new season lamb and sheep generally start to hit the market in late July and picks up in August to see slaughter improve, and prices fall. As always, climate will play a part, but recent moves have defied expectations.

Major sheep areas in both the east and west have received above-average rainfall in July, and the Bureau of Meteorology (BOM) are forecasting a wet spring. Given the wet July, we would have thought it might push back the timing of the traditional suppy increase, but price may have trumped grass this time.

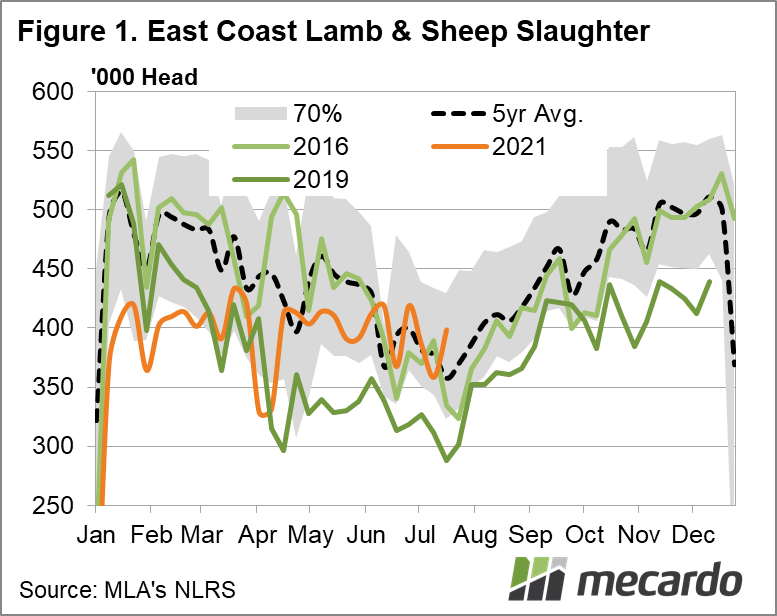

Figure 1 shows that combined east coast sheep and lamb slaughter has been tracking the five-year average for the last month, but it kicked higher a week early. As noted in the weekly comments on Friday, the lift in combined slaughter for the week ending 16th July came from a 136% increase in NSW sheep slaughter.

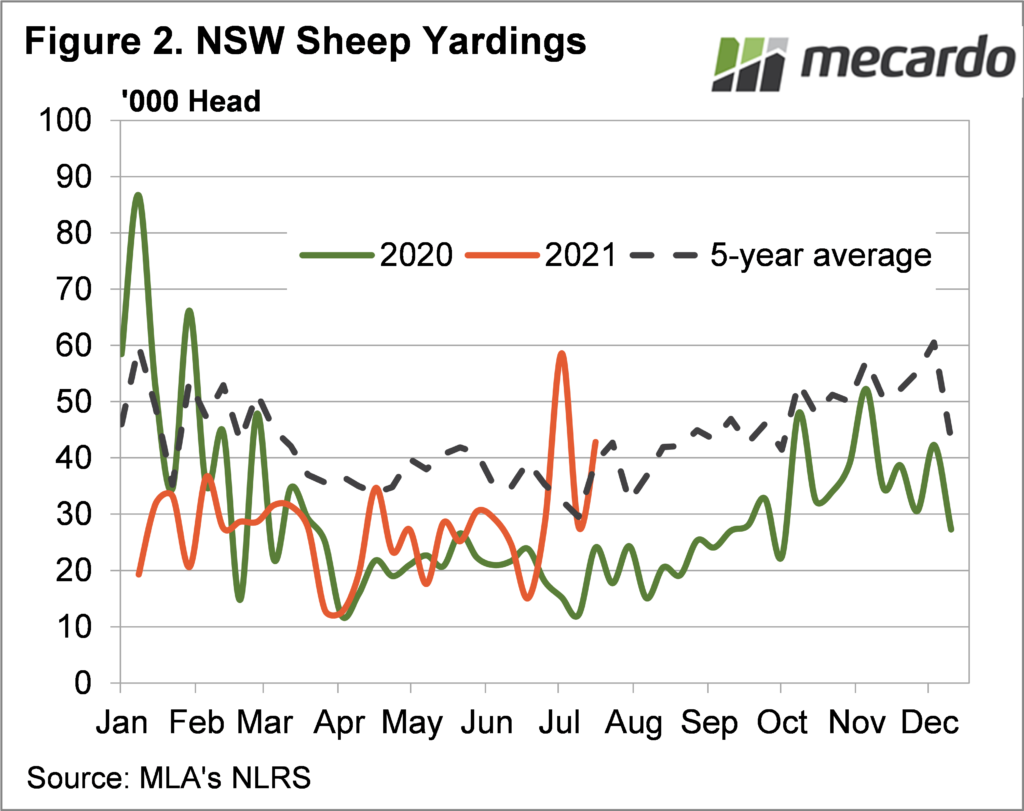

Such a large lift, after a fall two week prior, suggests it was the return of a processor from a fortnight of maintenance shutdown, that drove higher rates. Still, the sheep had to come from somewhere, and the fact that NSW Sheep yardings (figure 2) have been at or above average for the last three weeks suggests growers are liking the prices on offer.

Last year was obviously a bumper year, but Covid restrictions upset seasonal supply trends. We can go back to 2016, the previous wet spring, figure 1 shows it took until half way through August before sheep and lamb slaughter reached the levels seen in mid-July this year.

In 2016 slaughter increased through to September, before taking a break and then rising through to a strong finish at the end of the year. Figure 1 shows that last year we never saw the big November and December slaughter thanks to the flock rebuild.

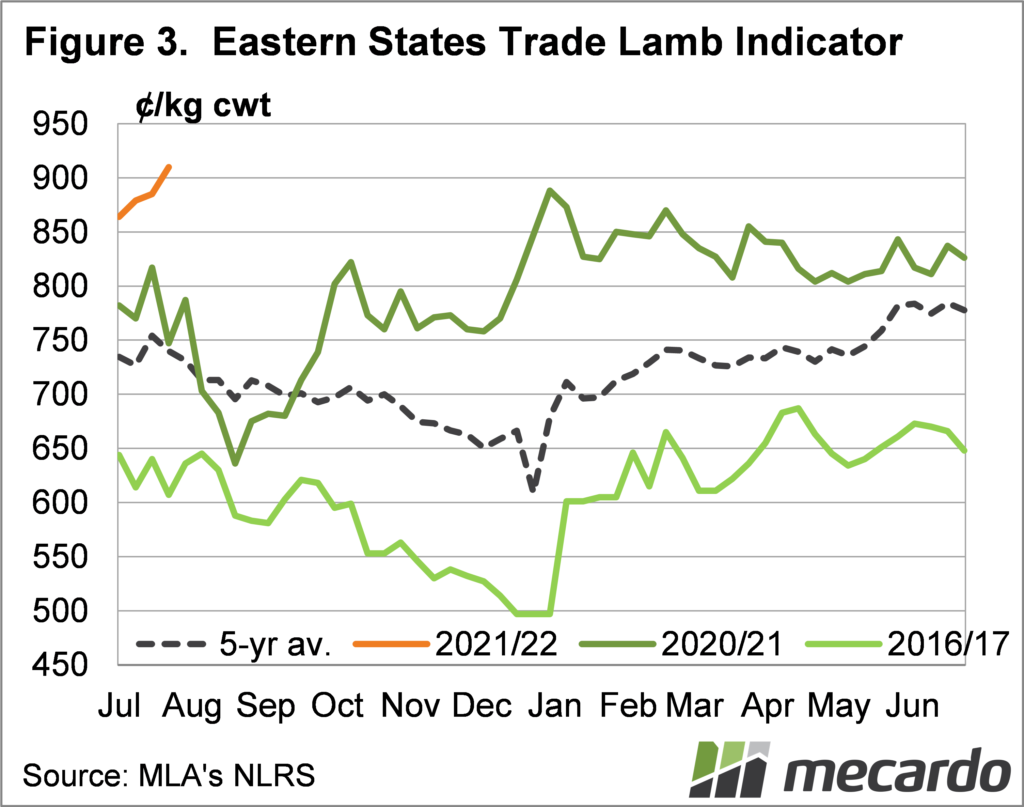

In terms of price, we often say, the more sheep and lambs which are slaughtered now the better it is for prices later. If current strong prices draw out more stock early, we might avoid a repeat of the consistent decline we saw in 2016, which wiped 23% of the price from August to December.

What does it mean?

A 23% decline in price from current highs would still leave the Eastern States Trade Lamb Indicator (ESTLI) at a respectable 700ȼ, which would be no disaster with a good season. In 2016 mutton prices were relatively steady, as the good season encouraged demand.

If the BOM forecasts are somewhere near the mark, and spring rainfall is good, we can expect lambs to come late, and heavy, pressuring prices in early summer. For sheep, the lamb price will somewhat dictate levels, but a good season will no doubt extend the strong restocking demand and support prices.

Have any questions or comments?

Key Points

- Given the wet July, the strong sheep slaughter and yardings in mid-July were unexpected.

- Good prices are drawing sheep and lambs out, which is positive for prices later in the season.

- Prices are likely to fall from these high levels, with later and heavier supply expected.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo