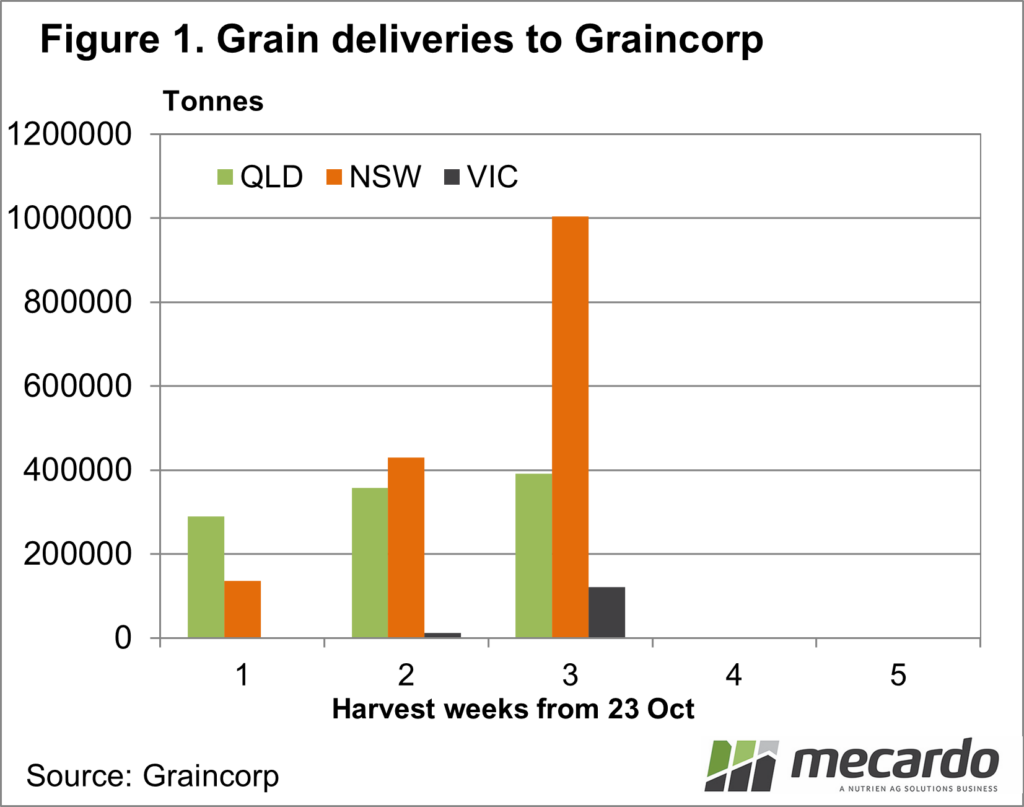

Harvest is off to a flyer this year. Graincorp has already produced three harvest updates, with the latest released on Monday. Last year the first harvest update didn’t come until the 16th of November.

Figure 1 shows Graincorp’s grain receivals by state for the last three weeks. The Queensland harvest is all but over, with only 392,100t received in the Sunshine State. Last year Graincorp received 2.157 million tonnes. The decline is significant, to say the least. There is a note to say direct-to-Port receivals are excluded, which wasn’t the case last year.

In New South Wales harvest really ramped up last week. Graincorp received over 574,000 tonnes, as wheat is coming in at Wyalong and Griffith, and Canola in Riverina sites.

Victoria only really got going last week, mostly in the Mallee, with a little bit of activity in the Wimmera. If we compare it to the 16th of November last year, receivals are currently 33% ahead. In Victoria and NSW receivals are 6.3 times higher, such as the slow start to harvest last year, and earlier start this year.

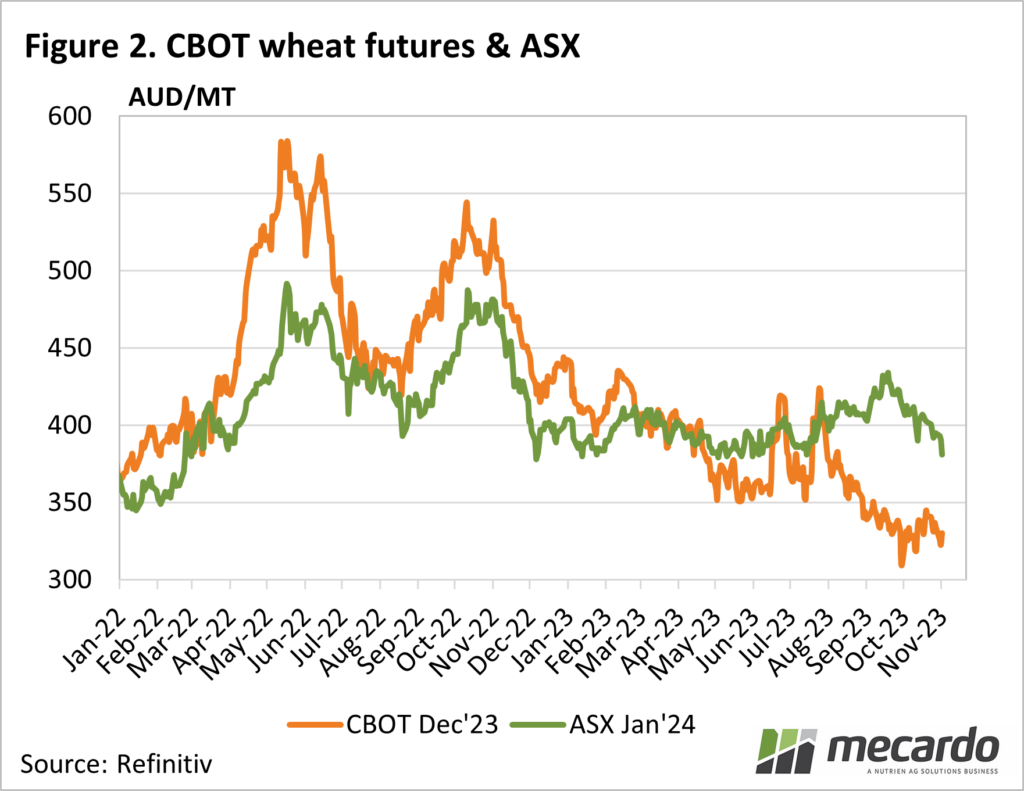

Harvest progression has seen pressure come on prices. Wheat has continued to ease, the downward trend now into its sixth week. ASX Jan 24 Grain Futures sat at $381/t on Monday, back at a $50 premium to Chicago Soft Red Wheat (SRW). The peak of the ASX premium was just over $100 back at the end of September.

We will have an exportable surplus of wheat and barley this year, and prices have fallen to work grain into export markets.

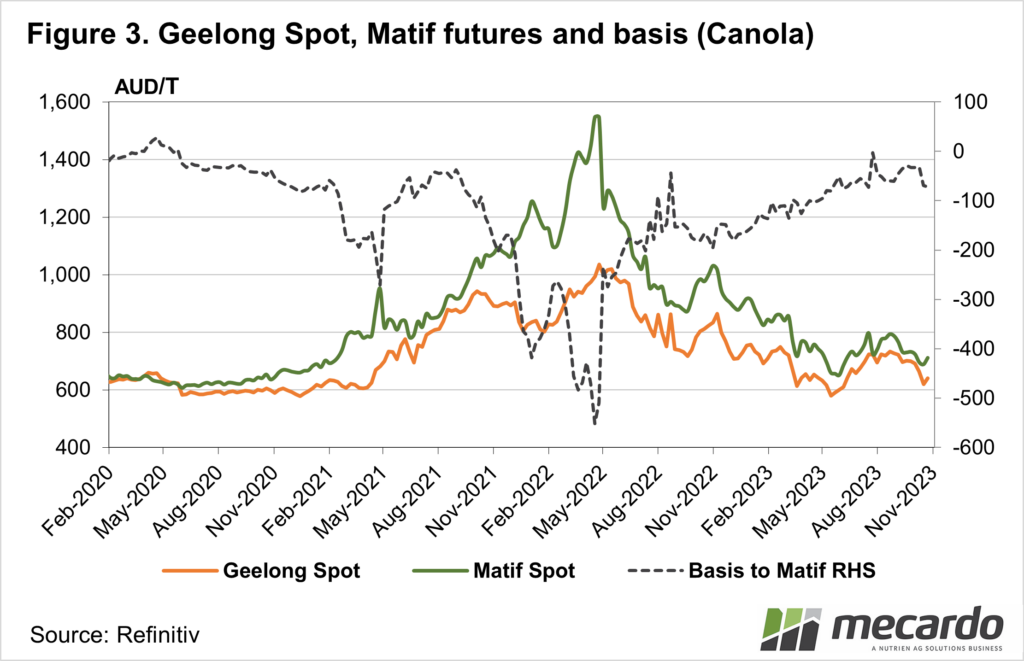

Canola prices have steadied, and even rallied, on the back of improving prices in Europe. Having said that, the local canola basis has weakened markedly since harvest started. Figure 3 shows canola pricing in the $620-650/t port range, with Matif Rapeseed back above $700/t. Canola is usually subject to harvest pressure, being the first crop off, and with higher value, it is used for cash flow.

What does it mean?

As it turns out locking in the harvest sale early would have been the go this year. It’s not always the case, especially in wet harvests, but it can often avoid selling into a falling market at harvest.

With plenty more grain to come, there could be further declines in prices, without some support from international values. Having said that, basis is now at levels we would expect in a drier year.

Have any questions or comments?

Key Points

- Harvest is well underway in NSW, and starting up in Victoria.

- Prices and basis have fallen over the last month, impacted by harvest pressure.

- Any price increases will be on the back of international values rising.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Graincorp, Refinitiv, Mecardo