Australian sorghum production is expected to reach the highest levels in over five years, both on increased acreage and higher yields. Today we take a look at how prices are evolving, and how they compare to prior seasons as well as the demand outlook from our main customer, China.

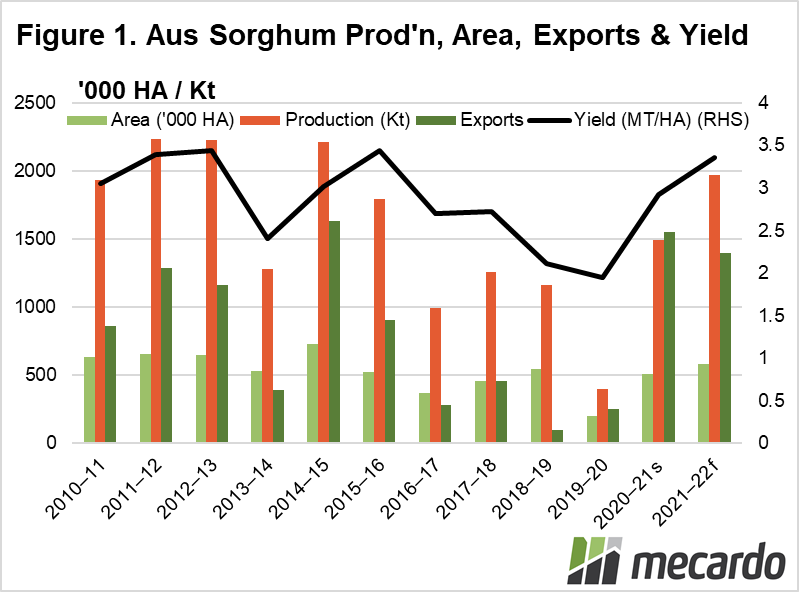

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) crop forecast tips Aussie sorghum production to reach 2mmt this year, a 31% lift on last season. The lift in tonnage forecast has dual drivers, with both a 15% increment in area planted to 586 KHA and a 15% increase in expected average yield to 3.4MT/HA. (figure 1). NSW yields, at 3.6MT/HA are expected to fare better than QLD, with the Grains Research and Development Corporation (GRDC) research indicating that for every mm above 100mm falling over the growing season can be expected to yield an average of 15Kg grain per hectare (view GRDC research here).

Early planted sorghum on the western downs of QLD has already matured and is in the process of being harvested. Early reports have indicated huge yields of around 5-6 tonnes per hectare.

Over the last month, producers in the central Queensland region have been planting sorghum in earnest, looking to harvest in the more typical months of April and May this year. However, farmers are banking on seeing some decent rain to consolidate soil moisture levels and ensure a solid result.

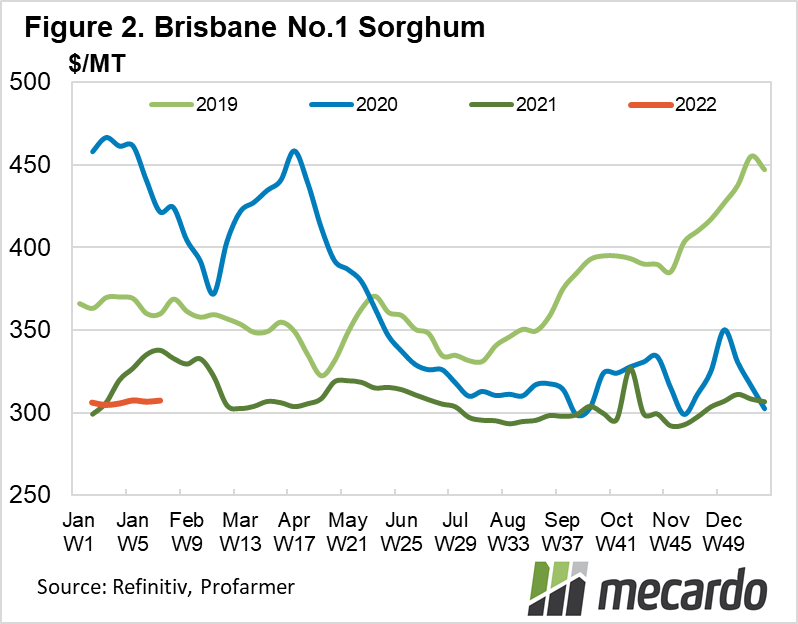

The sizable crop expected this year, combined with another La Nina season suppressing domestic feed demand has not done any favours to pricing for this year’s harvest. Currently, the sorghum price, delivered Brisbane is sitting at $307/MT. (figure 2) This is around $30/MT(9%) cheaper than the same time in 2021.

Locational discounts are also present across other receival points, with Newcastle, Gladstone and Mackay respectively trading at a $12(4%), $32(10%) and $31(10%) discount to Brisbane.

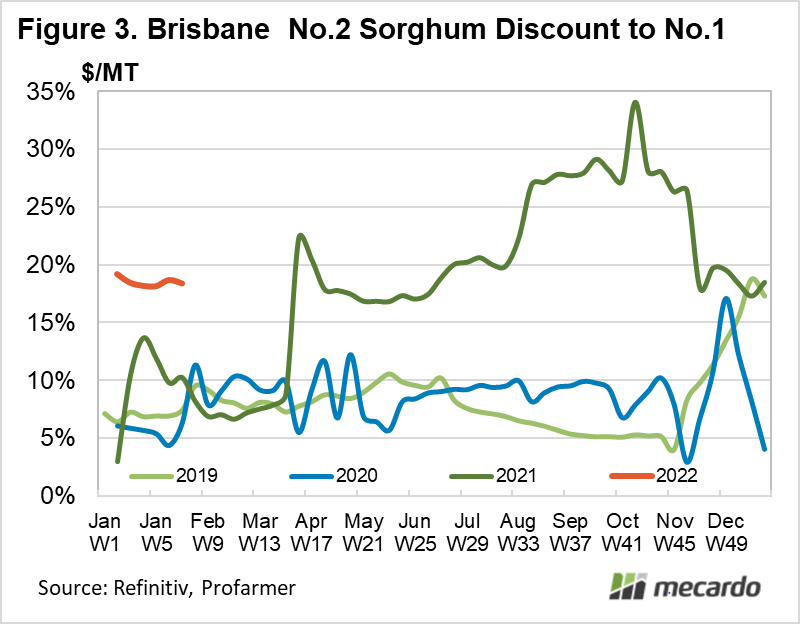

Similar to the situation at harvest last year, quality is key, and penalties for inferior and defective grain are considerable, with No.2 grade Brisbane sorghum already suffering an 18% discount to the superior No.1 prices. (figure 3) The early deep discounting of lower quality grain with sprouting or contaminant problems this year compared to last year is possibly related to the early harvests that have already been conducted this year, giving buyers more choice. If the trend seen in 2021 is repeated where quality discounts hit a peak of 34% later in the year, buyers will continue to discriminate, and the discount will likely blow out further as the 2022 season progresses.

Where is the sorghum being consumed?

In recent years, the balance of Australian sorghum demand has switched from domestic consumption to export markets (figure 1), with the majority being destined for China. Competitors in the export market to China include the USA and Argentina.

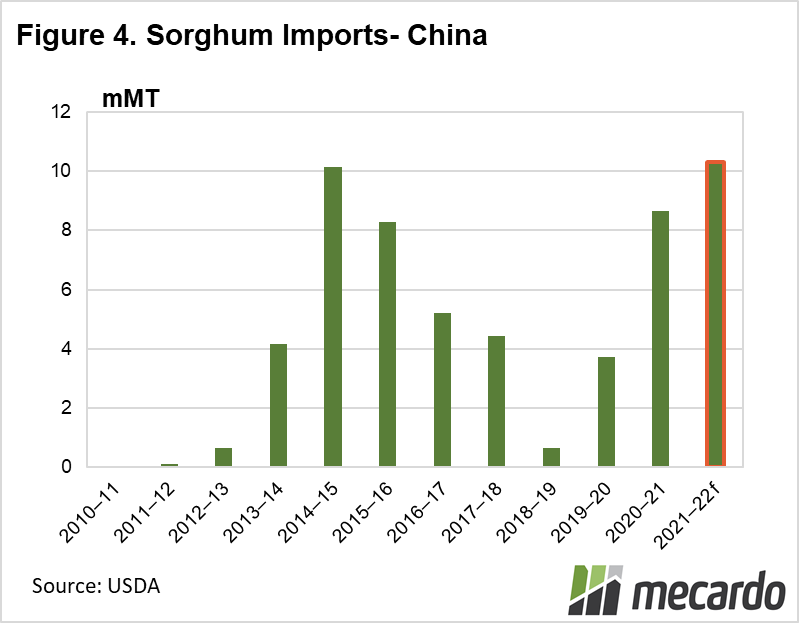

China’s appetite for feed grains is voracious and holds the crown for the largest sorghum importer in the world, with this year tipped to be no exception. The USDA forecasts that China will import 10.3mmt of sorghum in the 2021/22 crop season, up 1.7mmt(18%) from the prior year. (figure 4)

What does it mean?

In the last couple of years, export markets, particularly to China have become the dominant source of demand for Australian sorghum. Early indications are that the expectation of a large crop this year, and limited domestic demand may have put a dent in prices.

Due to the emphasis on quality for export, the practice of holding onto inferior grade grain may not prove to be a winning strategy if quality discounts deepen, and supply remains strong enough along the marketing year to keep prices suppressed.

Have any questions or comments?

Key Points

- Bumper sorghum harvest of 2mmt expected in 2022.

- Quality is paramount, with deepening discounts for inferior grain likely to repeat in 2022

- Most sorghum is destined to be exported to China.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources:

ABS, MLA, ABARES