January rains have only really seen a small part of New South Wales reach its monthly average, but it has certainly sparked restocker interest in lambs. We thought it might be mutton which was the big winner from rainfall, but so far is seems restockers are intent on competing with processors and feeders for light lambs.

A little under a month ago we took a look at the restocker lamb market, with the conclusion that it looked a little cheap. Rainfall has obviously helped, but we didn’t expect restocker lamb to streak towards record highs so quickly.

Some of the statistics on price movements make for interesting reading, and point towards some serious restocker activity. Since the start of the year the NSW restocker lamb indicator has gained 200¢, to just break through 900¢/kg cwt (figure 1).

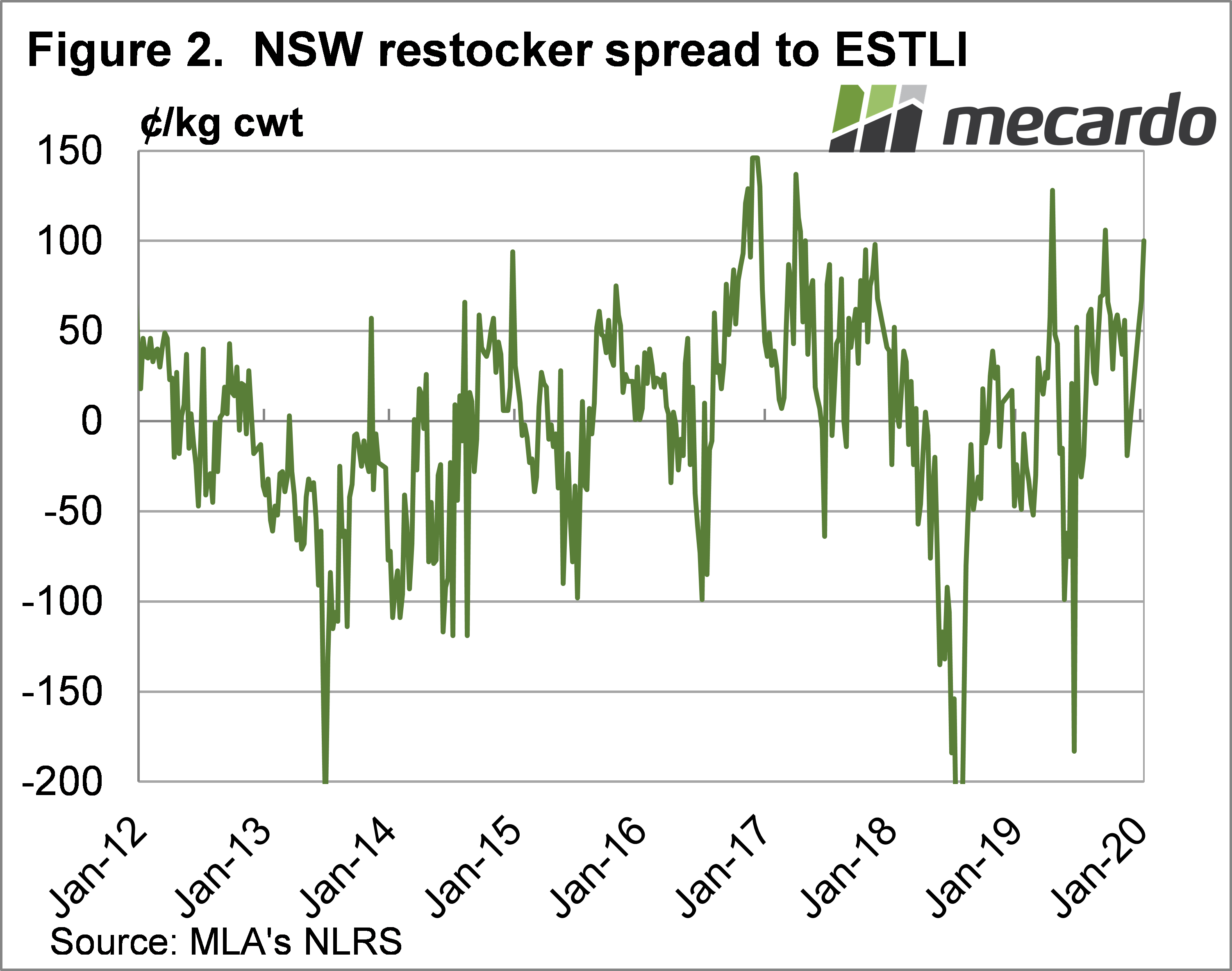

This time last year NSW restocker lambs were making just 629¢/kg cwt and were at a 23¢ discount to the Eastern States Trade Lamb Indicator (ESTLI). On Wednesday NSW restockers were making 100¢ more than the ESTLI (figure 2), and have only ever been higher for three weeks, back in July and September 2019.

There have been reports of the rapid hike in restocker values coming partly from competition from light lamb processors. With rain falling its likely light lambs are being held tightly, so supplies are weaker and restockers are trying to buy the same lambs.

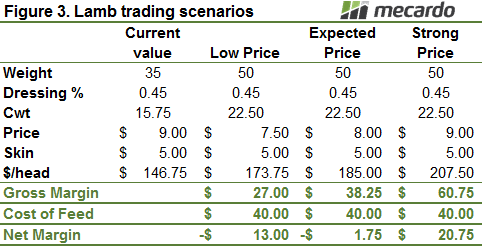

While processors would be struggling to make money on light lambs, lamb feeders are also going to need stronger prices to make a dollar. Figure 3 shows our usual lamb feeding calculation table, and the margins to be made before and after feed at different price levels.

At 800¢/kg cwt for finished lambs, which is the current ESTLI quote, lamb feeders are likely making a loss. We can see however, that if feed is grown, lamb trading looks pretty good. If finished lamb prices move to 900¢, there is money in feeding, and great money if done on grass.

What does it mean?

Demand has surged for restocker lambs on the back of rain, and expected increases in finished lamb prices. We can see that margins on trading lambs are good if the feed is grown from recent rains, and at least some producers who have destocked are looking for something to take advantage of feed and possible price rises.

Mutton is currently being left behind in the price surge. This is interesting as mutton supply is likely to become extremely tight if the rain continues. There can’t be many old ewes left out there, and with a push to restock sales might be very limited.

Have any questions or comments?

Key Points

- Restocker lamb prices have rallied strongly with rain and tighter supply.

- Stronger restocker demand is pushing processors to pay more for light lambs too.

- Mutton is being left behind, but could make its move in the coming month.

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: MLA, Mecardo