Restocker lambs have opened the year as one of the hottest commodities, surging higher as producers, feeders and processors compete for whatever livestock they can afford - and hopefully make a profit on.

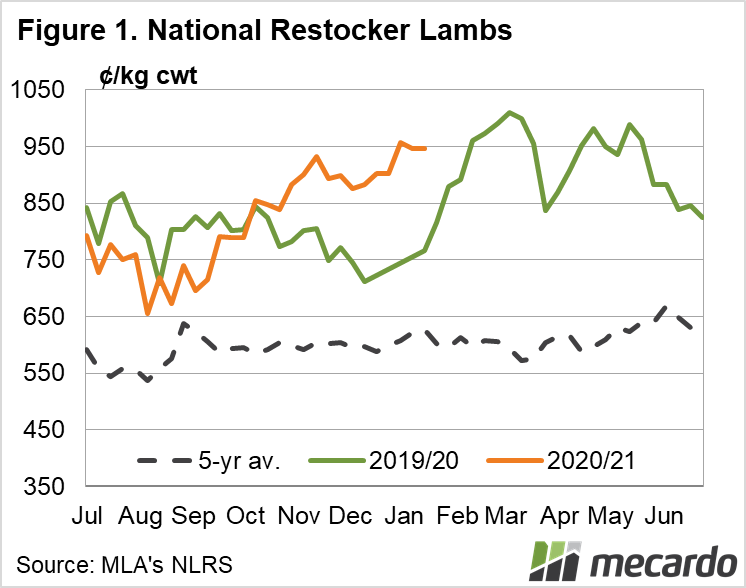

Finishing last week at 946¢/kg, the national restocker indicator is close to 20 per cent higher than the same time last year, and there is little evidence any downward pressure will be applied in the short term. This indicator has only traded higher once before – from mid-February to mid-March 2020 – and if rainfall forecasts stay favourable, it could be headed back to that 1000¢/kg mark once again.

The demand side is straight forward. A mild and wet summer for many sheep producing areas has left restockers and opportunist traders with greater opportunity to capitalise and buy in, whether it be to fatten or breed, while lotfeeders are keen to take advantage of the bumper summer harvest in the east to fill their feeders. We looked at the supply side last week here, which showed total lamb supplies likely to be lower again in 2021. This is after total lamb slaughter already fell 10% year-on-year for 2020.

How are trading margins looking? Restocker lambs in the eastern states were making 961¢/kg as of yesterday, while trade lambs were at 828¢/kg. Back of the envelope, if we leave out skins and you aren’t paying for what’s going down their throats, a 15kg (carcass weight) lamb will cost you about $145. Turn that into a 22kg lamb, and it is returning $182 – at current prices. Still a tidy profit across a truckload, if you can keep your costs to a minimum. Covid-19 and export demand will dictate how finished lamb prices will play out this year, but there is little to indicate that tight supply won’t keep them supported in the early winter as usual.

What does it mean?

If you have unfinished lambs in the paddock and feed is getting light on, there’s plenty of opportunity to cash them in and either swap in breeding stock, or give the pastures some breathing space until the autumn break. If you’ve got grass of summer crops to be eaten, and you aren’t interested in upping your breeding numbers, light lambs might not be a bad bet. Put it this way, the national trade lambs at a 9% discount to restockers, it is still a lot closer than cattle, where the heavy steer price is 18% lower than the EYCI.

Have any questions or comments?

Key Points

- Restocker lamb prices have once again started the year on an upward march, following last year’s trend.

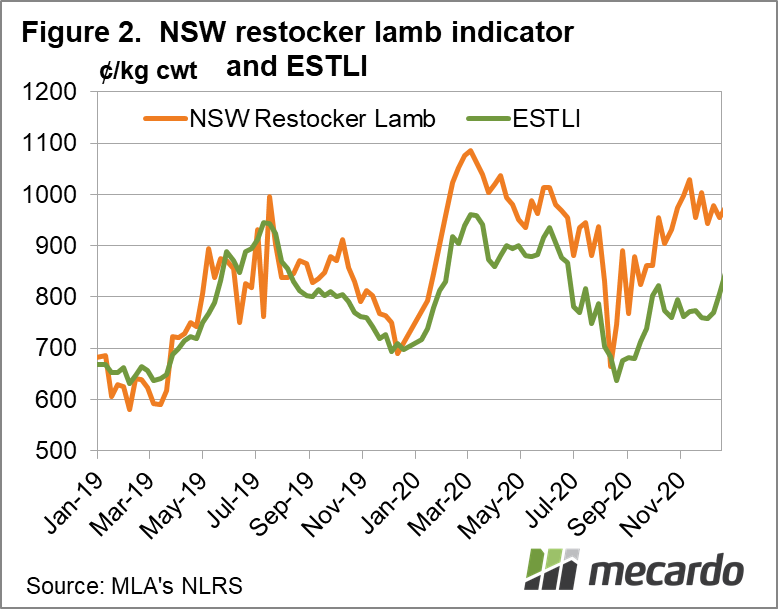

- NSW Restocker lamb indicator has been trading equal or at a premium to the ESTLI since August 2020.

- Tight supply and positive seasonal conditions should see restocker price support continue.

Click to expand

Click to expand

Data sources: MLA, Mecardo