With cattle and lamb prices at saleyards currently sitting close to three and seven-year lows respectively, surely local consumers are benefitting from lower red meat values? The June Consumer Price Index (CPI) data suggest not yet, but it should be coming, and with it hopefully a boost in consumption.

During the exceptional rise in lamb and cattle prices over the past few years we have seen retail prices track higher. There is plenty of consternation regarding the fact that as cattle and lamb prices have eased over the past twelve months, retail prices have remained stubbornly sticky.

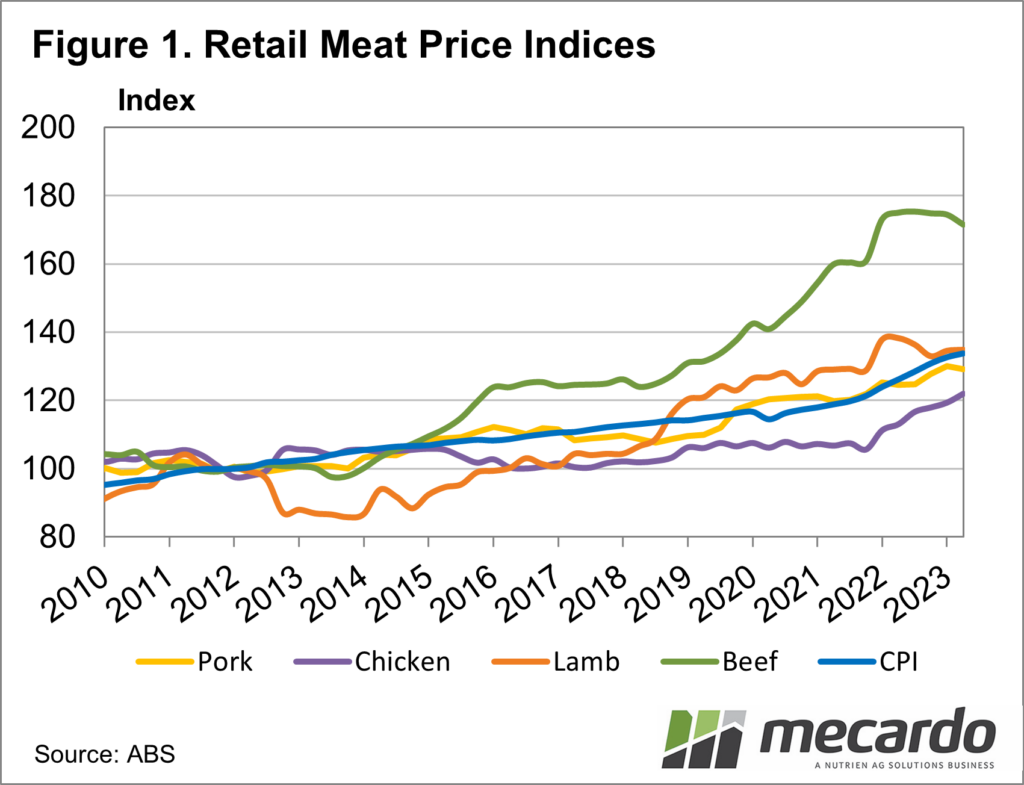

The latest CPI data for June shows beef at the retail level falling 1.66%, and lamb is steady (Figure 1). Over the past year, beef has fallen 2% and lamb 2.46%, so prices have eased, but only marginally. To put these moves into perspective, a 2% fall on $30/kg steak would see it fall to $29.40. Hardly enough to see it rushing off the shelves.

Over the last five years retail beef prices have risen 38% and lamb 26%. We need to compare this to the saleyard price changes over that time. At its peak, of just over 1000¢/kg, the NSW Trade Steer Indicator had gained 90% over the 2018 price. For lamb, the peak set in late 2021 was 39% higher than 2018 values. Saleyard lamb has now been in decline for nearly two years.

Now cattle prices at saleyards are very close to 2018 levels, but retail prices are 38% higher than 2018 levels. Does this mean retail beef prices are heading back to 2018 levels? With the increases in costs of labour, energy and transport in the processing and retail sector we can hardly expect retail prices to fall that far.

Lamb prices at saleyards in June this year were also at similar levels to 2018. With retail lamb 26% higher over the five years, there is an argument that they should decline further with saleyard prices, but again retailers are probably not making super profits on lamb at the moment.

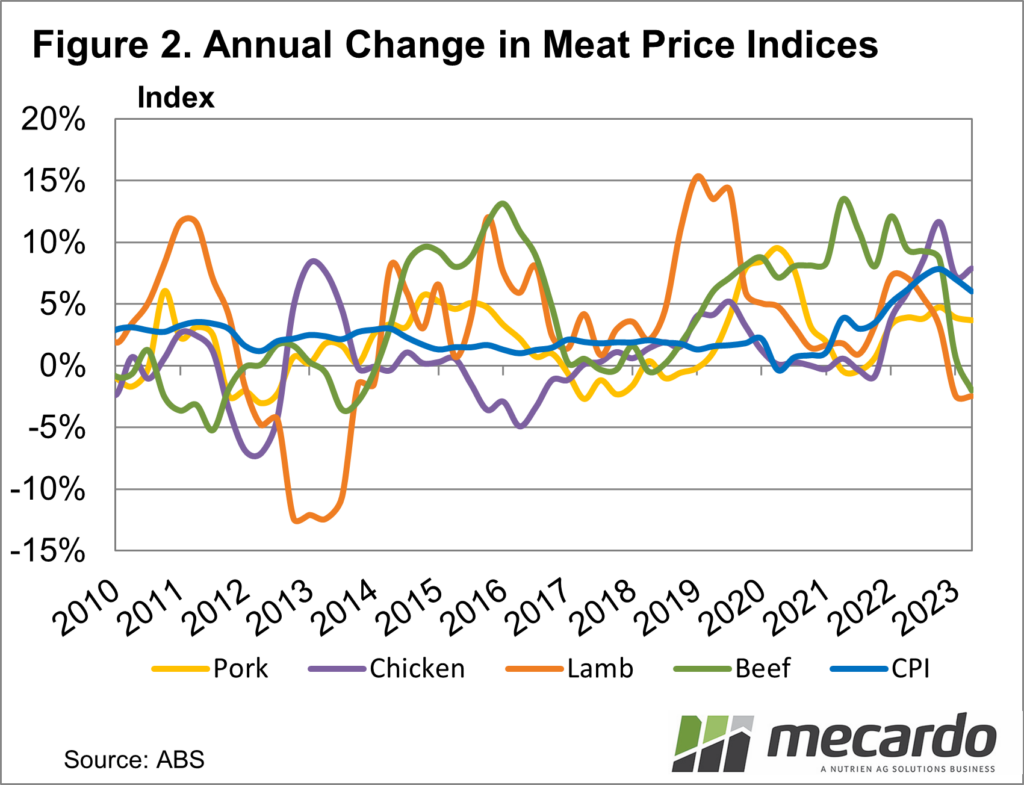

It is interesting to note the strong rises in chicken and pork prices over the last two years, having lagged behind the red meats for the previous ten. This makes red meat more attractive to consumers, with a smaller price difference. Figure 2 shows we have only seen significant falls in retail beef and lamb prices once over the last 15 years. That was in Lamb and after a solid rally.

What does it mean?

Given the rising costs, it’s hard to see a rapid decline in retail red meat prices, but they will continue to ease if livestock values remain low.

Producers would obviously rather see livestock value rise back to match retail, but any lower retail prices and subsequent boost in domestic consumption would be positive.

Have any questions or comments?

Key Points

- The June CPI data showed small decreases in retail red meat prices.

- Retail prices didn’t rise as much as livestock did but are now sticky despite falls at saleyards.

- Retail red meat values should ease further but not sharply.

Click on figure to expand

Click on figure to expand

Data sources: ABS, MLA, Mecardo